Higher income groups pay more in taxes relative to their income in Hawaii.

A progressive tax structure is defined as one where higher income taxpayers pay a larger percentage of their income in taxes. By this metric, Hawaii’s individual income tax is clearly progressive.

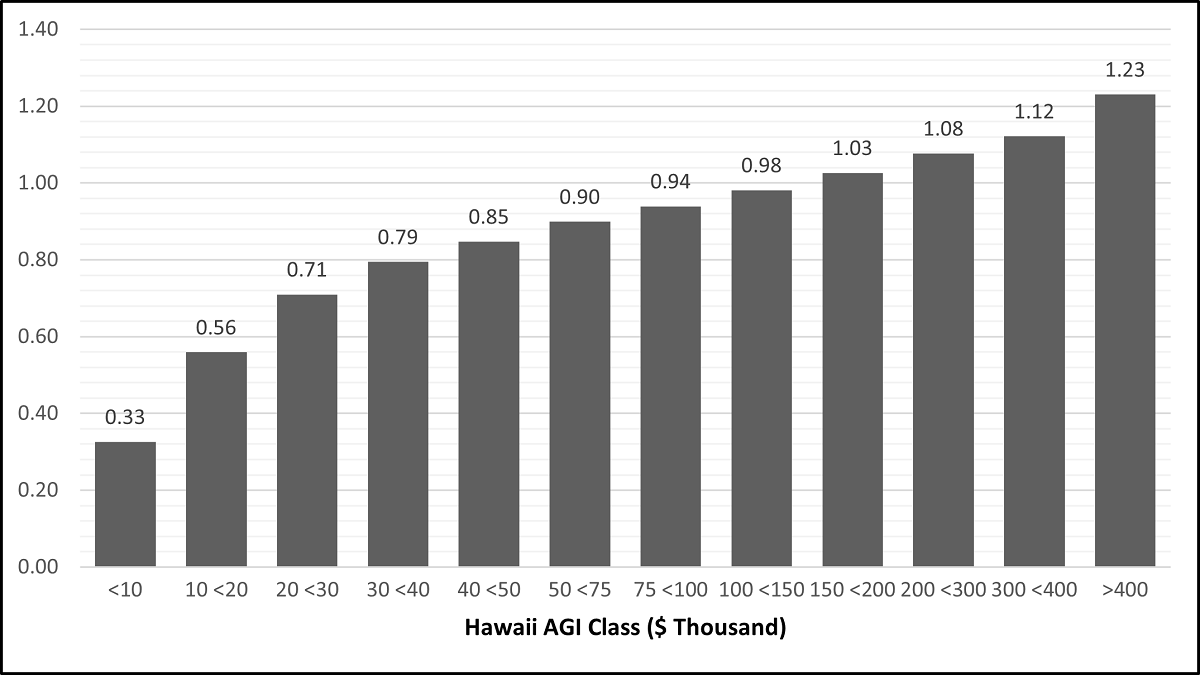

Figure 1 from the Individual Income Tax Statistics report shows the ratio of gross tax liability share (before credits) to taxable income share by income group for Hawaii residents in 2019.

The ratio is a given income bracket’s share of gross tax liability divided by the same income bracket’s share of taxable income among all Hawai’i residents. A score of ‘1’ for an income group implies that the share of gross tax liability is equal to the share of taxable income overall. If an income group has 10% of Hawaii’s taxable income, a ratio of ‘1’ would imply that they are liable for 10% of gross resident taxes.

The ratio increases with income, ranging from 0.33, for Hawaii AGI Class of less than $10,000, to 1.23, for $400,000 and over. In 2019, the ratio exceeded ‘1’ for all Hawaii AGI classes above $150,000, suggesting that the shares of gross tax liabilities of higher-income taxpayers were higher than their shares of taxable income among Hawai’i residents. Taxpayers’ share of gross tax liabilities with Hawaii AGI of $400,000 and over was 23% larger than their share of taxable income.

Non-High-Income groups, while much higher in number, pay a lower percentage of the tax burden. Resident taxpayers with Hawaii AGI under $150,000 filed 92.5% of resident returns, but represented just 59.0% of total Hawaii AGI, and only 49.9% of total resident tax liability before credits.

The ratio of the Share of Gross Tax Liability to Share of Taxable Income of Residents by Hawaii Adjusted Gross Income (AGI) Class in 2019

Source: Hawaii Individual Income Tax Statistics Report for Tax Year 2019, Hawaii Department of Taxation.

Please see the most recent Individual Income Tax Statistics report for more detailed information.