Pass-Through Entity Taxation

Pass-Through Entity (PTE) Taxation Information

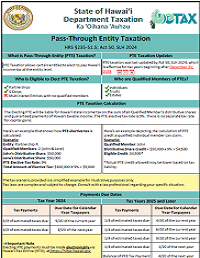

On June 1, 2023, S.B. 1437, S.D. 1, H.D. 2, C.D. 1 was signed into law by Governor Josh Green, M.D., and was codified as Hawai‘i Revised Statutes (“HRS”) §235-51.5. HRS §235-51.5 allows partnerships and S corporations to elect to pay Hawai‘i income taxes at the entity level. Eligible members of an electing pass-through entity (PTE) will receive a Hawai‘i income tax credit for the pro rata share of PTE taxes paid. Act 50 takes effect on January 1, 2024, and applies to taxable years beginning after December 31, 2022.

On June 19, 2024, S.B. 2725, H.D. 1, C.D.1, was signed into law by Governor Josh Green, M.D. and became Act 50, Session Laws of Hawai‘i 2024 (“Act 50, SLH 2024”). Act 50, SLH 2024 repealed the multi-tier entity provisions of HRS §235-51.5, modified the definition of qualified members of Pass-Through Entities, and allows for a nonrefundable carry forward of unused PTE credits to subsequent years. Act 50, SLH 2024 took effect on June 19, 2024 and applies to taxable years beginning after December 31, 2023.On May 15, 2025, H.B. 1146, H.D. 1, S.D. 1, was signed into law by Governor Josh Green, M.D., and became Act 58, Session Laws of Hawaii 2025 (“Act 58, SLH 2025”). Act 58, SLH 2025 amends section 235-51.5(e), HRS to require that any qualified member of an electing PTE shall add to the qualified member’s taxable income the qualified member’s share of taxes pay by an electing pass-through entity under HRS § 235-51.5.

Temporary Administrative Rules

The Department of Taxation has REPEALED the Temporary Administrative Rules Relating to Pass-Through Entities that were effective February 16, 2024 as initially enacted by Act 50, Session Laws of Hawaii 2023.

EFFECTIVE JANUARY 2, 2025, The Department of Taxation has issued Temporary Administrative Rules Relating to Pass-Through Entities as enacted by Act 50, Session Laws of Hawaii 2024.

Tax Information Releases

The Department has issued guidance for PTE Taxation in Tax Information Release (“TIR”) 2024-01. This TIR replaces and supersedes TIR 2023-03 (Amended) for taxable years beginning after December 31, 2023.

Information Guides

Pass-Through Entity (PTE) Taxation FAQs

- General Guidance

- PTE Taxation Eligibility

- PTE Taxation Election

- PTE Taxation Calculation and Payments

- Estimated Payments of PTE Tax

- Pass-Through Entity Tax Credit

- Credit for PTE Taxes Paid to Another State

- PTE Tax Filing Requirements

- Multi-Tiered Entities

The Department of Taxation (“Department”) has issued guidance for PTE Taxation in Tax Information Release 2023-03 Amended.

General Guidance

Has the Department provided any written guidance related to PTE?

Yes, please see Tax Information Release 2023-03 Amended for tax year 2023 and Tax Information Release 2024-01 for updates pursuant to Act 50, SLH 2024.

Where can the necessary forms for PTE election, calculation, claiming the credit, etc. be found?

All forms are available on the Forms & Publications page on the Department’s website.

What are the benefits of electing PTE taxation?

The stated purpose of Act 50, SLH 2023, codified as HRS §235-51.5, is to “help Hawaii’s small businesses by allowing taxpayers to deduct Hawaii state income taxes paid on their federal income tax returns.” The Department does not advise taxpayers on whether they should elect PTE taxation or what the particular tax consequences of their election may be. Taxpayers should consult with their tax professional in determining whether to elect PTE taxation.

What changes were made to PTE taxation in Tax Year 2024?

Act 50, SLH 2024, made the following changes:

- Amends the PTE tax base by imposing the tax on the sum of the distributive shares and guaranteed payments of all “qualified member[s].” A “qualified member” is now defined as a member of an electing PTE that is an individual, trust, or estate. Accordingly, PTEs without qualified members are no longer eligible to elect PTE taxation.

- Amends the PTE tax rate from the highest rate of tax applicable to the individual under HRS §235-51.5, to 9 percent.

