There has been significant talk of a recession in the financial press. High levels of inflation have prompted the Federal Reserve (Fed) to take decisive action by raising the benchmark interest rates. Will the abrupt change in monetary policy cause a recession? And if so, what would be the impact on Hawaii’s tax revenues? This post seeks to clarify these questions.

Recession? Soft-landing? Does it matter?

Recession or not, an economic slowdown is coming. While nearly all economic policy makers want to avoid a recession, the Fed is intentionally trying to slow down economic growth to curb inflation. When inflation goes outside of an acceptable range, the Fed reduces the availability of money in the system by raising the benchmark interest rate and reversing the policy of Quantitative Easing.i

Tighter monetary policy reduces growth through the following channels: 1) it reduces asset prices, leading to a reduction in wealth. People with less wealth tend to spend less. 2) It reduces the purchasing power of individuals and businesses because it is now more expensive to borrow money. 3) Since every purchase is income for the person on the other side of the transaction, lower purchasing power translates to lower income.

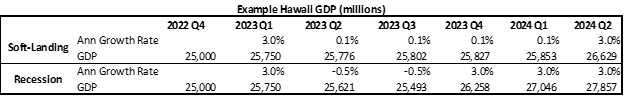

The Fed would like to engineer a soft-landing, which would imply lower levels of economic growth with minimal increases in joblessness, but this may not be possible given the magnitude of inflation pressures. The difference between a recession and a soft-landing can be largely semantic. Figure 1 shows growth scenarios for a soft-landing and a recession. It assumes that Hawaii’s GDP is $25 billion in 2022 Q4.ii The top half of the chart shows a soft-landing scenario where growth continues to be barely positive (0.1% rate) for six quarters. The bottom half shows a recession scenario where there are two quarters of economic contraction, followed by a quick rebound in growth. The technical definition of a recession is two consecutive quarters of negative growth. What is interesting is that the size of quarterly GDP in 2024 Q2 is larger in the recession scenario ($27,857 million) than in the soft-landing scenarios ($26,629 million). An extended period of low growth can result in lower overall growth than a quick recession.

This example is meant to highlight the fact that the main concern is not whether Hawaii enters a recession since this is a largely semantic discussion. The main concern for Hawaii is the level of economic growth over the medium term. We know that growth is going to be lower because the this is precisely what the FED is trying to do. As long as inflationary pressures remain, the FED will keep monetary conditions tight, and growth will be low.

Economic Prospects for the State of Hawai’i and their effects on tax revenues

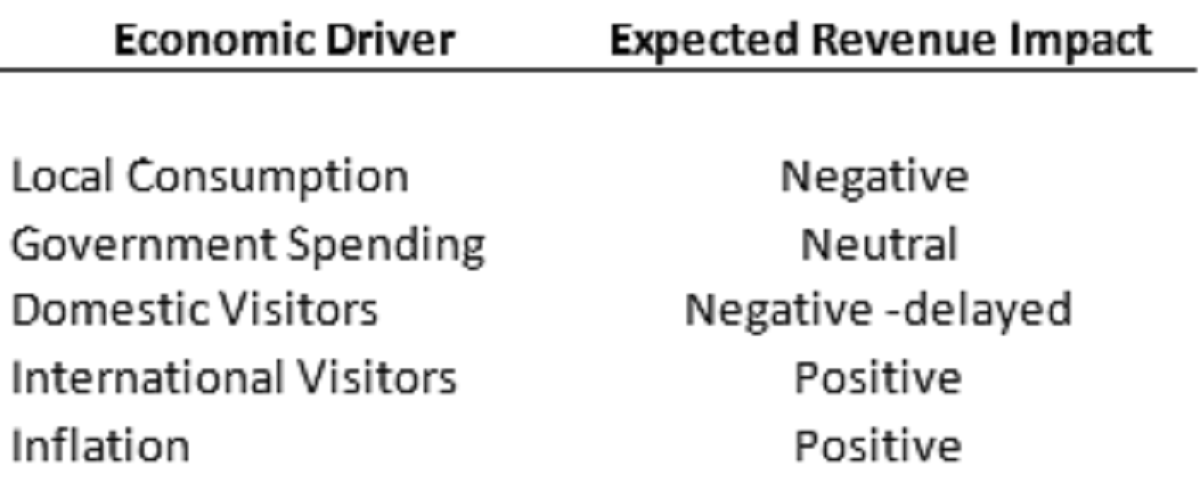

How will an economic downturn affect Hawaii’s tax revenues? Taking a closer look at the main components of the local economy (local consumption, government spending, and tourism) can help clarify the outlook.

Lower economic prospects should reduce local consumption levels, but strong savings cushions may mitigate the impacts. The biggest component of Hawaii’s economy is local consumption. We would expect consumption to decrease as consumers feel the bite of inflation and lower economic activity. It should be noted that it takes about six months for monetary policy to take full effect in the real economy. Thus, we would not expect to see a large impact on spending rates for several months. At which point, we would expect a reduction in spending to be a net negative for tax revenues. However, many US households accumulated savings cushions during the pandemic. The extra money that they tucked away may lessen the impact of slower economic growth. Figure 3 shows that households still have excess savings accumulated during the pandemic. The major takeaway is we would expect decreasing local consumption to be a drag on the economy, but this will take one or two quarters to take effect.

