There was a big drop in the General Excise & Use Tax (GET) exemptions claimed in 2021.

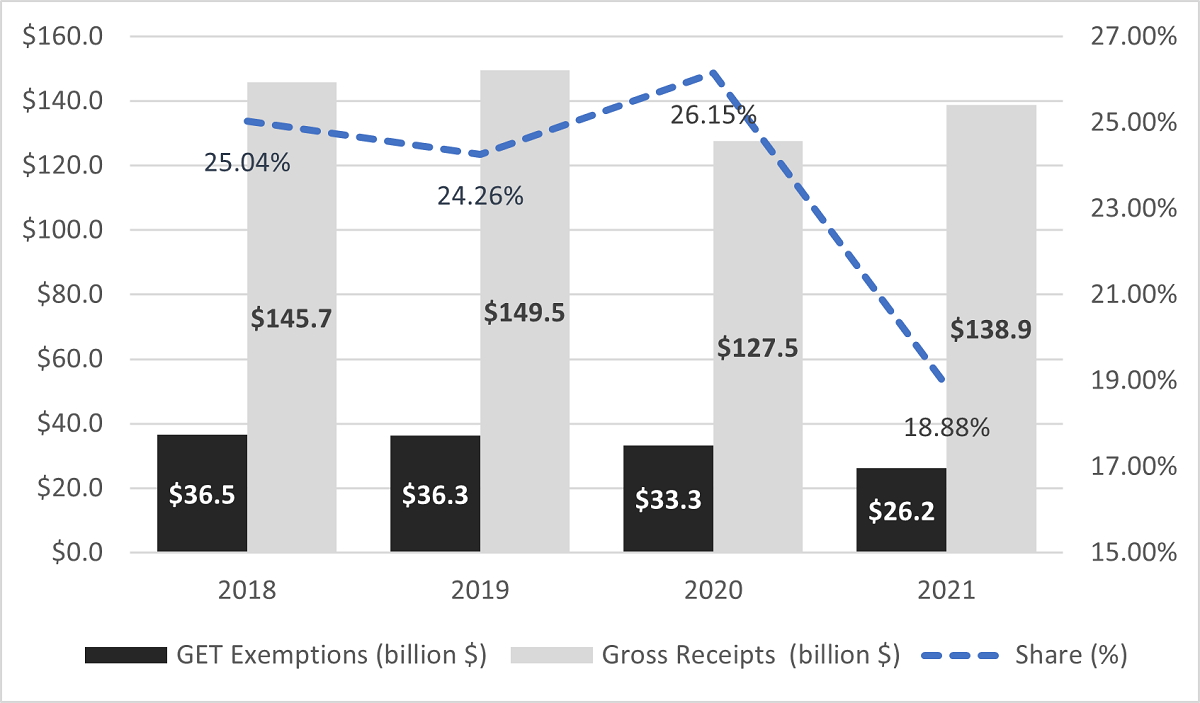

Figure 1 from the 2021 GET Exemptions Report presents the amount of gross receipts and GET exemptions claimed by Hawaii taxpayers since 2018.

GET Exemptions and Gross Receipts (billion $) for Tax Years 2018 through 2021

The share of GET exemptions in total gross receipts declined from a range of 24%-26% in 2018-2020 to 18.9% in 2021—a fall of about 6% (see the dashed line in Figure 1). Furthermore, GET exemptions declined by $7.1 billion between 2020 and 2021 despite the increase in gross receipts in the same period.

Two developments played a role in the decline of GET exemption claims in 2021. First, the Department limited the type of transactions eligible for the Foreign Trade Zone (FTZ) Sales exemption, which resulted in a 95.5% decline in claimed exemptions from $3.77 billion in 2020 to $0.17 billion in 2021. The decline in FTZ Sales exemption accounted for nearly half of the $7.1 billion decline in GET Exemptions that occurred in 2021.

Second, the Department made changes in its computer system that increased the compliance rates. The changes made it more difficult for taxpayers to claim GET exemptions for incorrect business activities.

For example, the GET Exemption for Non-profit Organizations is only applicable to nonprofit organizations to exempt their nonprofit income which would be taxed at the 4% retail rate. Therefore, this exemption cannot be claimed under the wholesaling business activity because it would not apply to nonprofit organizations that are not wholesalers. In the past, taxpayers were misusing this exemption when they claimed it under wholesaling, presumably thinking their sales to nonprofits would be exempt.

Another example is the “Transient Accommodations Rentals” business activity. In the past, taxpayers were incorrectly claiming GET Exemptions under this activity for Affordable Housing, Maintenance Fees, and Out of State Sales among others, which are not applicable and unrelated to transient accommodations rentals.

GET exemption for Maintenance Fees can only be claimed by condominium/apartment owners’ associations, not unit owners themselves. GET is a gross receipts tax which means the tax is on total business income before deduction of any business expenses. GET exemptions are not deductions for business expenses.

Finally, GET exemption for Out of State Sales is only for gross proceeds received by a manufacturer, producer, or seller of tangible personal property shipped to a point outside of the State where it is resold or otherwise consumed or used outside the State. Short-term accommodation, by definition, is consumed in the State.

The implementation of automated adjustments through the modernized computer system has saved both time and money spent on compliance efforts by the Department.

Using taxpayer level detailed GET data, we estimate that changes in the Department’s modernized computer system saved the Hawaii taxpayers $183.3 million while the clarification for FTZ exemption saved another $13.2 for a total of $196.5 million in foregone GET revenues.

For more detailed information, please see the most recent GET Exemptions Report.