Tax Research Insights

Welcome! This site shares posts written by authors of the Department’s annual research reports. The researchers highlight interesting findings from the reports they produce. Each post focuses on a key idea from their research.

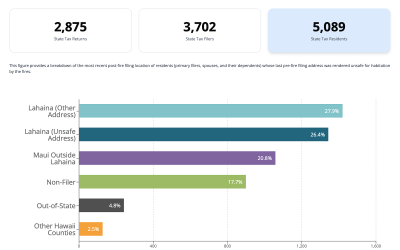

Migration Effects of the Maui Wildfires

Executive Summary: An analysis of state income tax filing addresses indicates that the 2023 Maui wildfires reduced Maui’s population by at least 1,000 residents, due to both increased out-migration and reduced in-migration. At least 430–510 Maui residents have moved...

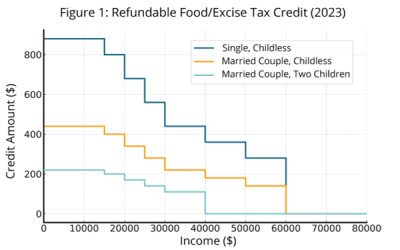

Why do so many low-income households not claim their tax credits?

In 2021, low-income households in Hawaii were eligible for about $42 million through the state’s refundable food/excise income tax credit. But over one third—or $15.3 million—of this money went unclaimed. These estimates come from a new analysis of state income tax...

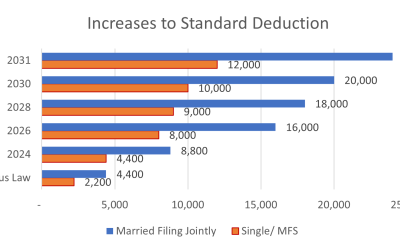

Estimating the Impacts of Hawaiʻi’s 2024 Tax Cut Bill

The Governor signed tax bill H.B. 2404 H.D. 1, S.D.1, C.D.1 into law, becoming Act 46 SLH 2024. The tax law change, known as the Green Affordability Plan II (GAP II), significantly reduces Hawaiʻi’s individual income tax liability for everyone in the state. It...

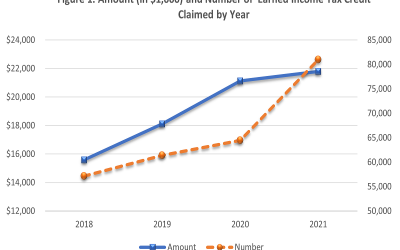

Increased Claims in the Earned Income Tax Credit are Mostly in the Lower Income Brackets in Tax Year 2021

Hawaii has several tax credits that promote social welfare. The Food/Excise Tax Credit is the most frequently claimed tax credit. The Earned Income Tax Credit (EITC) is the second most commonly claimed tax credit. The credit is 20% of the federal EITC allowed and...

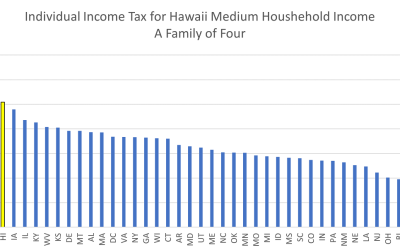

Comparing Hawaii’s Income Tax Burden to Other States

This post looks at how Hawaii’s individual income tax burden compares to other states. The relative level of taxation is one of many factors affecting the economic competitiveness. The level of taxation must be assessed with other factors like the quality and quantity...

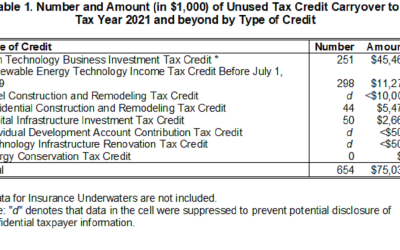

The State is still on the hook for more than $75 million from expired tax credits

There are two kind of tax credits that taxpayer can claim: the refundable and the nonrefundable credit. For the refundable tax credit, the taxpayer receives the full amount of tax credit in the form of either a reduction of tax liability, a refund, or both. For the...

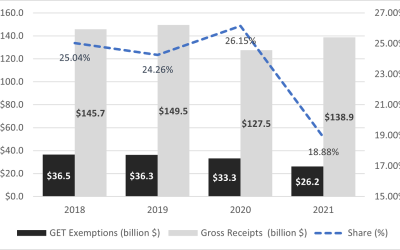

New Departmental Tax Initiatives Significantly Reduced GET Exemptions in 2021, Saving the Hawaii Taxpayers an Estimated $196.5 Million

There was a big drop in the General Excise & Use Tax (GET) exemptions claimed in 2021. Figure 1 from the 2021 GET Exemptions Report presents the amount of gross receipts and GET exemptions claimed by Hawaii taxpayers since 2018. Figure 1GET Exemptions and Gross...

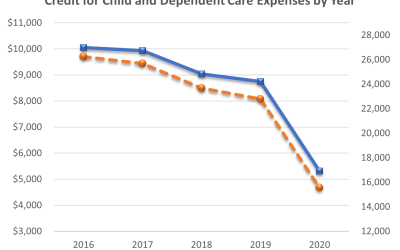

Covid-19 reduced the usage of the Child Care Tax Credit

A resident taxpayer may qualify for a tax credit that offsets some of the cost of childcare. The tax credit is called the Tax Credit for Child and Dependent Care Expenses. The credit is normally the third most commonly claimed tax credit, but it fell to fourth place...

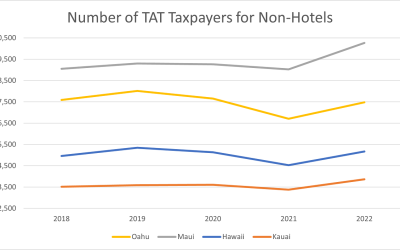

The Covid-19 pandemic has led to big changes in Hawaii’s Tourism Industry

The pandemic took a big toll on Hawaii’s tourism industry. Global shutdowns drastically curtailed the ability for travel. Governor’s Ige decision to restrict air travel to Hawaii also reduced the number of visitors. What is interesting is that the subsequent recovery...