This post looks at how Hawaii’s individual income tax burden compares to other states. The relative level of taxation is one of many factors affecting the economic competitiveness. The level of taxation must be assessed with other factors like the quality and quantity of public services. Ultimately, the level of taxation and the level of government services reflect the values and wishes of the voters. Comparing Hawaii’s tax system to other states provides helpful information for decision-makers as they decide the appropriate trade-off between taxation and public services. The individual income tax is one component of a larger tax system. While outside of the scope of this analysis, a comprehensive evaluation of any tax system should include all taxes and their interactive effects.

Comparing income tax systems

Comparing tax systems is not a straight-forward exercise as several factors influence burden like marginal tax rates, standard deduction, personal exemption, and income-based tax credits. Furthermore, tax burdens tend to vary by income level.

The post addresses these issues by calculating the income tax burden for each state at different income levels. DOTAX collected information about the marginal tax rates, standard deduction, personal exemption, and income-based tax credits for every state. It then calculated the tax burden for each state under different scenarios using this information. To make the analysis comparable and relatively simple, this exercise was only applied for filers claiming the standard deduction and not for itemized deductions. The advantage of this approach is it calculates the actual amount of the taxes paid at different income levels by state.i

Hawaii has one of the highest income tax burdens of any state for all income levels

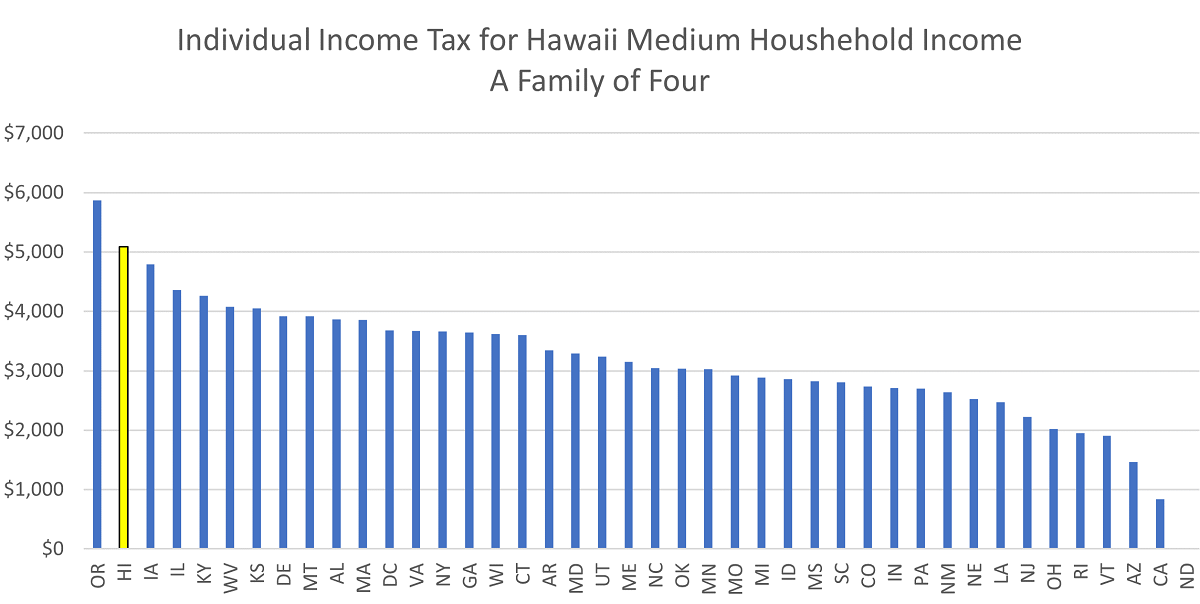

Figure 1 shows the individual tax burden for a family of four earning Hawaii’s median income of $88,005. The taxes are calculated for taxpayers filing jointly, claiming the standard deduction with two dependents and claiming all eligible credits. Of the 41 states and the District of Columbia that have an income tax, Hawaii has the second highest tax burden after Oregon, a state with no sales tax.ii Under current tax law, a family of four living in Hawaii and making the State’s median income would pay $5,086 in individual income taxes per year.

Figure 1

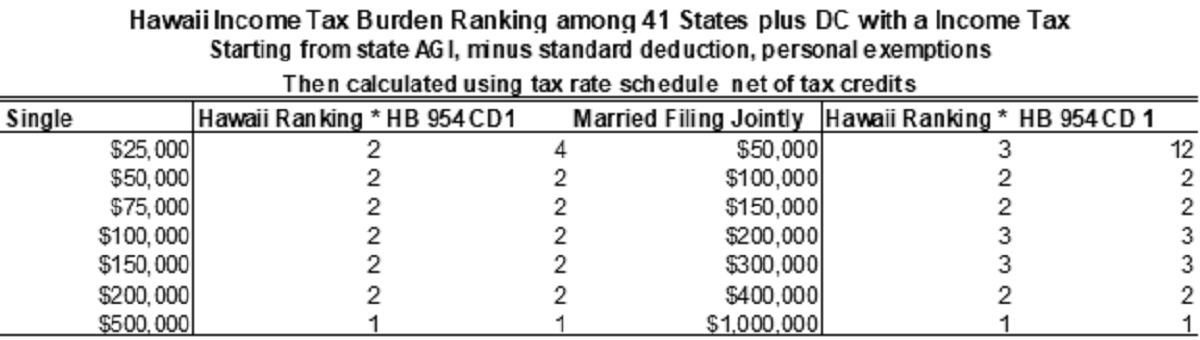

Figure 2 shows Hawaii’s income tax ranking over various income levels and filing status. The state ranks between first and the third place for highest income tax burden for every income level. Hawaii has the highest tax burden for very high-income taxpayers making over $500,000 filing single and $1,000,000 filing jointly, highlighting the progressivity of the state’s brackets.

