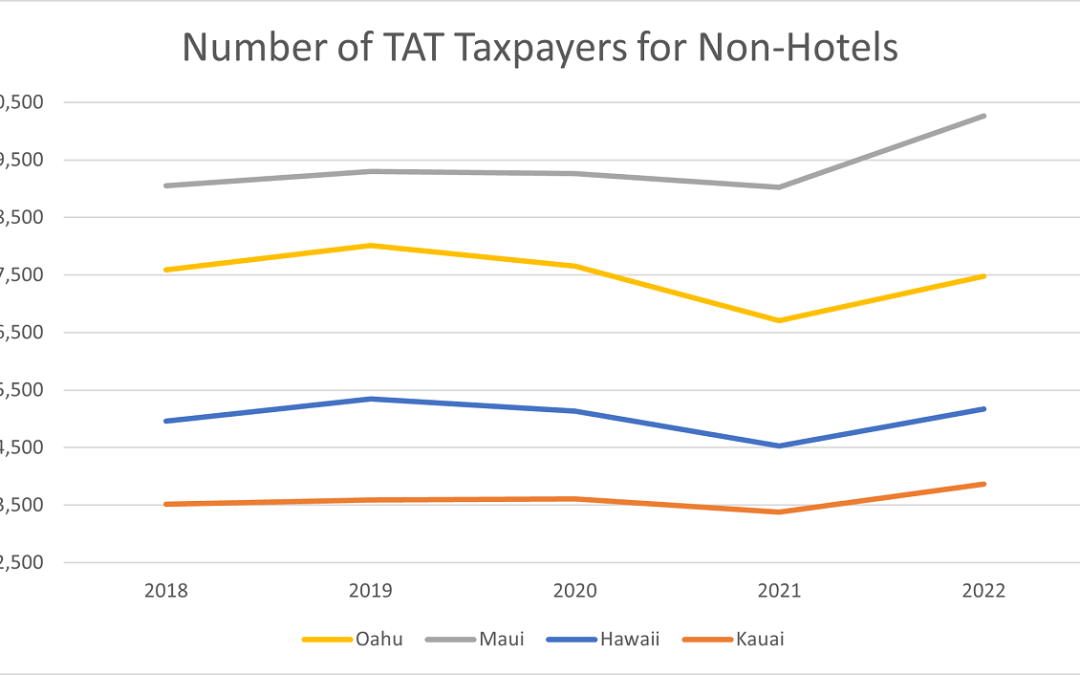

Dec 14, 2022 | Tax Research Insights

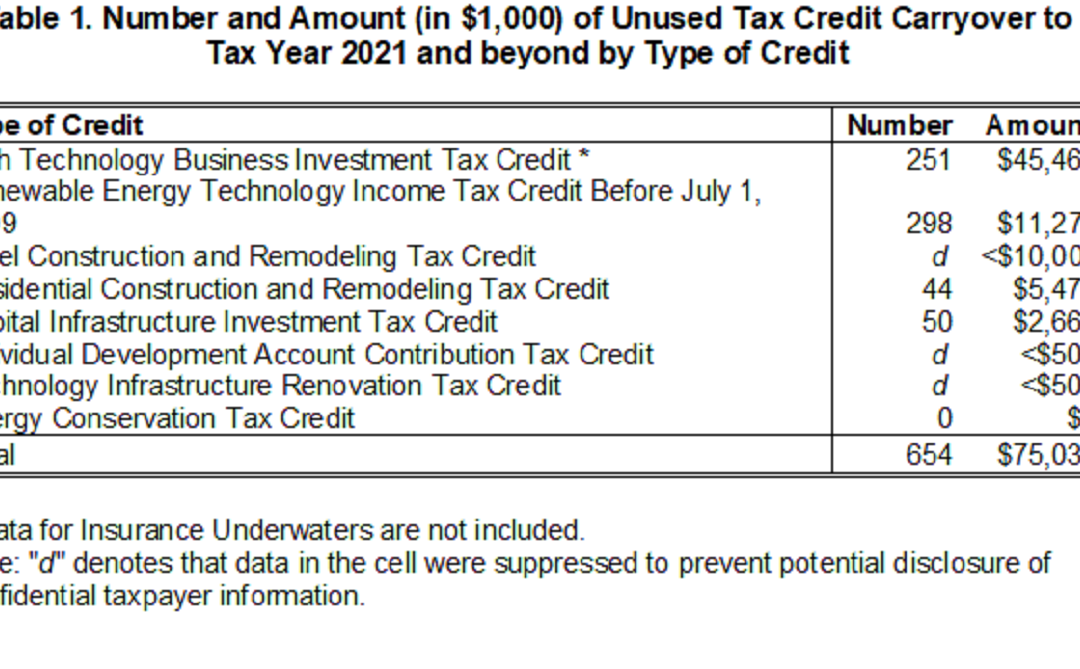

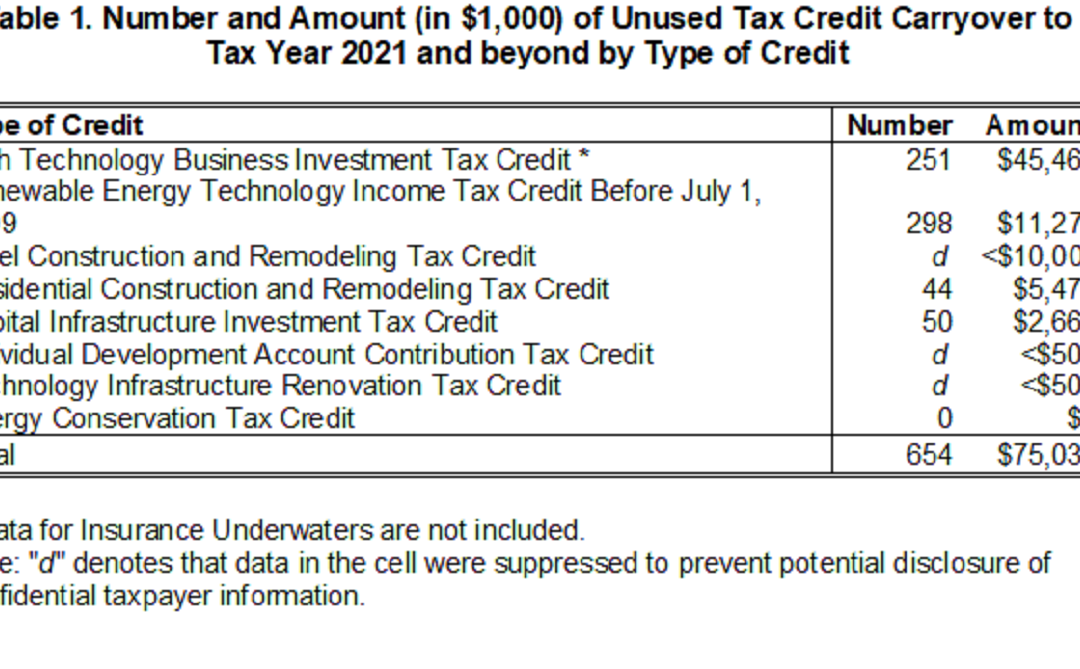

There are two kind of tax credits that taxpayer can claim: the refundable and the nonrefundable credit. For the refundable tax credit, the taxpayer receives the full amount of tax credit in the form of either a reduction of tax liability, a refund, or both. For the...

