The Governor signed tax bill H.B. 2404 H.D. 1, S.D.1, C.D.1 into law, becoming Act 46 SLH 2024. The tax law change, known as the Green Affordability Plan II (GAP II), significantly reduces Hawaiʻi’s individual income tax liability for everyone in the state. It represents the largest tax cut in the State’s history.

What Does the Law Do?

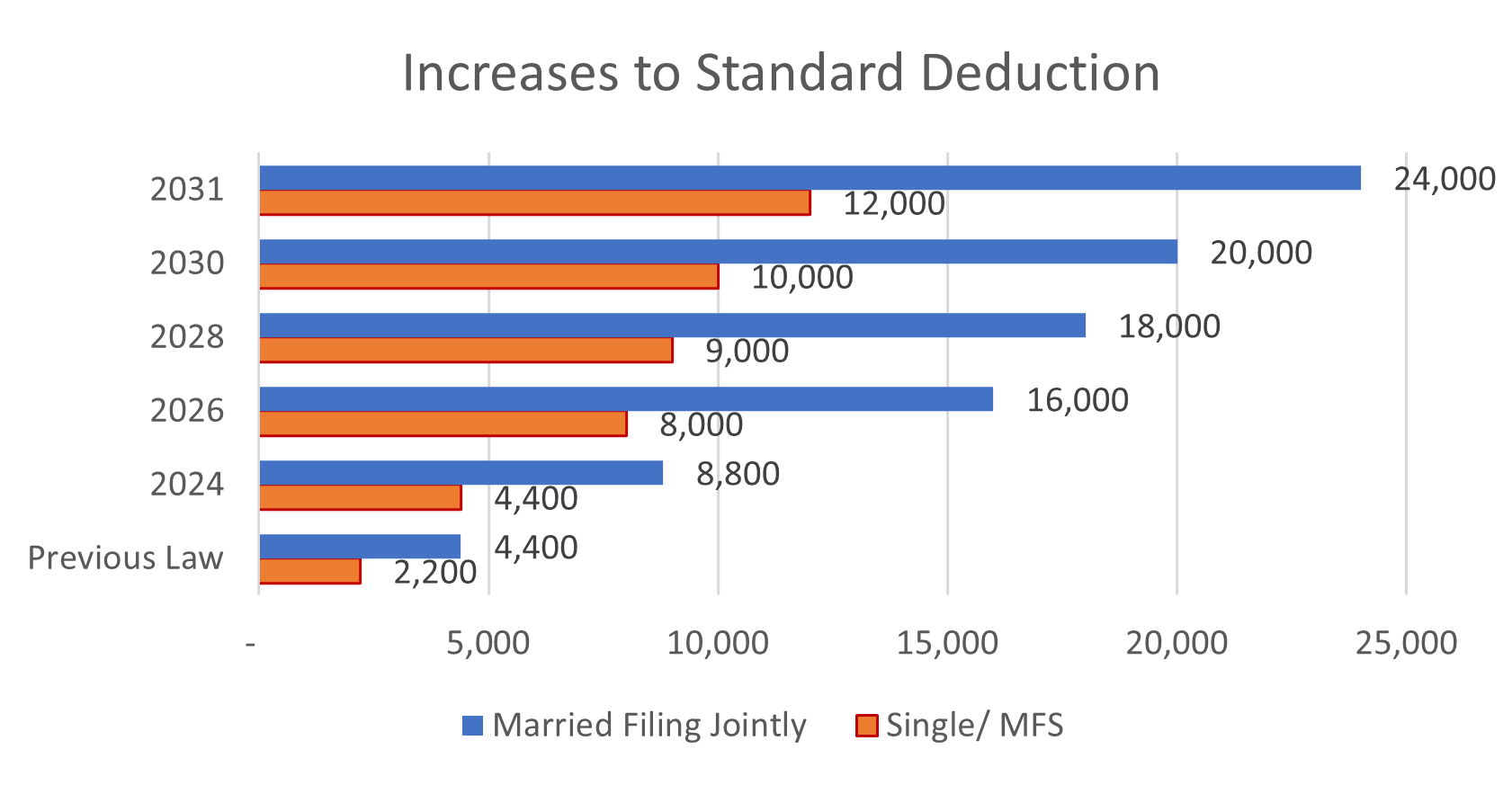

GAP II makes incremental changes to the standard deduction and tax brackets between 2024 and 2031 (see Table 1).

