Hawaii has several tax credits that promote social welfare. The Food/Excise Tax Credit is the most frequently claimed tax credit. The Earned Income Tax Credit (EITC) is the second most commonly claimed tax credit. The credit is 20% of the federal EITC allowed and nonrefundable. Act 114 SLH 2022 and Act 163 SLH 2023 made the credit refundable and changed the percentage from 20% to 40% of the federal amount starting in tax year 2023.

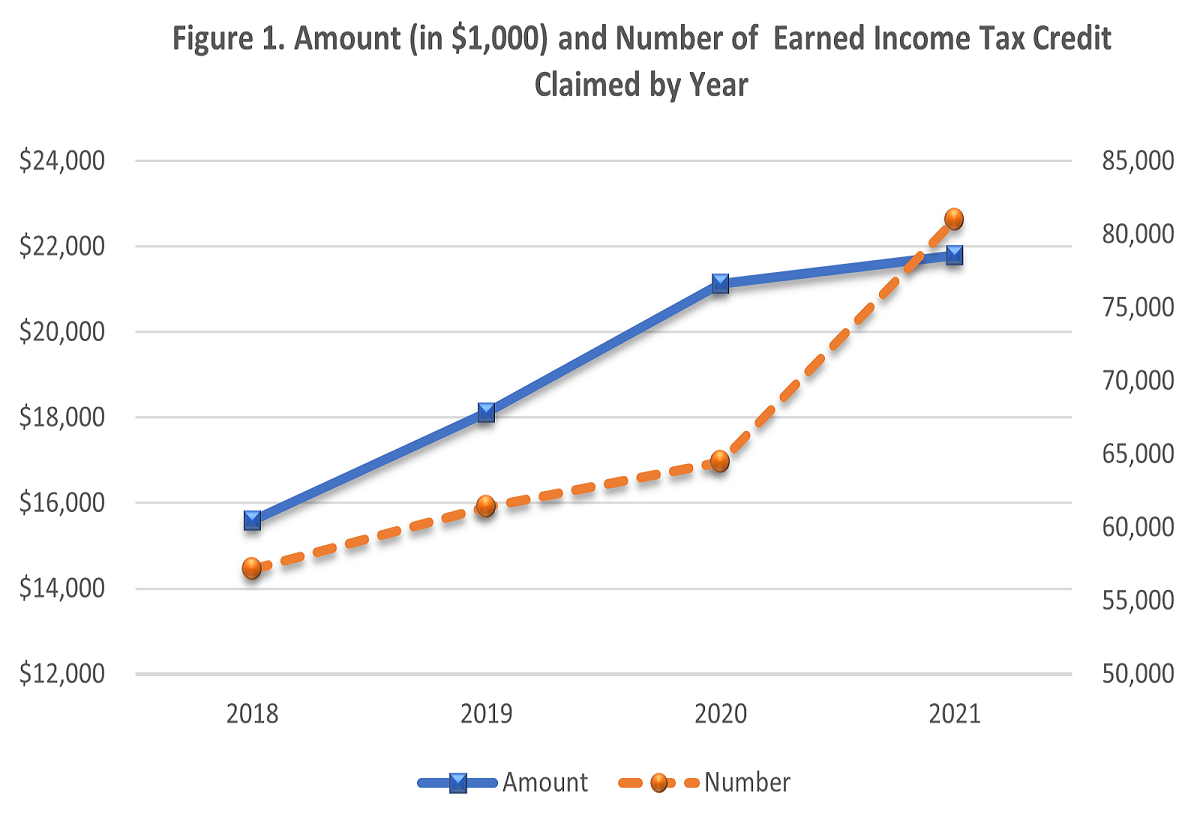

Figure 1 shows the number and amount of EITC claimed from 2018 to 20211.

There’s a steep increase (25.7%) in the number of claims for EITC from 2020 to 2021 while the amount increased slightly (3.2%). This likely reflects the nonrefundable nature of the credit since the allowed amount is restricted by the taxpayer’s tax liability.

