May 11, 2022 | Tax Research Insights

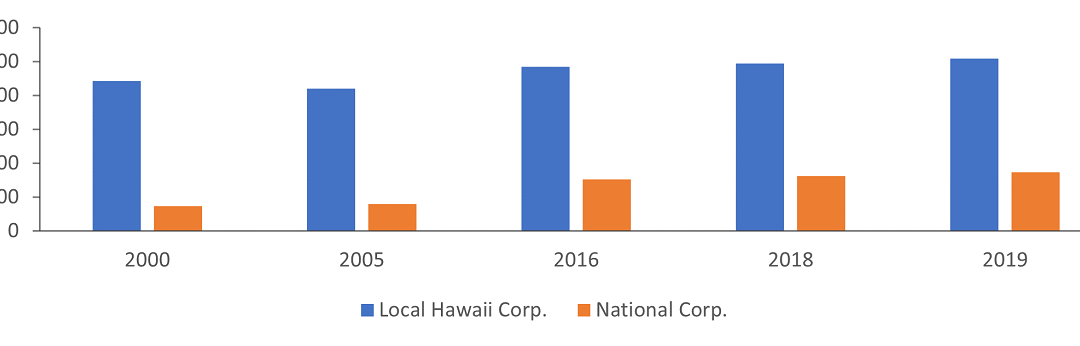

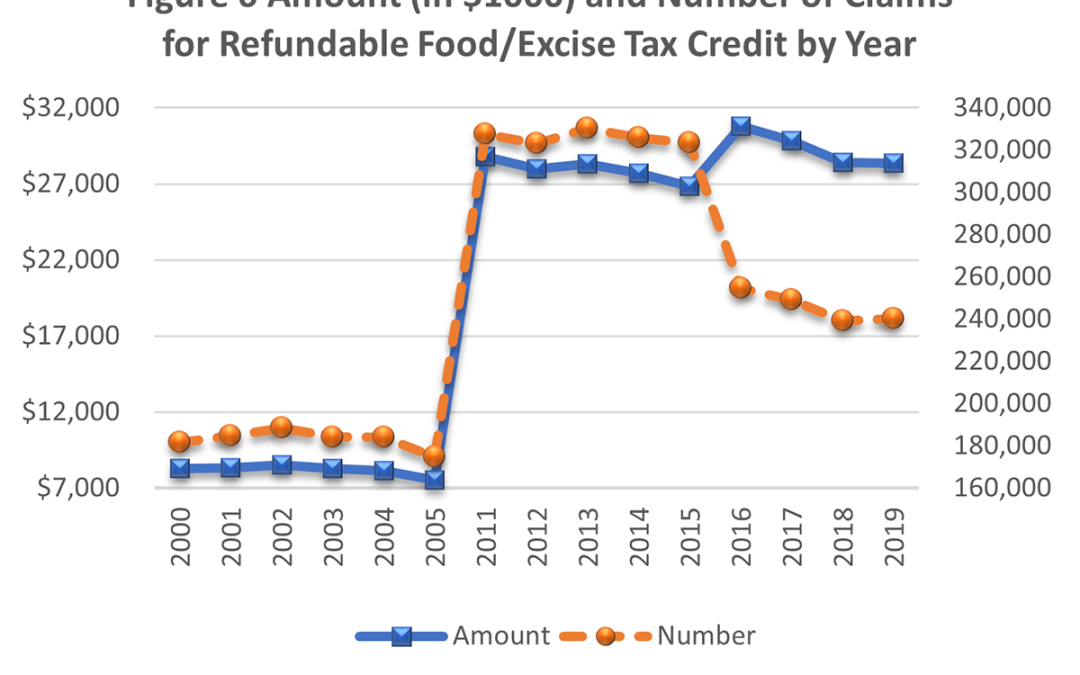

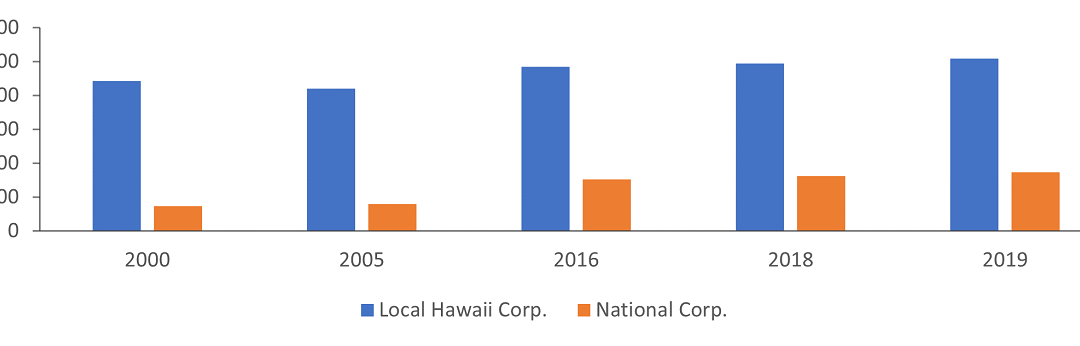

Corporations are the main contributors of Hawaii business receipts. In tax year of 2019, corporations contributed 78% of Hawaii business receipts. There are two types of corporations: those operating only in the State of Hawaii and those that operate nationally (i.e....