Nov 25, 2022 | Tax Research Insights

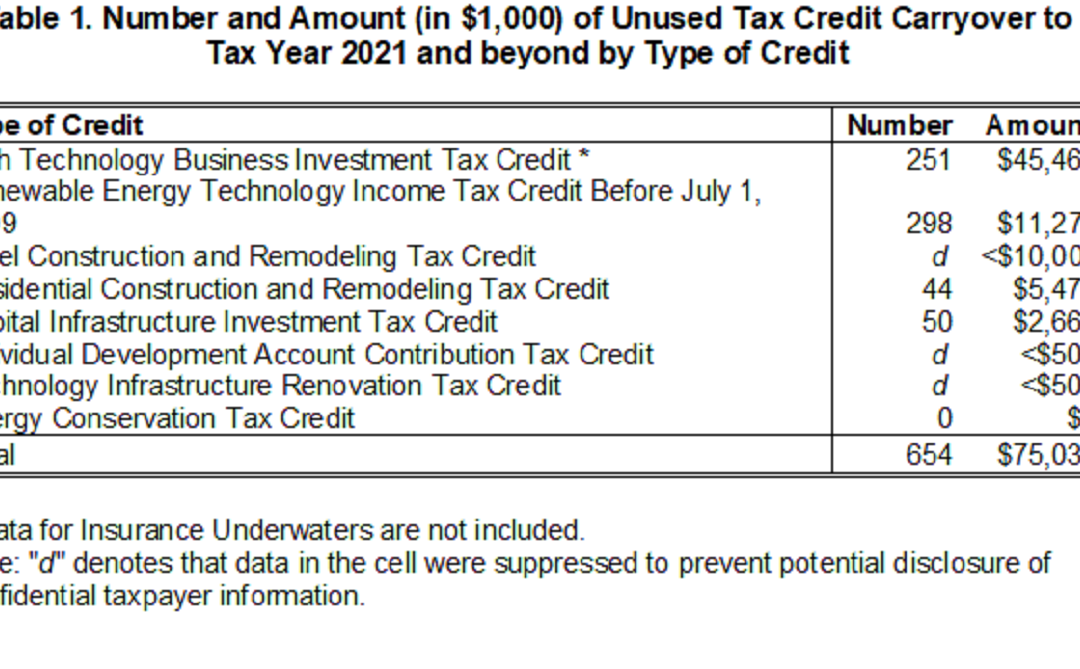

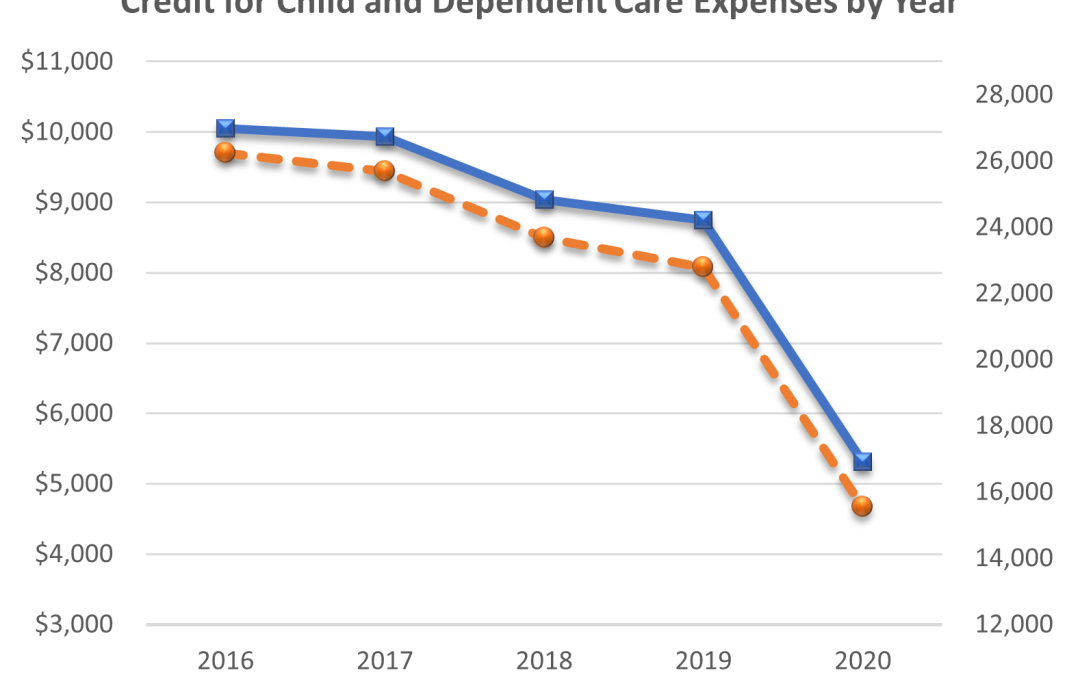

A resident taxpayer may qualify for a tax credit that offsets some of the cost of childcare. The tax credit is called the Tax Credit for Child and Dependent Care Expenses. The credit is normally the third most commonly claimed tax credit, but it fell to fourth place...