Standard Deduction Increase

The legislation raises the standard deduction in 2024, 2025, 2028, 2030, and 2031, expanding the amount of income that is exempt from taxation (see Figure 1). When all the changes have occurred, Hawaiʻi’s standard deduction will increase from $4,400/$2,200 for married filing jointly (MFJ) and Single/Married Filing Separately (MFS), respectively, to $24,000/ $12,000, an almost six-fold increase.

Enlarging the standard deduction disproportionately benefits low-to-moderate-income taxpayers. Higher-income taxpayers typically itemize their deductions because they have access to larger deduction amounts for things like state and local taxes paid and the mortgage interest deduction.i Taxpayers at the lower end of the income spectrum are less likely to use these deductions. For this reason, a larger standard deduction exempts more income from taxation for lower-income households relative to higher-income households.

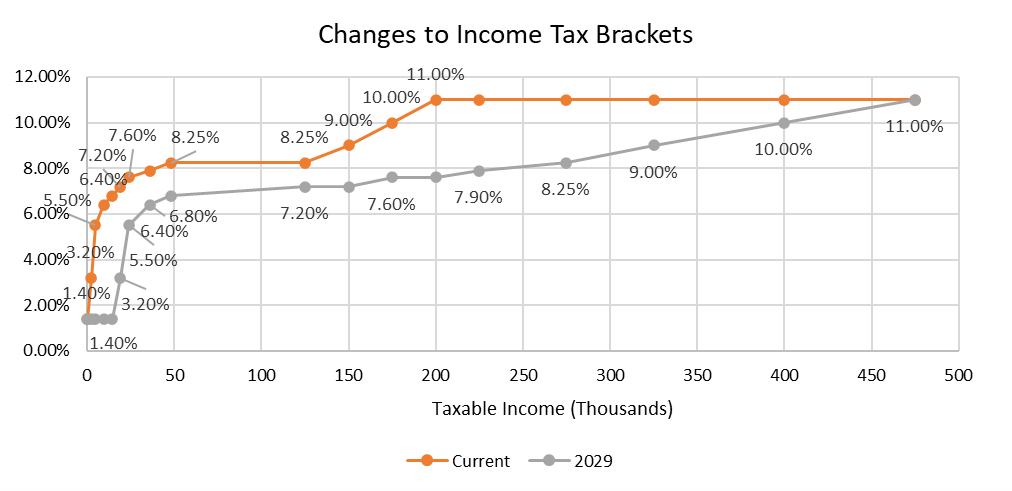

Shifting the Tax Brackets

The law makes changes to the income tax brackets in 2025, 2027, and 2029. Figure 2 shows the marginal tax rate at different income levels for the status of single/ married filing separate under current law (orange) and in 2029 (grey) when all changes to the brackets have occurred. Under current law, the tax brackets increase rapidly at low levels of taxable income. For example, the 8.25% rate goes into effect at $48,000. The high rates imposed on low incomes help explain why the income tax burden was so high for lower-income taxpayers. GAP II addresses this issue by shifting the imposition of higher tax brackets to higher income levels.

How Does GAP II Affect Affordability?

