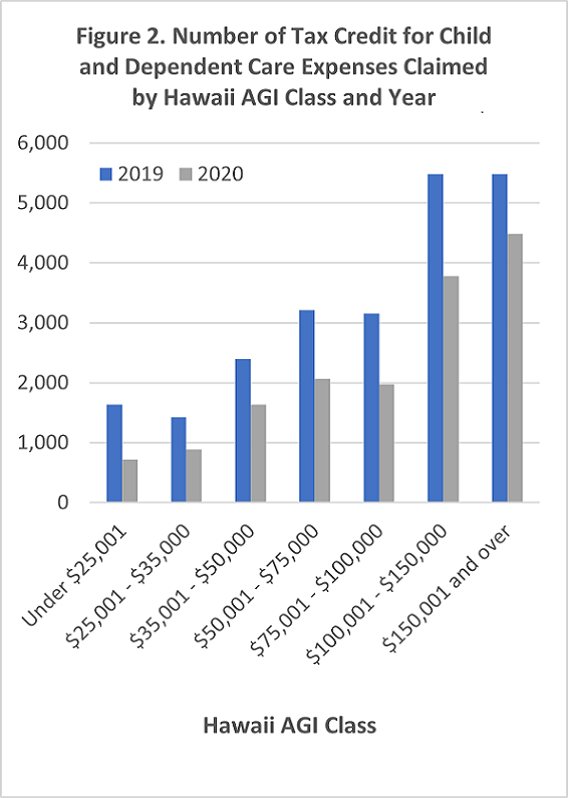

A resident taxpayer may qualify for a tax credit that offsets some of the cost of childcare. The tax credit is called the Tax Credit for Child and Dependent Care Expenses. The credit is normally the third most commonly claimed tax credit, but it fell to fourth place in 2020 as more parents stayed home during the pandemic. In 2020, there were 15,547 claims worth $5.3 million for this credit, a 40.2% reduction from the 2019 amount of $8.7 million.

Figure 1 is derived from Figure 8 from the 2020 report Tax Credits Claimed by Hawaii Taxpayers.

The claims for the dependent care tax credit were slowly declining from 2016 to 2019 with a sharp decline in 2020. The steep drop in the tax credit claims in 2020 is likely the result of the shutdown of child care centers and telework policies implemented during the Covid-19 pandemic, which lead to less childcare spending by taxpayers. This is an example of how taxes reflect economic activity.