- Allows the PTE credit to be carried forward in subsequent years until exhausted.

PTE Taxation Eligibility

Who is eligible to elect PTE taxation?

Partnerships and S corporations are eligible to elect PTE taxation. The term “partnership” means the same as is defined in the Internal Revenue Code (IRC) and includes limited liability companies (LLCs) treated as partnerships for federal income tax but does not include publicly traded partnerships as defined in IRC section 7704. The term “S corporation” means a corporation with a valid election under IRC section 1362(a).

Can a multi-member LLC that elects to be taxed as a C corporation elect PTE taxation?

No. A multi-member LLC that elects to be taxed as a C corporation is not eligible to elect PTE taxation.

Can a single-member LLC elect PTE taxation?

A single-member LLC is not eligible to elect PTE taxation. However, a single-member LLC that elects to be taxed as an S corporation is eligible to elect PTE taxation.

Can an electing PTE have a C corporation as a member?

Yes. An electing PTE may have a C corporation as a member. However, the distributive shares and guaranteed payments of the C corporation are not included in calculating the PTE tax.

PTE Taxation Election

How does a partnership or S corporation make an election for PTE taxation?

A partnership or S corporation may elect PTE taxation by timely filing Form N-362E (Pass-Through Entity Tax Election). Form N-362E requires the signatures of each member of the electing PTE or the signature of one authorized member with attestation under penalty of perjury that the authorized member possesses authority to bind the entity.

Does a PTE election need to be made every year?

Yes. A separate election for PTE taxation must be made for each tax year.

When is the deadline to file Form N-362E (Pass-Through Entity Tax Election)?

Form N-362E must be filed by the 20th day of the 4th month following the close of the taxable year, or the 20th day of the 10th month following the close of the taxable year if an extension is granted. An extension is automatically granted if the electing PTE pays the properly estimated tax liability.

Can digital signatures be used on the PTE Taxation Election Form?

Yes.

Does the PTE taxation election apply to all members?

Yes. An election for PTE taxation is binding on all members of an electing PTE and cannot be revoked for that tax year.

PTE Taxation Calculation and Payments

What is the PTE tax rate?

The PTE tax rate for tax year 2023 is set at the highest rate under HRS §235-51, currently 11%.

The PTE tax rate for tax year 2024 and forward is set at 9%.

How is the PTE tax calculated?

The PTE tax is calculated by multiplying the sum of all Qualified Members’ distributive shares and guaranteed payments by the PTE tax rate.For tax year 2023, “Qualified Members” include all members that hold an interest in the electing PTE, except for C corporations.

For tax year 2024 and forward, “Qualified Members” means all members of an electing PTE that are individuals, trusts, or estates.

Are capital gains taxed at a different rate?

No. There is no separate tax rate for capital gains.

When is the deadline to pay the PTE tax?

The deadline to pay the balance of the PTE tax (the total tax less any estimated tax payments made) is the 20th day of the 4th month following the close of the taxable year.

Does an automatic extension to file extend the time to pay the PTE tax?

No. An extension of time to file is not an extension of time to pay the PTE tax. Penalties and interest will accrue on any tax liability not paid on or before the prescribed due date.

Can an electing PTE take a Hawaiʻi State deduction for PTE taxes paid?

Yes.

Does an electing PTE with nonresident qualified members have to withhold income tax for those members in addition to paying the PTE tax?

No. For electing PTE entities with nonresident qualified members, the payment of the PTE tax and election of PTE treatment will be deemed to have satisfied the nonresident withholding requirement.

How are PTE losses handled?

If an electing PTE experiences a net loss, the loss may be carried forward and applied in future years as long as the PTE continues to elect PTE taxation.

Estimated Payments of PTE Tax

Are estimated payments required for an electing PTE?

Estimated payments are required for electing PTEs, starting in tax year 2024.

What are the due dates for making estimated payments for tax year 2024 and beyond?