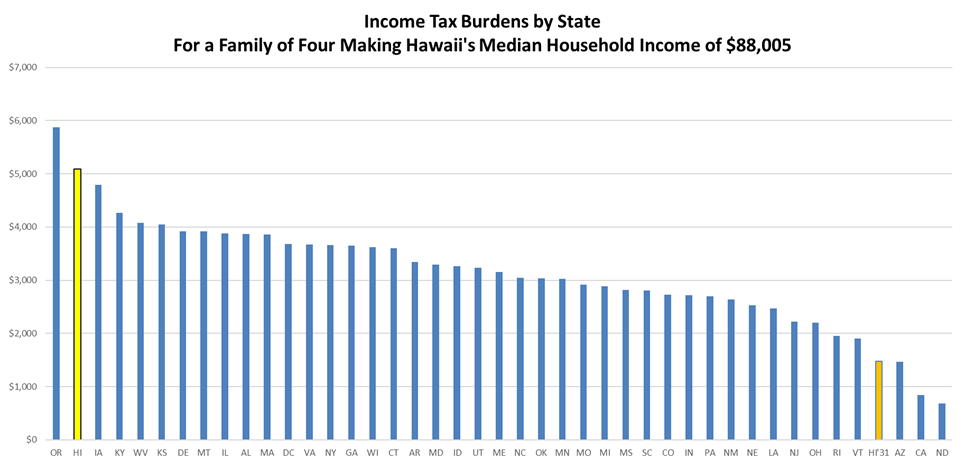

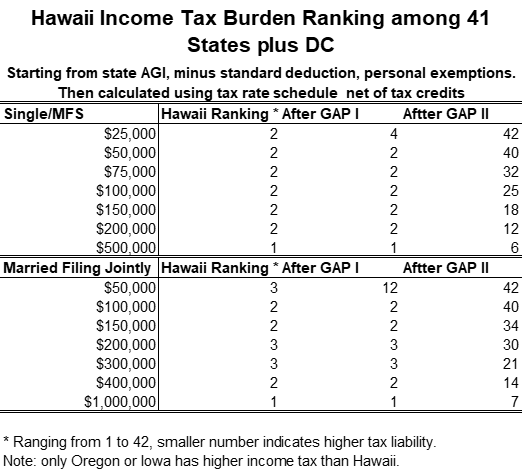

The tax burden is one of many factors that contribute to the state’s cost of living. Figure 3 shows the estimated income tax burden for 41 states and the District of Columbia for a family of four making Hawaiʻi’s 2023 median household income of $88,005 taking the standard deduction.ii Prior to the passage of this legislation, Hawaiʻi had the second-highest income tax burden in the nation. The only state with a higher rate was Oregon, which does not have a sales tax. When sales tax and income tax are combined, Hawaiʻi’s households face the highest tax rate in the country.

The income tax burden is relatively high for low-to-middle-income families because of the small standard deduction, which means that very little income is exempt from taxation. The burden is also high because tax brackets with high marginal rates took effect at low levels of income. The previous section of this post discusses how GAP II addresses both of those issues.

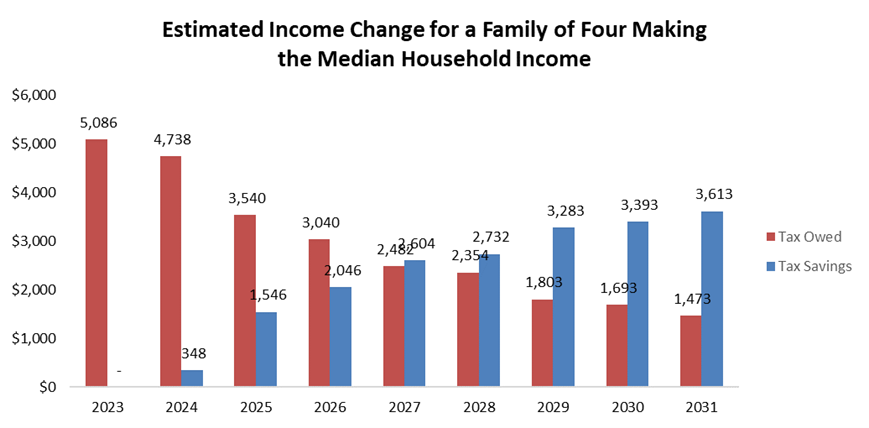

After all the tax law changes in 2031, working-class families in Hawaiʻi will have the fourth lowest tax burden. A family of four making $88,005 will see their income tax liability drop from $5,086 to $1,473 in 2031 (see Figure 4). This represents a 71% decrease in their tax liability and a 4.1% raise in take-home income.

The tax law changes will affect taxpayers at different income levels differently. Table 2 shows how Hawaiʻi’s tax burden will compare to that of other states at different income thresholds. Once GAP II is fully implemented, lower-income taxpayers will have some of the lowest tax burdens in the country while higher-income taxpayers will have burdens moderated. Table 2 shows that the relative size of the tax burden increases as one moves up the income spectrum—evidence of the law’s progressivity.

Is The Tax Law Change Progressive?