May 11, 2022 | Tax Research Insights

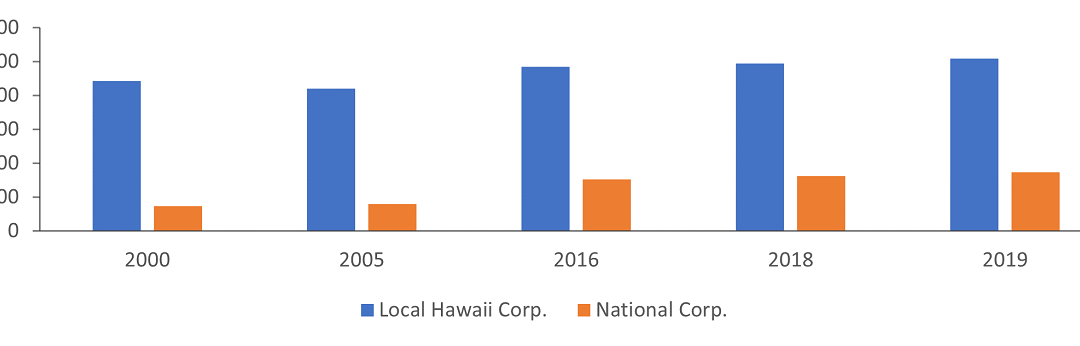

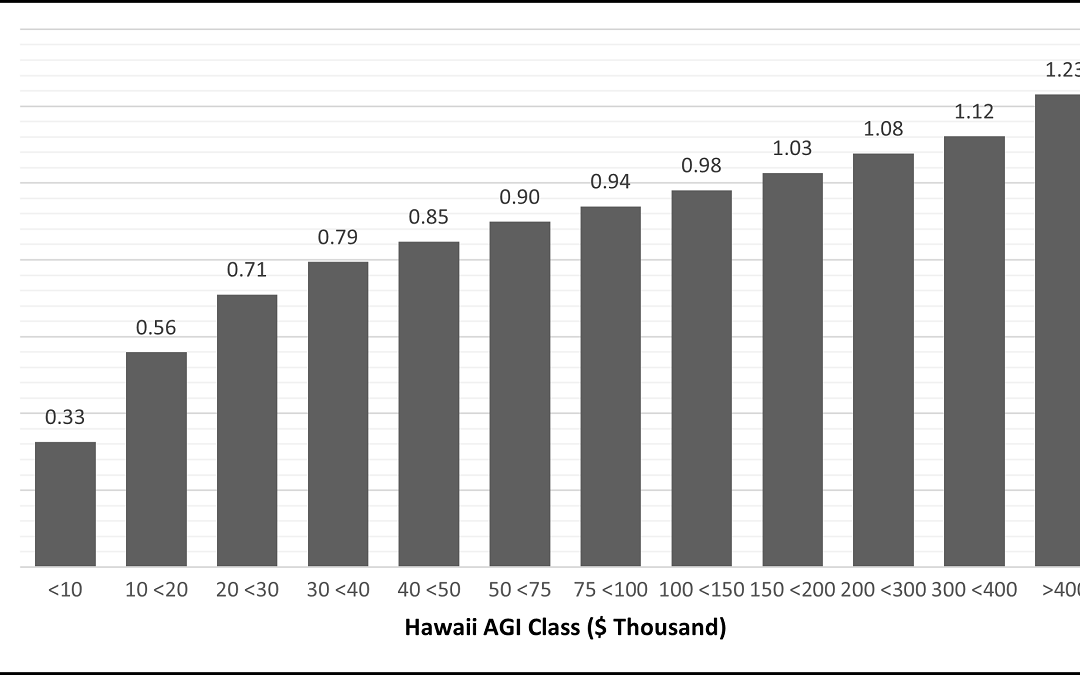

Higher income groups pay more in taxes relative to their income in Hawaii. A progressive tax structure is defined as one where higher income taxpayers pay a larger percentage of their income in taxes. By this metric, Hawaii’s individual income tax is clearly...