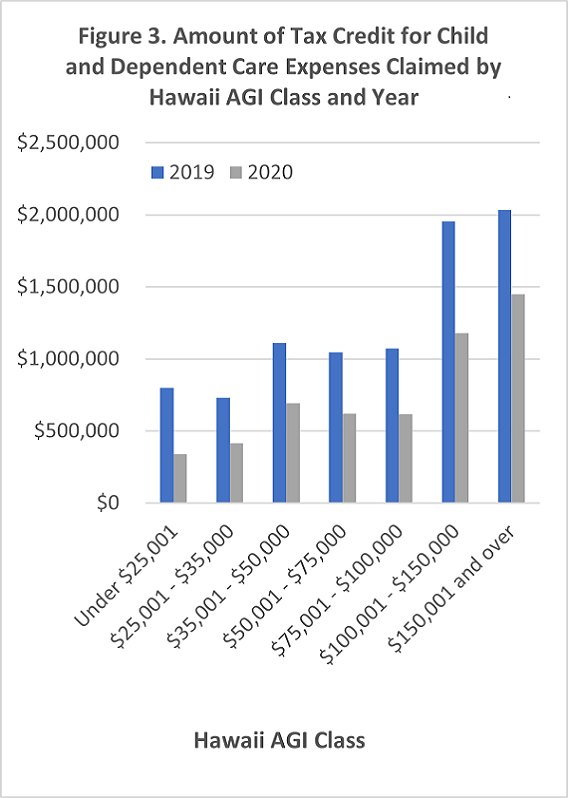

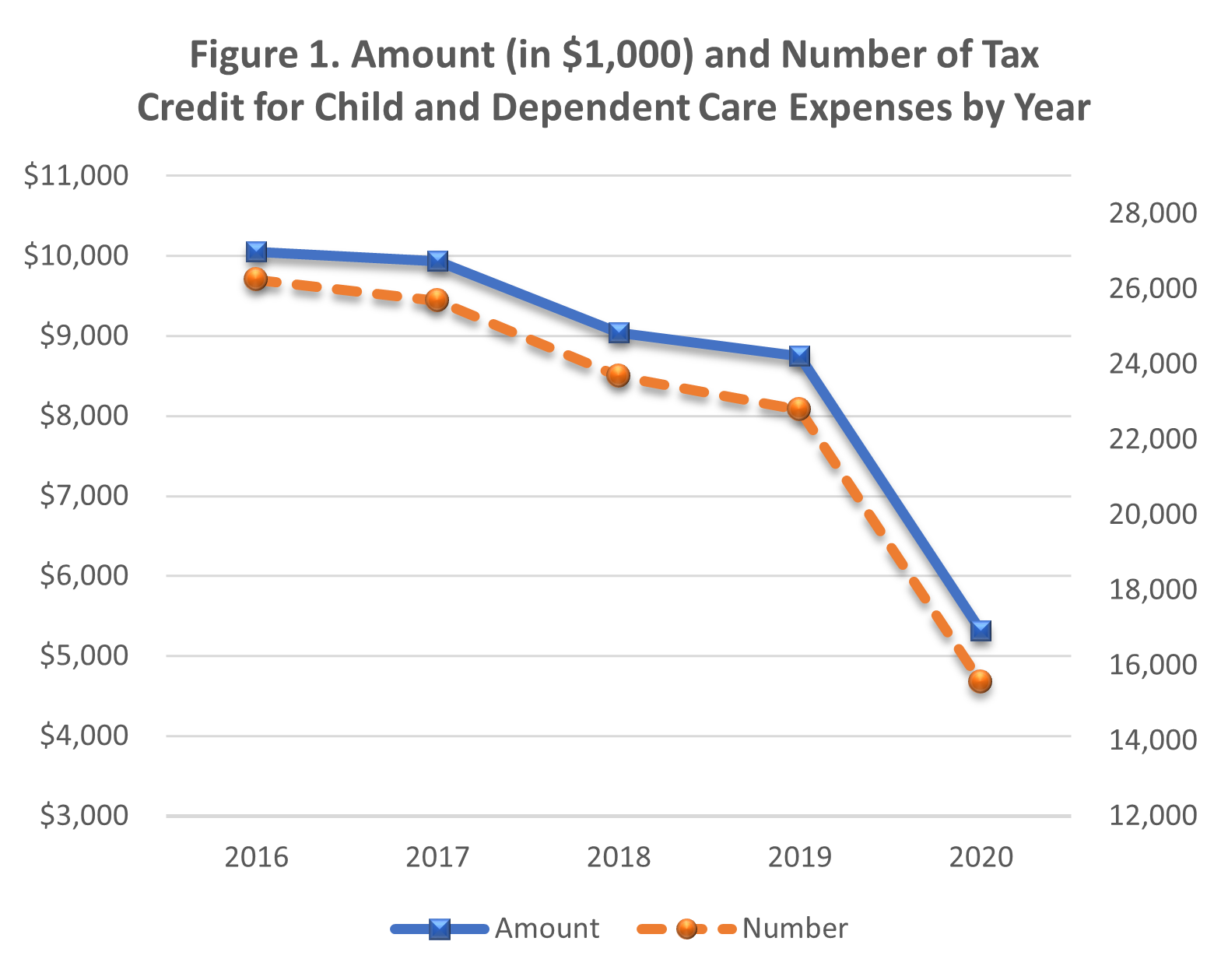

The Child and Dependent Care Tax Credit is mostly claimed by higher income taxpayers

70% of the amount of the credit was claimed by taxpayers with Hawaii AGI more than $50,000. Figures 2 and 3 show the number and amount of the tax credits by income levels. Taxpayers with Hawaii AGI more than $100,000 claimed roughly 50% of the tax credit t even though they represent about 20% of all individual tax returns. This makes sense since higher income households are more likely to spend more on child care. The tax credit claims in 2020 decreased within every income bracket compared to 2019.