Nov 10, 2022 | Tax Research Insights

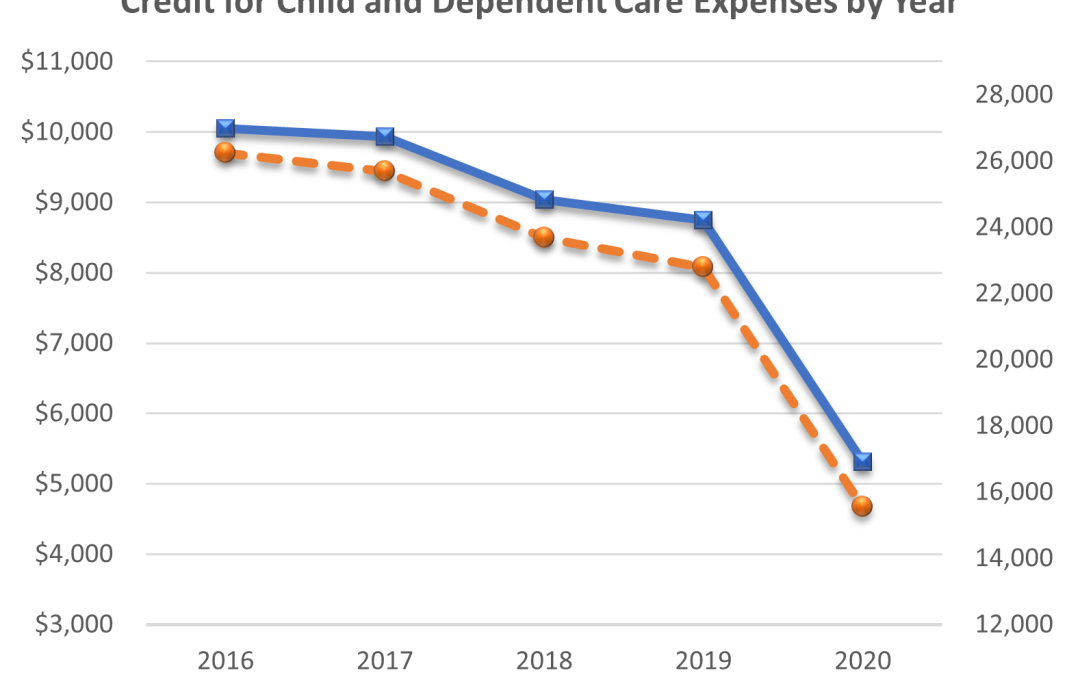

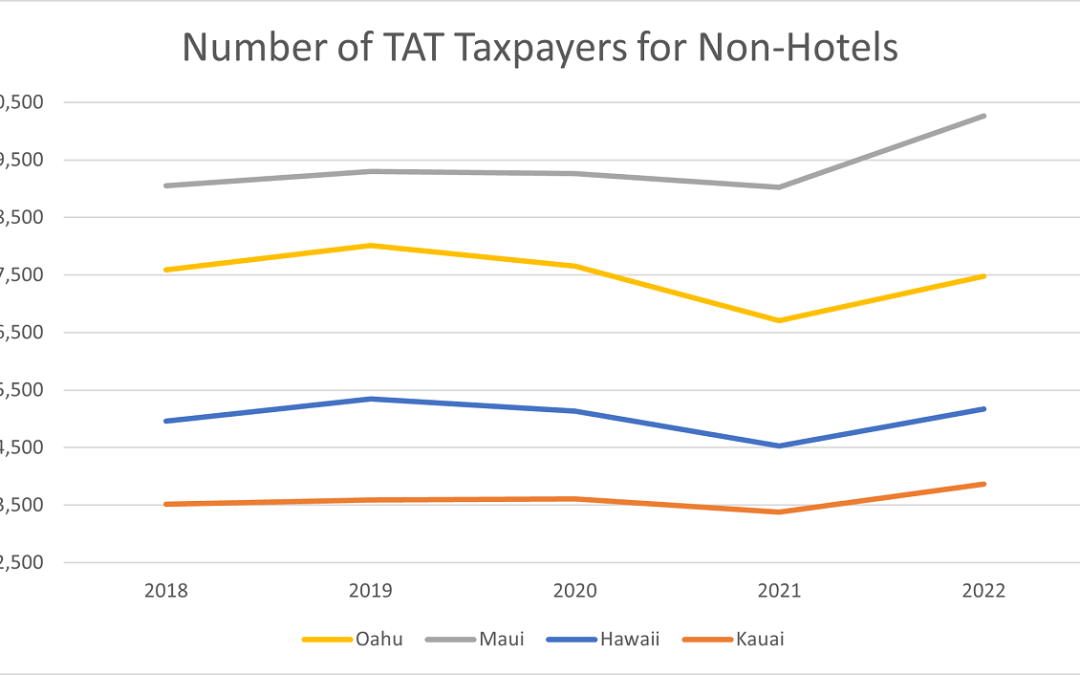

The pandemic took a big toll on Hawaii’s tourism industry. Global shutdowns drastically curtailed the ability for travel. Governor’s Ige decision to restrict air travel to Hawaii also reduced the number of visitors. What is interesting is that the subsequent recovery...

