How Can We Help

Interpreter Services

Important Resources

News and Announcements

-

News Release 2026-01

Release PDF – Travel Lodging, Exercise Gym and Their Agents Charged with Criminal Tax Violations

-

News Release 2026-02

Release PDF – Tax Filing Tips for the 2026 Tax Season

-

Council on Revenues

Tuesday, March 10, 2026 2:00 P.M.

-

Tax Review Commission

Agenda – Tuesday, February 17, 2026 at 2:00 P.M.

Recent Updates

-

Rental Collection Agreement

Persons authorized under agreements to collect rent (third party rent collectors) on behalf of owners of real property and transient accommodations located within Hawaii are required to file Form RCA-1 electronically. Form RCA-1 will be available for filing at Hawaii Tax Online starting on January 2, 2025.

Visit the Rental Collection Agreement Information page for more information.

-

Pass-Through Entity Taxation

For taxable years beginning after December 31, 2022, partnerships and S corporations may elect to pay Hawai’i income taxes at the entity level. Eligible members of an electing pass-through entity (PTE) may claim a Hawai’i income tax credit for the pro rata share of PTE taxes paid.

Visit the Pass-Through Entity Taxation page for more information.

Tools & Resources

Tax License Search

Use this page to search for your Hawaii Tax license(s) and status(es).

report tax violations

To ensure that all sectors of Hawaii’s economy, especially those that transact business in cash, pay their fair share of taxes.

online certificate of vendor compliance (hce)

Expedites your ability to furnish proof of compliance with the requirements of 103D-310(c), HRS

Protect Your Information

Helpful tips and reminders to prevent you from getting scammed and to protect your information.

Third Party Registration

This page provides information on how to register as a Verified Practitioner under the State of Hawai‘i.

Collections Services

Tax Collection Services is charged with the recovery of taxes. Got a Collections issue or question?

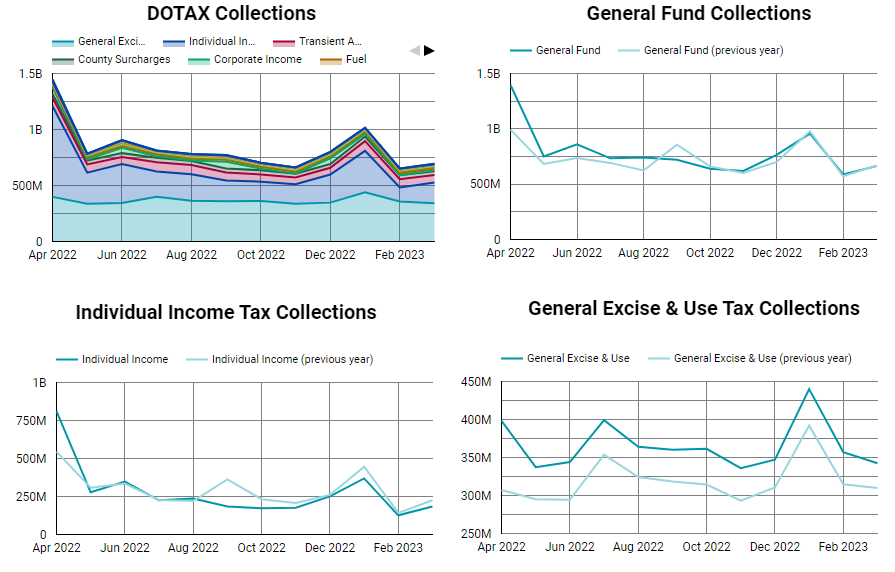

Reports & Data

OAHU

Taxpayer Services

- Tel:

- 808-587-4242

- Toll-Free:

- 1-800-222-3229

- Fax:

- 808-587-1488

- Hours:

- M-F 8:00 am – 4:00 pm

Office Audit Branch

- Tel:

- 808-587-1644

- Fax:

- 808-587-1633

- Hours:

- M-F 8:00 am – 4:00 pm

Collection Branch

- Tel:

- 808-587-1600

- Fax:

- 808-587-1720

- Hours:

- M-F 8:00 am – 4:00 pm

*8 am – 3 pm first Wed of month

NEIGHBOR ISLANDS

Maui

- Tel:

- 808-984-8500

- Fax:

- 808-984-8522

- Hours:

- M-F 8:00 am – 4:00 pm

Molokai

- Tel:

- 808-553-5541

- Fax:

- 808-553-9878

- Hours:

- M-F 8:00 am – 4:00 pm

*Closed 1:30 pm – 2:30 pm

Hawaii (Hilo and Kona)

- Tel:

- 808-974-6321

- Fax:

- 808-974-6300

- Hours:

- M-F 8:00 am – 4:00 pm

*Kona office closed 12 pm – 1 pm

Kauai

- Tel:

- 808-274-3456

- Fax:

- 808-274-3461

- Hours:

- M-F 8:00 am – 4:00 pm