Mar 1, 2022 | Tax Research Insights

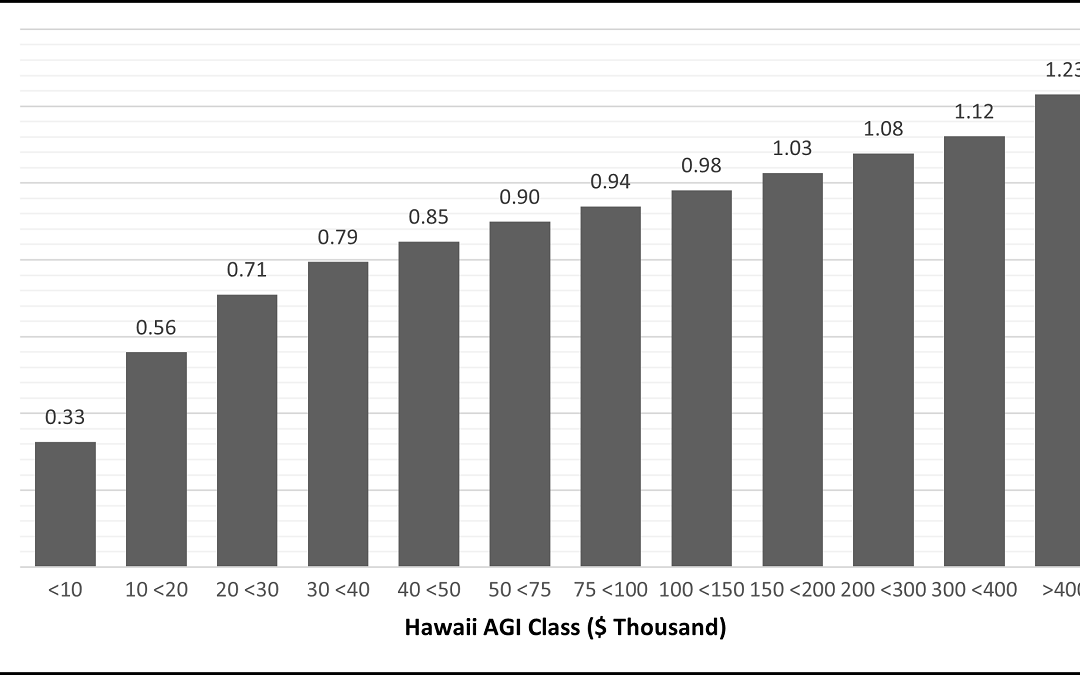

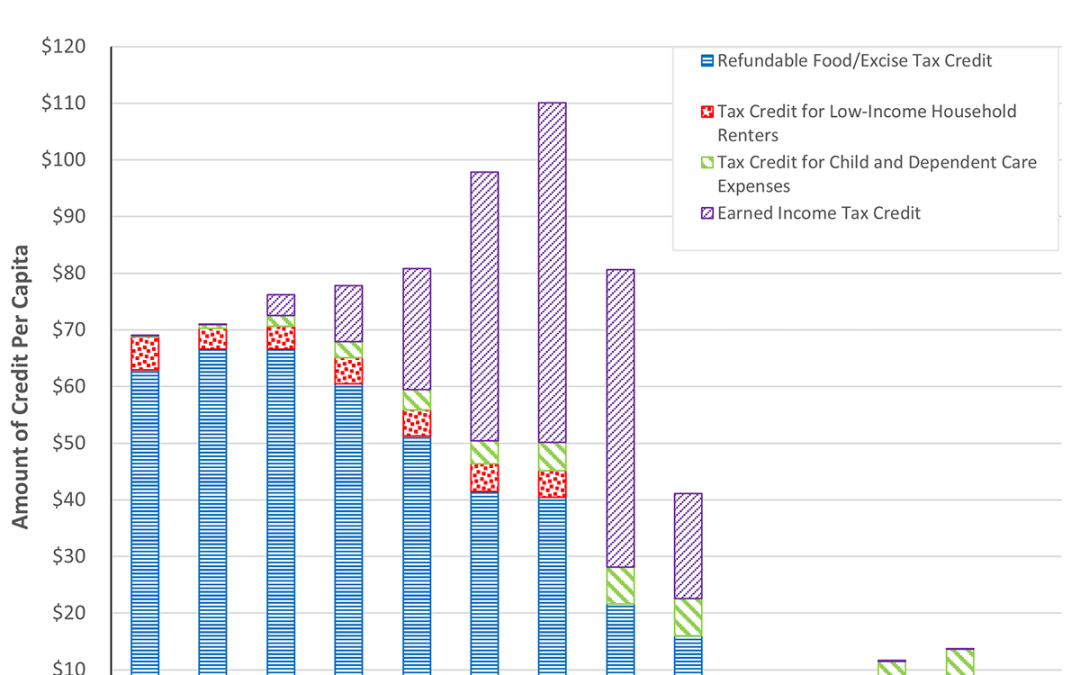

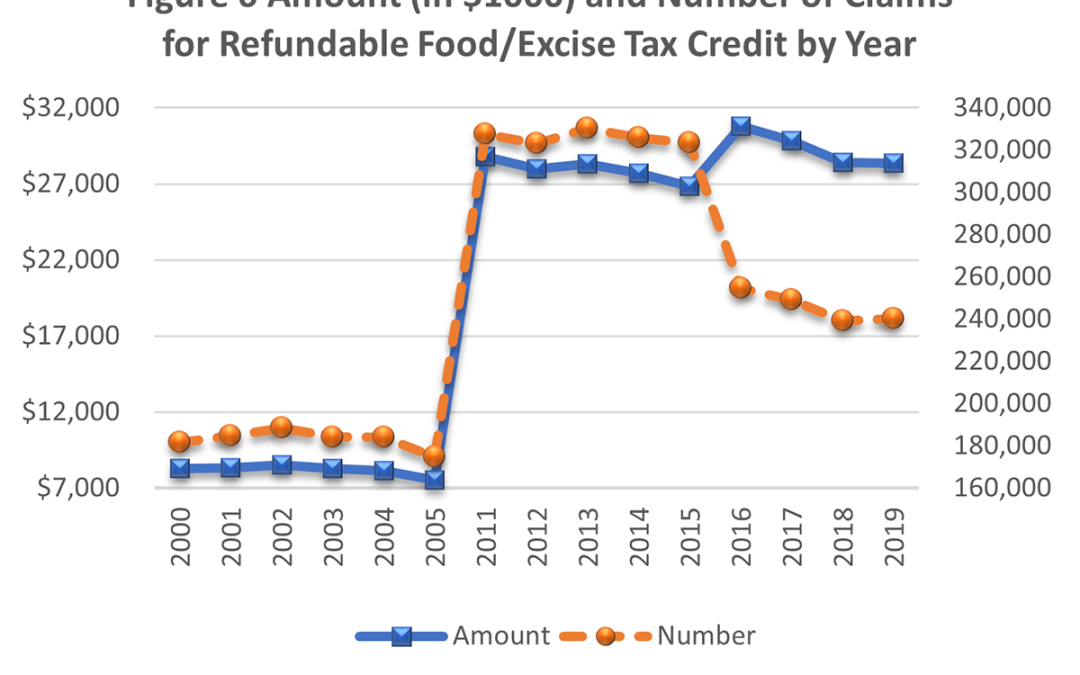

