There are two kind of tax credits that taxpayer can claim: the refundable and the nonrefundable credit.

For the refundable tax credit, the taxpayer receives the full amount of tax credit in the form of either a reduction of tax liability, a refund, or both.

For the nonrefundable tax credit, the taxpayer can only claim the amount up to the taxpayer’s tax liability in the year it is claimed. For most nonrefundable tax credits, the unused credits can be carried forward (carryover) to future years until it’s exhausted. This is true even if the tax credit is expired.

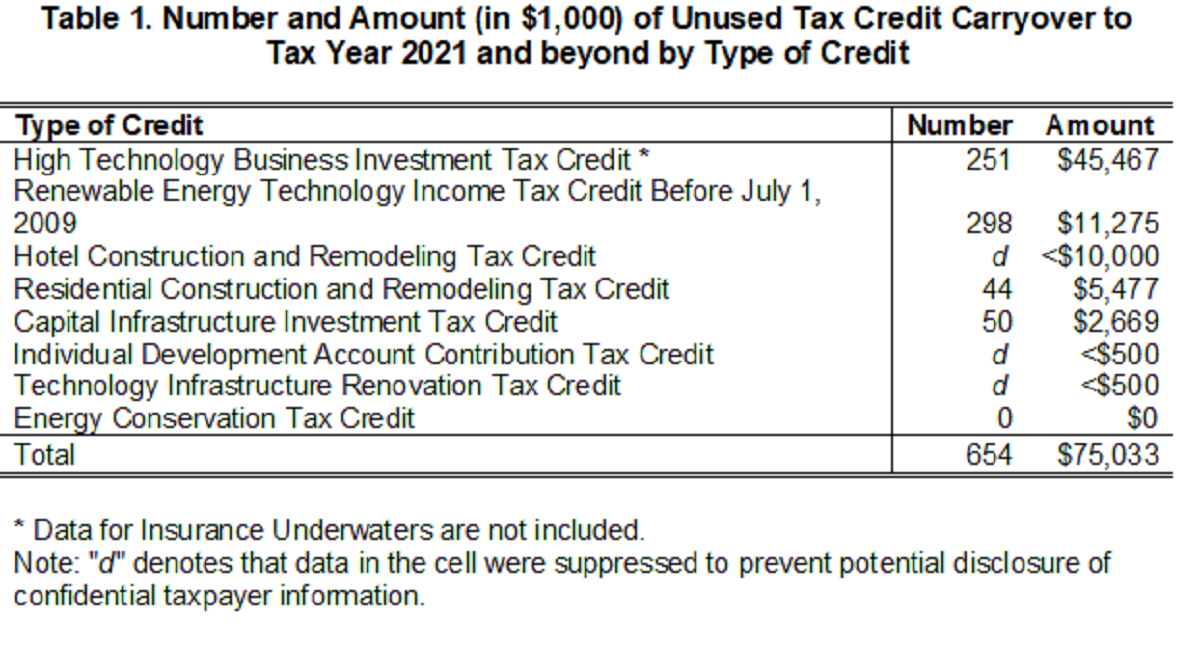

As of 2020, there were 7 expired nonrefundable tax credits worth more than $75 million that were carried over from previous years. The largest amount was for high technology business investment tax credit at more than $45.5 million. The lowest was for individual development account contribution tax credit and technology infrastructure renovation tax credit with less than $0.5 million while the energy conservation tax credit was already exhausted. Table 1 shows a breakdown of expired tax credits and their associated liability to the state.

For more information on this topic, see the Tax Credits Claimed by Hawaii Taxpayers..

.