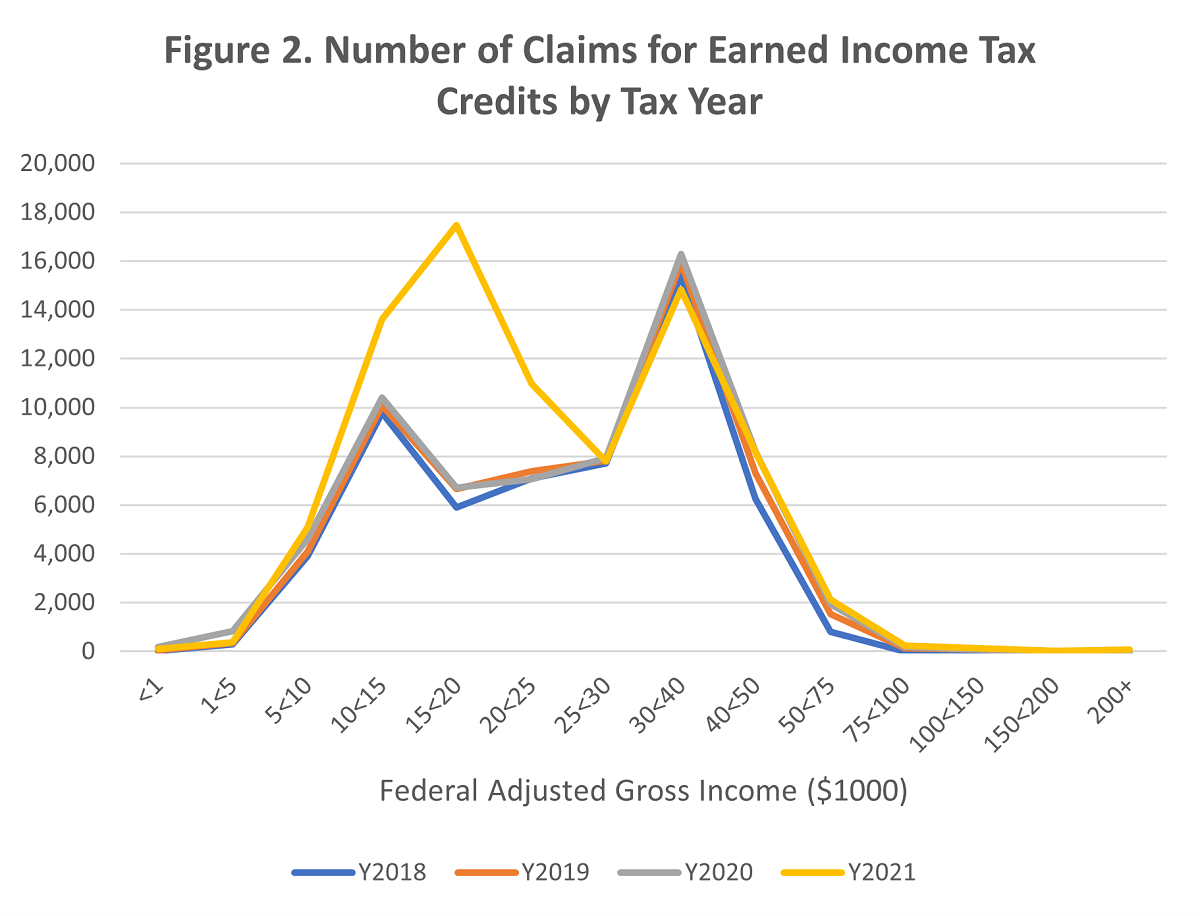

Looking at the credits across federal AGI bracket (Figure 2), the number of claims is relatively consistent across years. An exception is found in the three lower income brackets ($10,000 – $15,000, $15,000 – $20,000 and $20,000 – $25,000), where the number of claims increased in 2021. This may be the result of rebounding employment due to the reopening of the economy after the COVID-19 pandemic, especially in the leisure and hospitality sector.

1 See also, Figure 11 of the 2021 report Tax Credits Claimed by Hawaii Taxpayers