Government spending is likely to remain constant. Government spending at the Federal and state level is another important part of the Hawaii economy. Government spending is expected to remain stable over the medium to long term. Spending will likely remain slightly elevated as governments spend the remaining parts of the Federal fiscal stimulus money and Federal money from Biden’s Build Back America program start flowing through. The spending will be much lower than during the height of the pandemic when several Federal fiscal stimulus measures resulted in a net transfer of $20 billion to Hawai’i.

Domestic visitor spending will likely be affected by an economic downturn, but not for several months. Tourism is another important piece of the State’s economy. It is best to divide up the sector into domestic and foreign visitors as they industry segments behave differently. In terms of domestic visitors, lower economic growth will put downward pressure on discretionary spending. Since most vacations to Hawaii are booked months in advance, decreased tourism demand will mainly come from new vacations not being booked versus existing vacation plans being canceled. This means that we would expect domestic tourism spending to be relatively strong for the next several months with a possible decline in the calendar year 2023.

The renewal of the Asian visitor market, which has been absent since the beginning of the pandemic, will provide an economic boost. Asian visitors are beginning to return after a multi-year hiatus due to pandemic travel restrictions in their home countries. Asian visitors tend to be amongst the biggest spenders. While the depreciation of local currencies like the Japanese Yen and lower diminished economic outlooks in Asia will dampen tourist spending, any increase in international visitor spending would result in a net-boost for the local economy since it is increasing from essentially zero.

Inflation may hurt consumers and businesses, but it will boost tax collections. It is important to distinguish between the total amount of dollars being spent versus the total amount of things being consumed. In high inflation environments, it is possible that total dollars spent continues to rise while total consumption decreases. In terms of tax revenues, the only concern is total dollars being spent. If inflation is running at 5% for the entire year, we would expect tax revenues to increase by slightly less than 5% even if economy did not grow at all in real terms.iii Higher levels of inflation will boost revenue prospects.

An assessment of Hawaii’s key economic engines suggests a relatively benign outlook for the State’s economy through the end of the calendar year. The delayed impacts of monetary policy on local consumption and domestic visitor spending will drag down growth in several months. These downward pressures will be partially offset by the resumption of international visitor spending. Higher prices (i.e. inflation) will boost tax revenues as well.

The negative economic effects will be more severe in calendar year 2023. This is when the bite of tighter monetary policy will take greater effect and the boost from the arrival of international visitors will dissipate.

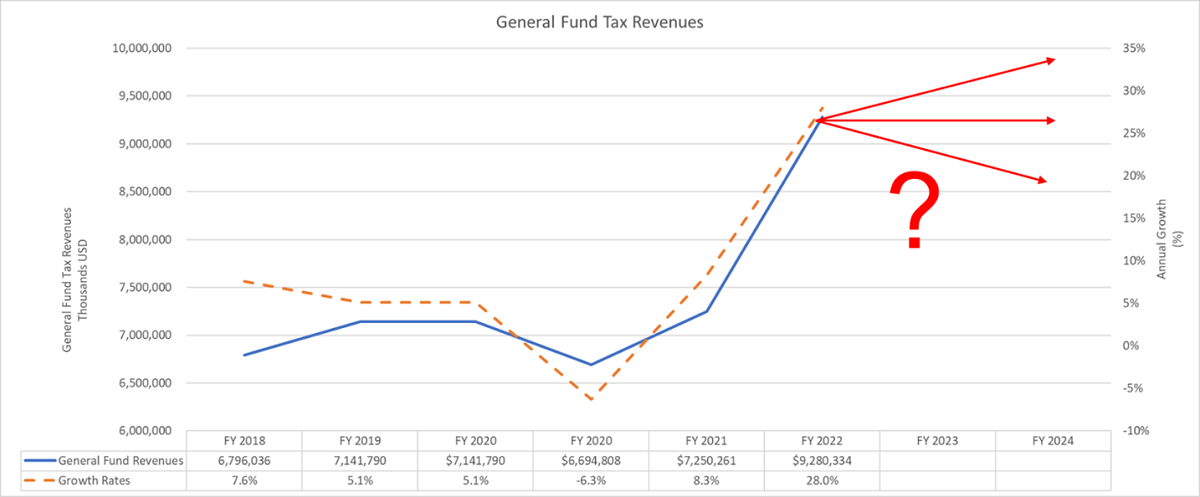

Nobody expects the high levels of revenue growth that occurred in FY 2022, but collections should remain relatively positive until 2023 when the outlook darkens. Tax collections of late have been extraordinary, which increased of 8.3% in FY 2021 and 28% expected by the Council on Revenues in FY 2022.