For tax years 2024 and beyond, electing PTEs are required to make estimated tax payments in four equal amounts as follows:

| PTE Estimated Tax Payments | Due Date for Calendar Year Taxpayers | Due Date for Fiscal Year Taxpayer |

|---|---|---|

| 1st Payment | 4/20 of the current year | 20th day of the 4th month of the fiscal year |

| 2nd Payment | 6/20 of the current year | 20th day of the 6th month of the fiscal year |

| 3rd Payment | 9/20 of the current year | 20th day of the 9th month of the fiscal year |

| 4th Payment | 1/20 of the next year | 20th day of the 1st month following the close of the fiscal year |

For tax year 2024 only, electing PTEs will not be subject to penalties for failing to make the first two estimated payments or for making unequal payments based on changes in the PTE tax rate under Act 50, SLH 2024, so long as the electing PTE (1) pays one-half of the total estimated tax by the 20th day of the 9th month of the taxable year and (2) pays the balance of the total estimated tax by the 20th day of the 1st month following the close of the taxable year. Electing PTEs that have not made the first two estimated payments may remit the final two estimated payments for tax year 2024. Electing PTEs that have already made estimated payments based on the prior PTE tax rate should adjust subsequent estimated payments to account for the new 9% PTE tax rate.

How are estimated payments of PTE tax made?

Electing PTEs may make estimated payments of the PTE tax via Hawaii Tax Online at hitax.hawaii.gov.

To make an estimated payment while logged in to your account:

- Select partnership or S corporation account;

- Select the Tax Period;

- Select Make a Payment;

- Select Estimated Tax Payment type;

- Enter payment information and complete payment.

Alternatively, to make an estimated payment without logging in to your account:

- Select Make a Payment;

- On the Payment Type screen, select the account type and type of payment for your entity type using the table below:

Entity Type Account Type Type of Payment Partnership Partnership Estimated Tax Payment S-Corp Corporate income Estimated Tax Payment - Enter payment information and complete the payment.

Are there any penalties for failing to make estimated payments?

Penalties, as outlined in HRS §235-97(f), will be applied to any underpayment of estimated tax beginning in 2024.

Does the failure by a partnership or S corporation to make estimated payments affect its eligibility to elect PTE taxation?

No. Whether a partnership or S corporation makes estimated payments of PTE tax does not affect its eligibility to make an election for PTE taxation. Note, however, that effective for tax year 2024 and thereafter, any underpayment of estimated tax will be subject to penalties under HRS §235-97(f).

Is it possible to transfer estimated payments made for individual income tax to the partnership or S corporation account of a member in an electing PTE?

No. Estimated tax payments that have already been made by an individual member may not be transferred as an estimated tax payment for a partnership or S corporation. The member may request a refund for any overpayment of estimated individual income taxes when the member files their individual income tax return. Further, all estimated tax and penalties must be submitted prior to 20th day of the 4th month following the close of the taxable year to take advantage of the automatic extension to elect PTE taxation.

How does an electing PTE request a refund for overpayment of estimated payments?

If an electing PTE’s estimated payments exceed the total amount of PTE tax reported on Schedule PTE, a refund may be claimed on Form N-20 or N-35.

How does an electing PTE request a refund of estimated payments when it chooses not to elect PTE taxation?

A PTE that makes estimated payments of PTE tax but decides not to elect PTE taxation may request a refund of the amount overpaid on Form N-20 or Form N-35.

PTE Tax Credit

Who is eligible to claim the PTE Credit for tax year 2023?

For tax year 2023, the PTE credit may be claimed by members of an electing PTE whose distributive shares and guaranteed payments are subject to PTE taxation for the taxable year. C corporations are not eligible to claim the PTE credit because their distributive shares and guaranteed payments are not included in calculating the PTE tax.

Who is eligible to claim the PTE Credit for tax year 2024 and beyond?

For tax year 2024 and beyond, the PTE credit may be claimed by qualified members of an electing PTE whose distributive shares and guaranteed payments are subject to PTE taxation for the taxable year. A qualified member must be an individual, trust, or estate. C corporations, S corporations, and partnerships are not eligible to claim the PTE credit.

When is the deadline to claim the PTE credit?

The PTE credit may be claimed when filing an individual income tax return. The due date for filing an income tax return is on the 20th day of the 4th month following the close of the taxable year, or the 20th day of the 10th month following the close of the taxable year if an extension is granted. Pursuant to section 235-111, HRS, the deadline to claim the PTE credit is three years from the date the return is filed or from the due date prescribed for the filing of the return, whichever is later.

Are PTE credits refundable?

PTE credits are nonrefundable.

For tax year 2023, any credits that exceed the member’s Hawaiʻi income tax liability are nonrefundable to the member and excess credits cannot be carried forward.

For tax year 2024 and beyond, any credits that exceed the qualified member’s Hawaiʻi income tax liability are nonrefundable to the member and excess credits may be carried forward.