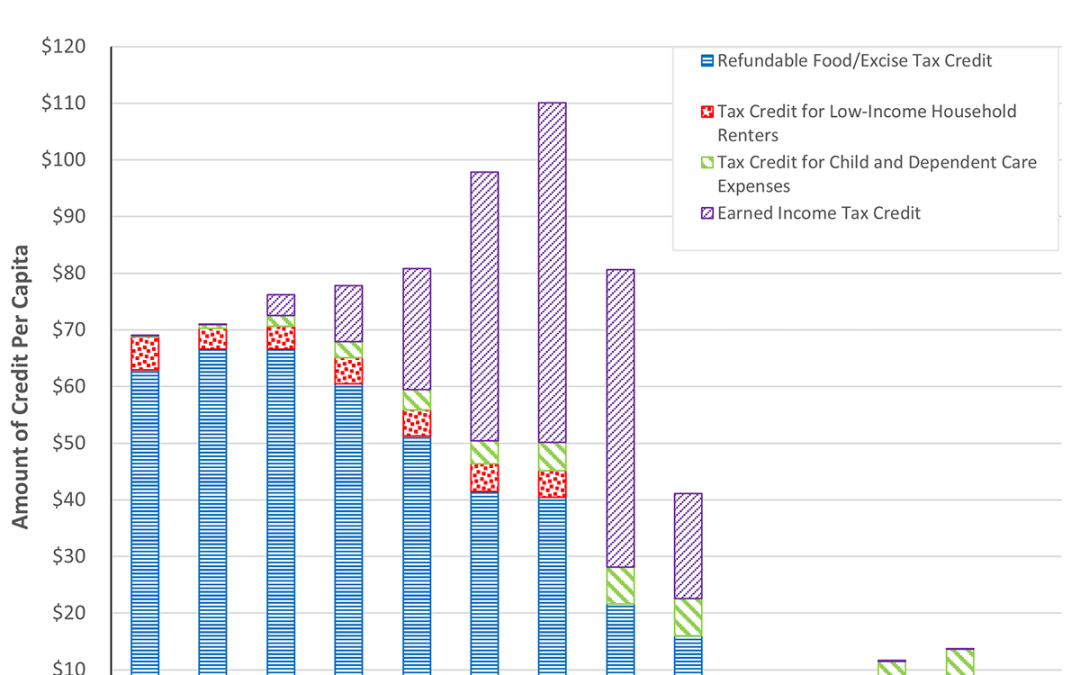

The Food/Excise Tax Credit is the largest tax credit in the State promoting social welfare. In the 2019, there were 240,158 claims worth $28.4 million. Figure 6, Tax Credits Claimed by Hawaii Taxpayers (copied below), shows how the credit has evolved overtime. The...