HB 954 CD 1 reduced the tax burden for low-income taxpayers

The 2023 Legislature passed HB 954 CD 1, which doubled the refundable food/excise tax credit and doubled the state’s refundable earned income tax credit. The impact of the law is that Hawaii fell in the rankings for single filers with Hawaii Adjusted gross income (HAGI) of $25,000 and joint filers with a HAGI of $50,000. These credits target low-income taxpayers.

Figure 2

Causes of Hawaii’s High Individual Income Tax

The income tax burden is affected by several different factors. The first is the effective rate, which is the tax rate levied on different levels of income. States like Hawaii have different marginal tax rates for different levels of income. This allows the State to tax higher income earners more than lower income earners, making the system more progressive. Some states just levy one tax rate against all levels of income.

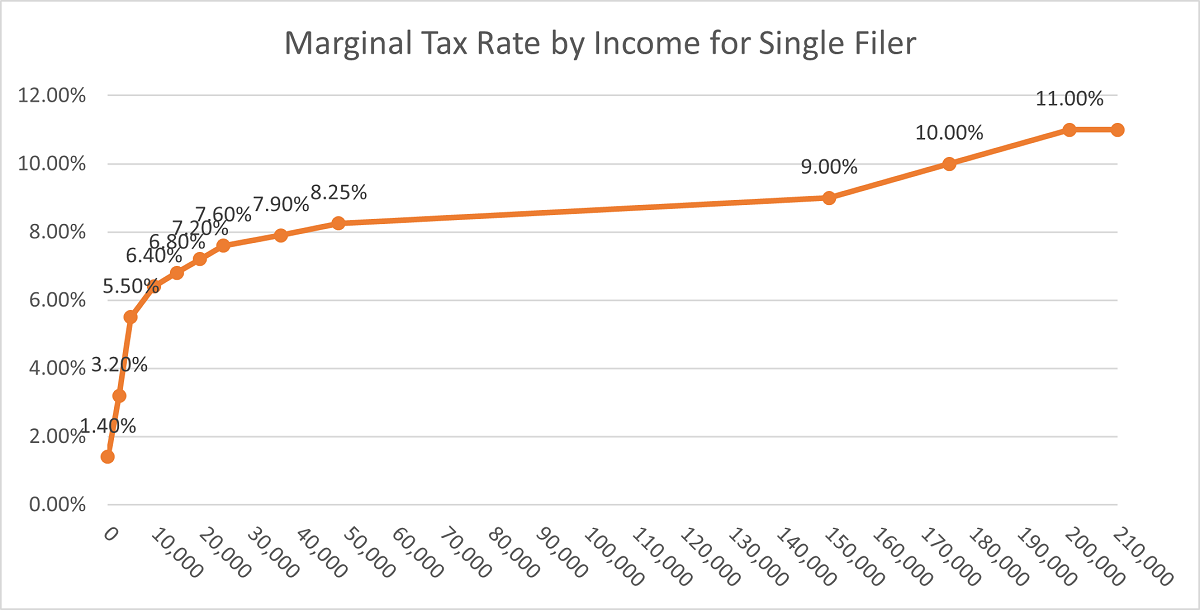

Hawaii’s has a progressive income tax schedule meaning that it starts low and increases with income. The rates increase quickly and at low-income levels however. Figure 3 shows where marginal tax rates increase occur along the income spectrum for a single filer. The marginal tax rates for married filing jointly occur at twice the level of single filers. For example, the 7.2% rate goes into effect at $19,200 for single filer status and $38,000 for married filing jointly status.

One of the reasons Hawaii ranks high across all income levels is that higher rates apply early on the income spectrum and increase rapidly means that most taxpayers are taxed at higher rates. Nearly all taxpayers are subjected to a relatively high rate. Prior to 2017, the highest marginal tax rate was 8.25% for all income over $48,000. Most other states do not apply such high rates until higher up the income spectrum.

Figure 3

The standard deduction also influences the overall tax burden for taxpayers. The standard deduction is the amount of income that is exempted from taxation. The standard deduction only affects taxpayers who choose not to itemize their deductions. Generally, lower to middle-income taxpayers are more likely to claim the standard deductions as they have fewer itemized deductions to claim like the mortgage interest deduction. Hawaii offers one of the lowest standard deduction amounts ($2,200 single/ $4,400 joint) of any state. This means that taxes are levied on a greater portion of the taxpayer’s income.

The personal exemption affects the overall tax burden by reducing the amount of taxable income by the number of exemptions. Generally, a state will grant an exemption for each person in the household. For this reason, families with more kids benefits more from the personal exemption than single filer taxpayers with no dependents. Not all states have personal exemptions. Of those that do, Hawaii’s personal exemption ($1,144 single/ $2,244 joint) is at the lower end, meaning more income is subject to taxation.

Some states grant income-based tax credits to support lower-income families. Hawaii offers two such refundable tax credits, the food/excise tax credit and the earned income tax credit. These significantly lower the tax burden of lower income households. HB 954 CD1 doubled the size of these credits and lowered the tax burden even further such that some taxpayers receive a net payment from the state through the tax system. The tax credits are a targeted means of lowering tax burdens for specific segments of the income spectrum.

i Other organizations have devised alternative ways of measuring tax burden. For example, the U.S. Census Bureau measures total individual income tax revenues and divides it by total personal income. Hawaii has the eleventh highest burden of any state in this analysis.

ii The states of Arkansas, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not levy any form of individual income tax.