How is the amount of the PTE credit determined?

Each qualified member of an electing PTE may claim a PTE credit equal to the member’s pro rata share of the PTE tax paid.

Who is responsible for communicating information about the pro rata shares of PTE credits to members of an electing PTE?

Electing PTEs are required to report to each member, for each tax year, the member’s pro rata share of PTE credits.

Can a member of an electing PTE claim the PTE credit and also claim a deduction for Hawaiʻi income taxes paid on their own distributive shares or guaranteed payments of income from the electing PTE?

No. Members who claim the PTE credit may not claim a deduction for amounts of Hawai’i state income tax the member paid on their own distributive shares or guaranteed payments of income from the electing PTE.

Does Hawaiʻi require an add-back to taxable income?

Yes, but only for tax years beginning after December 31, 2024. For tax years beginning after December 31, 2024, any qualified member claiming a credit must add back to their taxable income the share of the qualified member’s taxes paid by the electing pass-through entity.

Are members of an electing PTE allowed to amend the amount of PTE credit claimed?

Individual members may amend the amount of PTE credit claimed by amending their individual income tax returns. The amount of the PTE credit claimed must equal the member’s pro rata share of the PTE tax paid, as reported on the electing PTE’s Schedule PTE.

If a trust is a member of an electing PTE, can the trust pass the PTE credit to the beneficiaries of the trust?

Yes. A trust that is a member of an electing PTE and whose distributive shares and guaranteed payments are subject to the PTE tax may pass on the PTE credit to its beneficiaries. The trust must file Schedule PTE-U to report the allocation of the PTE credit received from the electing PTE to the trust’s beneficiaries.

In what order will PTE credits be applied to a taxpayer’s income tax liability?

In the offsetting of a taxpayer’s income tax liability, tax credits are applied in the following order:

- Tax credits that may be refunded or paid to a taxpayer who has no income tax liability;

- Nonrefundable tax credits that may not be carried forward; and

- Nonrefundable tax credits that may be used as a credit against taxes in subsequent years until exhausted.

For tax year 2023, PTE credits are nonrefundable tax credits that may not be carried forward.

For tax year 2024 and beyond, PTE credits are nonrefundable tax credits that may be used as a credit against taxes in subsequent years until exhausted.

Credit for PTE Taxes Paid to Another State

Who is eligible to claim the credit for PTE taxes paid to another state?

Residents and part-year residents who are members of a PTE may claim a credit for the member’s pro rata share of taxes paid to another state or to the District of Columbia, on income of any partnership or S corporation, so long as the taxes paid to the other state are substantially similar to the taxes imposed by as HRS §235-51.5.

How can the credit for PTE taxes paid to another state be claimed on the Hawaiʻi individual income tax return?

The credit for PTE taxes paid to another state must be claimed on line 11 of Schedule CR (“Income tax paid to another state or foreign country”). Do not claim the credit for PTE taxes paid to another state on line 13 of Schedule CR (“Pass-Through Entity Tax Credit”) or Form N-362. The taxpayer must attach the following to their income tax return: (1) a copy of the PTE’s tax return filed in the other state or District of Columbia and (2) all available schedules showing the taxpayer’s share of taxes paid by the PTE..

PTE Tax Filing Requirements

Can an electing PTE file its income tax returns and PTE forms by mail?

Electing PTEs are required to file all returns, schedules, statements, and other documents, and remit all payments electronically. Failure to electronically file and/or submit an electronic funds transfer shall result in cancellation of the election for PTE taxation unless an exemption is granted.

A list of approved software vendors that support the required forms and schedules for electing PTEs may be found on the Department’s website at tax.hawaii.gov/eservices/software/.

How can an electing PTE request an exemption from the electronic filing or electronic payment requirement?

The Department may grant an exemption to the electronic filing and/or payment requirement for good cause upon the electing PTE’s submission of Form L-110, Electronic Filing or Payment Exemption Application.

Is an individual member of an electing PTE required to file electronically to claim the PTE credit?

No. An individual may, but is not required to, file their income tax return electronically to claim the PTE credit.

Which forms must be filed by an electing PTE?

An electing PTE must file the following forms at the time that the N-20 (Partnership Return of Income) or N-35 (S Corporation Income Tax Return) is filed:

- Form N-362E (Pass-Through Entity Tax Election); and

- Schedule PTE (Pass-Through Entity Tax Calculation).