Jan 1, 2022 | Tax Research Insights

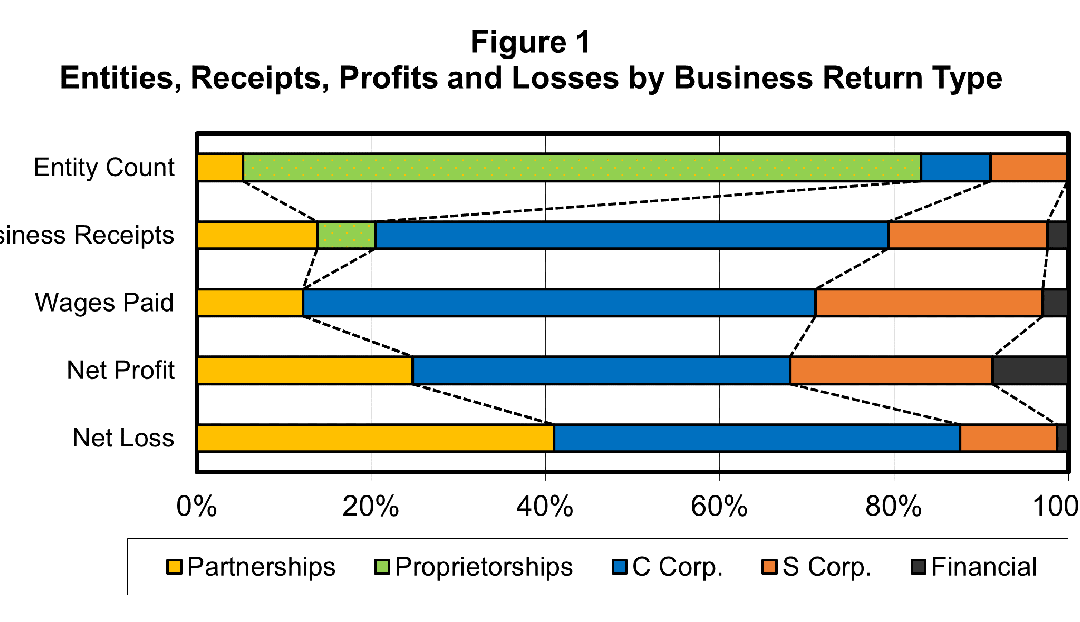

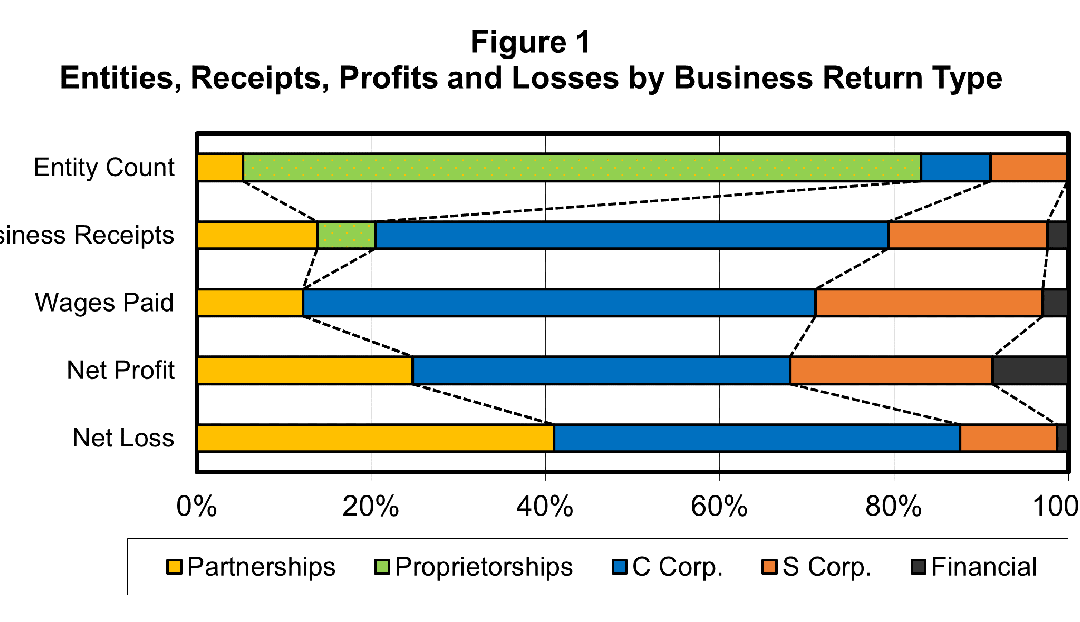

A business is classified by its entity size Businesses can legally organize themselves in different ways. C corporations have more flexibility in their activities, but they are required to pay corporate income tax. S corporations and partnerships are pass-through...