Other developments not incorporated in this analysis could have material impact on Hawaii’s economy and therefore revenues. These include: 1) A new development in the COVID-19 pandemic that forces renewed shutdowns. 2) Unexpected escalation and spillover from the War in Ukraine. 3) Unforeseen financial instability caused by tighter monetary policy. This could provoke a wave of corporate bankruptcies or sovereign debt crisis in Europe or an Emerging market.

The biggest source of economic stress is monetary policy. When inflationary pressures go away, the FED will be able to loosen monetary conditions. There is great uncertainty as to when inflationary pressures will subside. It is helpful to distinguish between the two sources of inflation. The first is inflation caused by temporary disruptions in the supply-chain and price spikes in commodity markets like oil and food. Markets will eventually adopt to these price shocks. The Fed has less control over these factors, so they will be less interested in these prices.

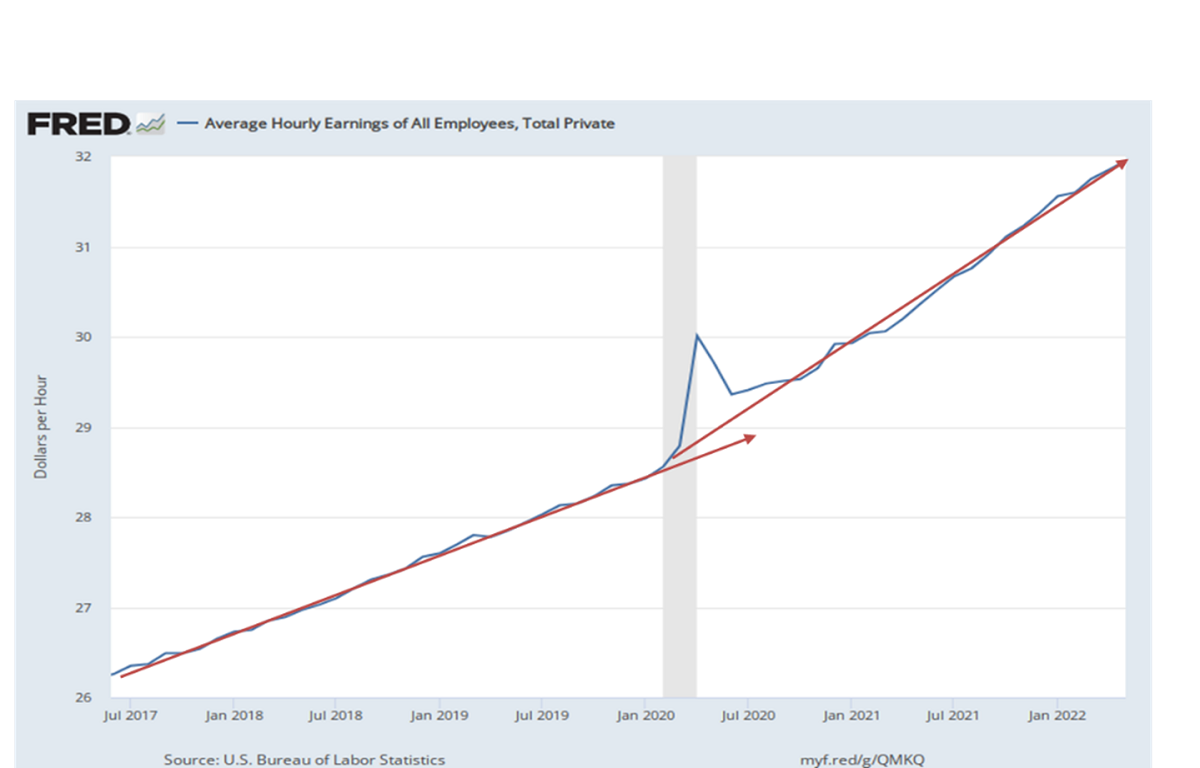

The other source of inflation comes from excessive demand caused by loose monetary policy. The Fed does have control over these prices. One area of particular interest is wage inflation. Wage growth has accelerated during the period of the pandemic (see Figure 4). The Fed wants to avoid the creation of wage/inflation spiral where wage prices become embedded in market expectations. An important metric to watch during the Fed’s battle with inflation is the wage growth data. A decrease in wage growth will remove a big source of inflationary pressure. The FED will keep monetary policy tight and economic growth subdued until inflationary pressures like wage growth are eliminated.

1 The policy of Quantitative Easing involved the purchase of long-dated securities like government bonds and mortgage-backed securities, which injected more money into the system. Reversing QE will involve selling the long-dated securities they bought. This will shrink the Fed’s balance sheet and reduce the liquidity in the system.

2 DBEDT forecasts that Hawaii’s GDP will be $98 billion for the full year in 2022, so $25 billion (100/4) is close to actual number of $24.5 billion.)

3 The impact of inflation is not all good for tax revenues since higher inflation will impact incomes of business owners if they cannot pass on the price increases to their customers. Poor performance of the stock market and other real assets will hurt capital gains tax collections, but the bulk of the impact is expected in 2023 when taxpayers report their income earnings for tax year 2022.