Which forms must be filed by an individual member of an electing PTE to claim the PTE credit?

At the time of filing the N-11 (Individual Income Tax Return Residents) or N-15 (Individual Income Tax Return Nonresident and Part-Year Resident), the taxpayer must complete and attach the following forms to the N-11 or N-15:

- Schedule CR (Schedule of Tax Credits);

- Form N-362 (Pass-Through Entity Tax Credit);

- Schedule K1 (Partner’s Share of Income, Credits, Deductions, ETC.).

When are allocation schedules (Schedule PTE) required to be filed?

The schedule of pro-rata shares (Schedule PTE) must be filed at the time of the filing of the electing PTE’s tax return, on or before the 20th day of the 4th month following the close of the taxable year, or the 20th day of the 10th month following the close of the taxable year if an extension is granted.

What are the filing deadlines, including extensions, for the PTE taxation forms and form amendments?

| Deadline | Form |

|---|---|

| 20th day of the 4th month following the close of taxable year |

N-362E Schedule PTE, including amendments Schedule PTE-U, including amendments |

| 20th day of the 10th month (with extension) following the close of taxable year |

N-362E Schedule PTE, including amendments Schedule PTE-U, including amendments |

How can an electing PTE obtain an extension to file Form N-362E or Schedule PTE?

An automatic six-month extension is granted to file Form N-362E or Schedule PTE, provided the conditions in section 18-235-98, Hawaii Administrative Rules (HAR), are met, including payment of the properly estimated tax liability for the taxable year.

Can allocation schedules (Schedule PTE) be amended?

Amendments or changes to Schedule PTE are allowed before the due date, which is the 20th day of the 4th month following the close of the taxable year, or the 20th day of the 10th month, following the close of the taxable year if an extension is granted.

No amendments to Schedule PTE will be allowed after the due date.

Multi-Tiered Entities

What are Multi-Tiered Entities?

For tax year 2023 only, the term “multi-tiered entities” refers to an organizational structure where there are multiple layers or levels of entities that pass through their income, losses, deductions, and credits to their respective owners or members. A member of one pass-through entity may also be a pass-through entity with its own members, creating a hierarchy or tiered structure.

What are lower-tiered entities?

For tax year 2023 only, the term “lower-tiered entity” refers to a PTE that has at least one member that is a PTE.

For tax years 2024 and beyond, the “lower tiered entity” provisions were repealed by Act 50, SLH 2024.

What are upper-tiered entities?

For tax year 2023 only, the term “upper-tiered entity” refers to a PTE that is a member of another PTE.

For tax years 2024 and beyond, the “upper-tiered entity” provisions were repealed by Act 50, SLH 2024.

Can members of an upper-tiered entity claim credits from a lowered-tiered entity?

For tax year 2023 only, a member of an upper-tiered entity may claim a PTE credit for taxes paid by an electing lower-tiered entity if:

- The electing PTE (i.e., the lower-tiered entity) properly files its income tax return with all required PTE forms, including Form N-362E and Schedule PTE;

- The upper-tiered entity properly files its income tax return with Schedule PTE-U; and

- The member of the upper-tiered entity files their income tax return with Schedule CR, Form N-362, and Schedule K-1.

For tax years 2024 and beyond, the “multi-tiered entity” provisions were repealed by Act 50, SLH 2024.

If an upper-tiered entity does not elect PTE taxation, can its members still receive PTE credits from a lower-tiered entity?

For tax year 2023 only, yes. An upper-tiered entity is not required to elect PTE taxation in order for its members to claim a PTE credit for PTE taxes paid by a lower-tiered entity. However, the upper-tiered entity must file Schedule PTE-U with its income tax return.

For tax years 2024 and beyond, the “multi-tiered entity” provisions were repealed by Act 50, SLH 2024.

Can an upper-tier PTE elect PTE taxation and pass on PTE credits from a lower-tier PTE to the upper-tier PTE’s members?

For tax year 2023 only, yes. An upper-tier PTE may elect PTE taxation and also pass on PTE credits from a lower-tier PTE to the upper-tier PTE’s members. The upper-tier PTE must file Schedule PTE (for its own election) and Schedule PTE-U (to pass on PTE credits from the lower-tier PTE) at the time the N-20/N-35 is filed.

For tax years 2024 and beyond, the “multi-tiered entity” provisions were repealed by Act 50, SLH 2024.