Jan 1, 2022 | Tax Research Insights

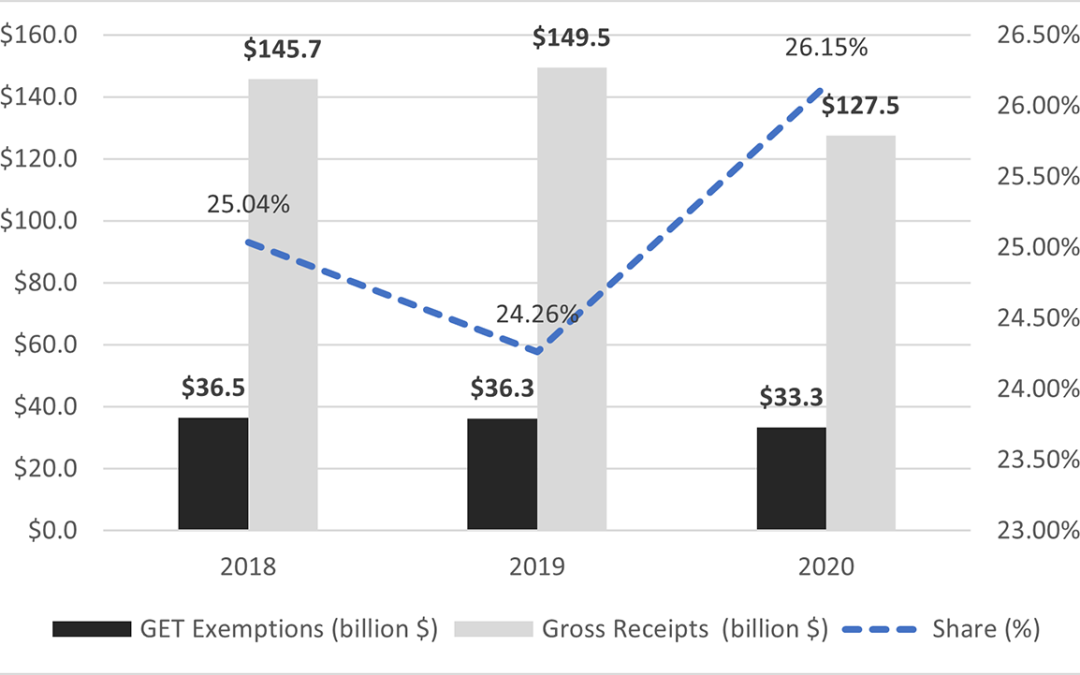

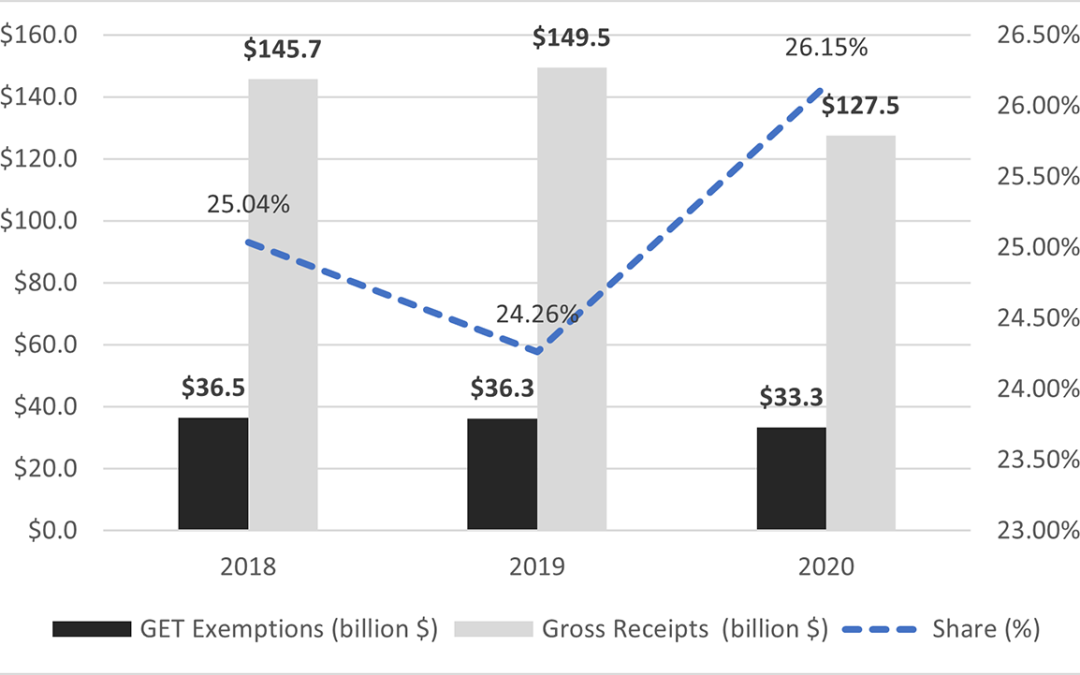

The top five exemptions account for 60% of all exemptions claimed. The General Excise & Use Tax (GET), which is a very broad gross receipts tax, is the largest tax type in Hawaii. GET is a tax on income from almost all business activities, including wholesaling,...

Jan 1, 2022 | Tax Research Insights

This post highlights some interesting trends that emerged in the 2019 Report Tax Credits Claimed by Hawaii Taxpayers. Figure 5 from the report (see below) shows how welfare enhancing tax credits varies by income and some interesting results emerge: The Refundable...