In economics, progressivity is defined as a system where the effective tax rate is higher for higher income levels. Hawaiʻi’s income tax system is already progressive by this definition. GAP II makes the state’s income tax even more progressive. Prior to 2024, tax returns with a Hawaiʻi AGI of $150,000 or greater represented 8.5% of all tax returns. This taxpayer segment contributed 53% of the State’s individual income tax. After HB 2404 has taken full effect in 2031, the same segment is estimated to contribute 69% of all income tax collections. This means a relatively small percentage of higher-income taxpayers will be paying a larger portion of income taxes.

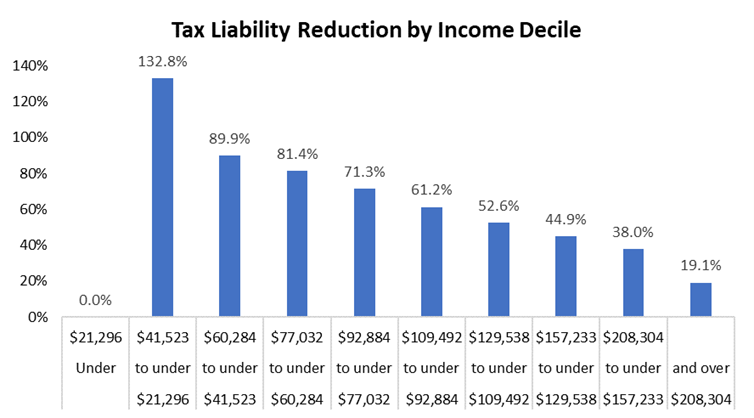

Figure 5 shows the average reduction in tax liability by income decile caused by GAP II. It shows that people in the lower-income deciles will see the largest reductions. The lowest income decile already has no tax liability on average, so they cannot receive a reduction. The second lowest decile will see a reduction of 132.8%. Taxpayers in this decile will go from having to pay taxes to receiving a tax refund due to the targeted tax credits for low-income households that were enlarged by GAP I.iii

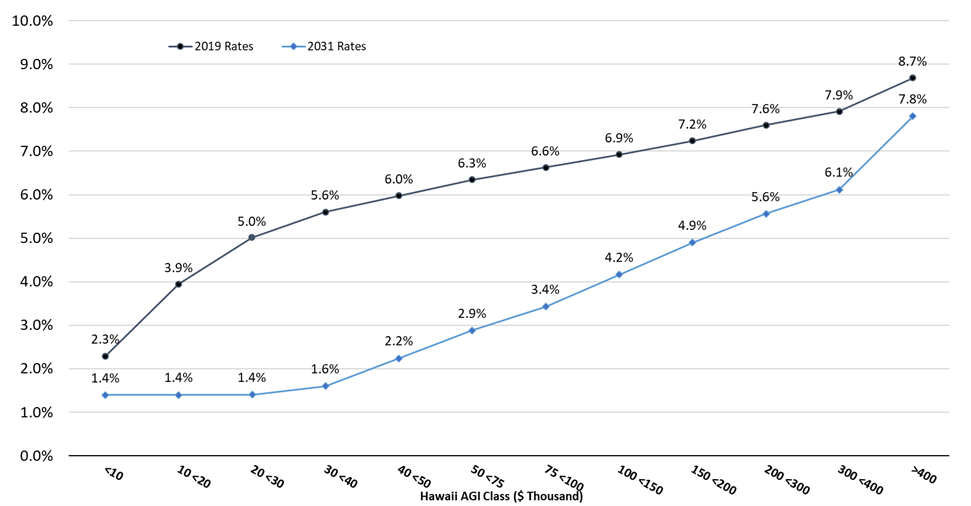

Figure 6 shows the average effective tax rate for different income levels. The black line shows the rates under the current system. The effective rates increase as income levels rise, evidence of a progressive tax system. The slope of the blue line increases after all the tax law changes are implemented. The effective rates are reduced the most at low incomes, lessening as one moves up the income spectrum.

i Taxpayers with Federal AGI greater than $100,00 Single/MFS, $150,000 HH, and $200,000 MFJ are ineligible to deduct state taxes under Hawaiʻi tax law.

ii Eight states do not impose an income tax.

iii Income deciles are created by dividing equal number of taxpayers into ten income tranches.