Nov 3, 2022 | Tax Research Insights

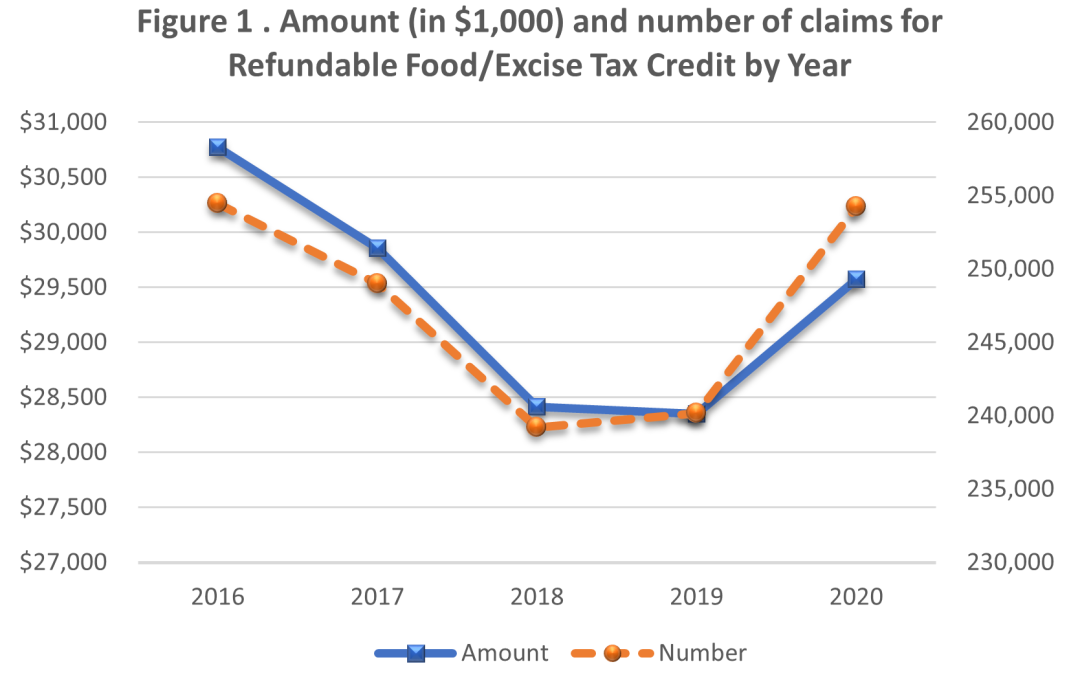

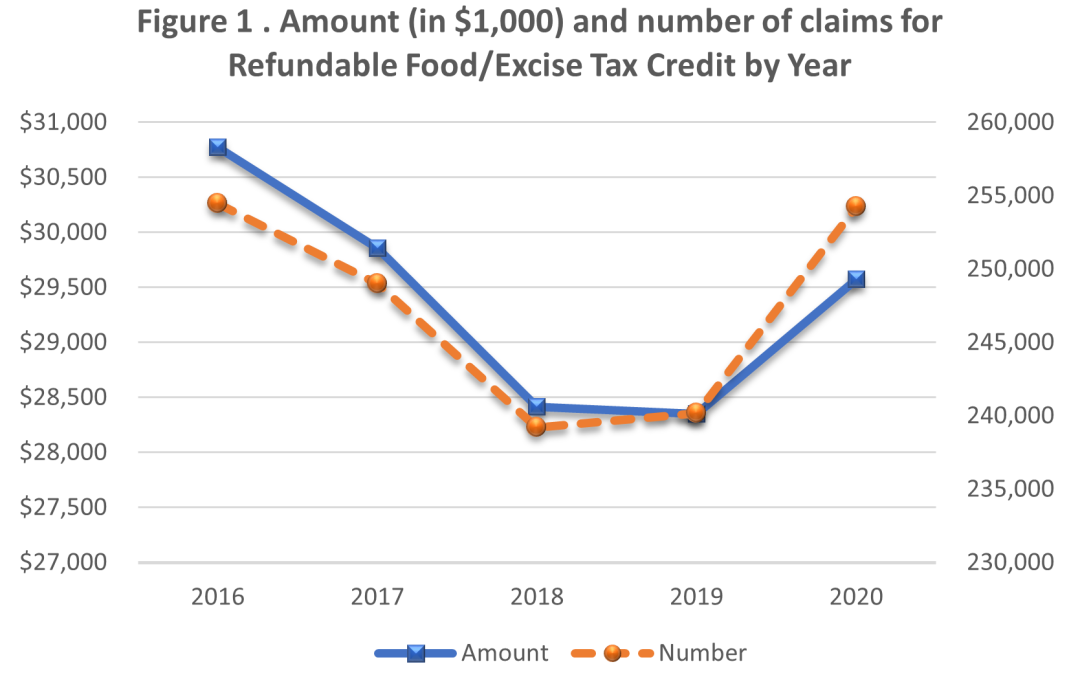

Hawaii has several tax credits that promote social welfare. More people claimed these credits during the Covid-19 pandemic, supporting the idea that these credits provide important economic support when Hawaii’s families are hurting the most. More Hawaii taxpayers...

Jun 27, 2022 | Tax Research Insights

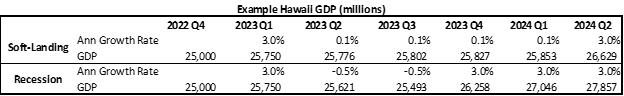

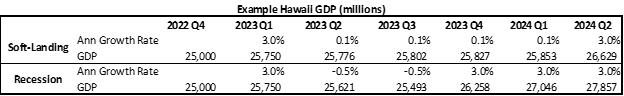

There has been significant talk of a recession in the financial press. High levels of inflation have prompted the Federal Reserve (Fed) to take decisive action by raising the benchmark interest rates. Will the abrupt change in monetary policy cause a recession? And if...