Hawaii has several tax credits that promote social welfare. More people claimed these credits during the Covid-19 pandemic, supporting the idea that these credits provide important economic support when Hawaii’s families are hurting the most.

More Hawaii taxpayers claimed the Food/Excise Tax Credit than any other tax credit promoting social welfare. There were 254,262 (33.9 % of individual income returns) claims worth $29.6 million in 2020.

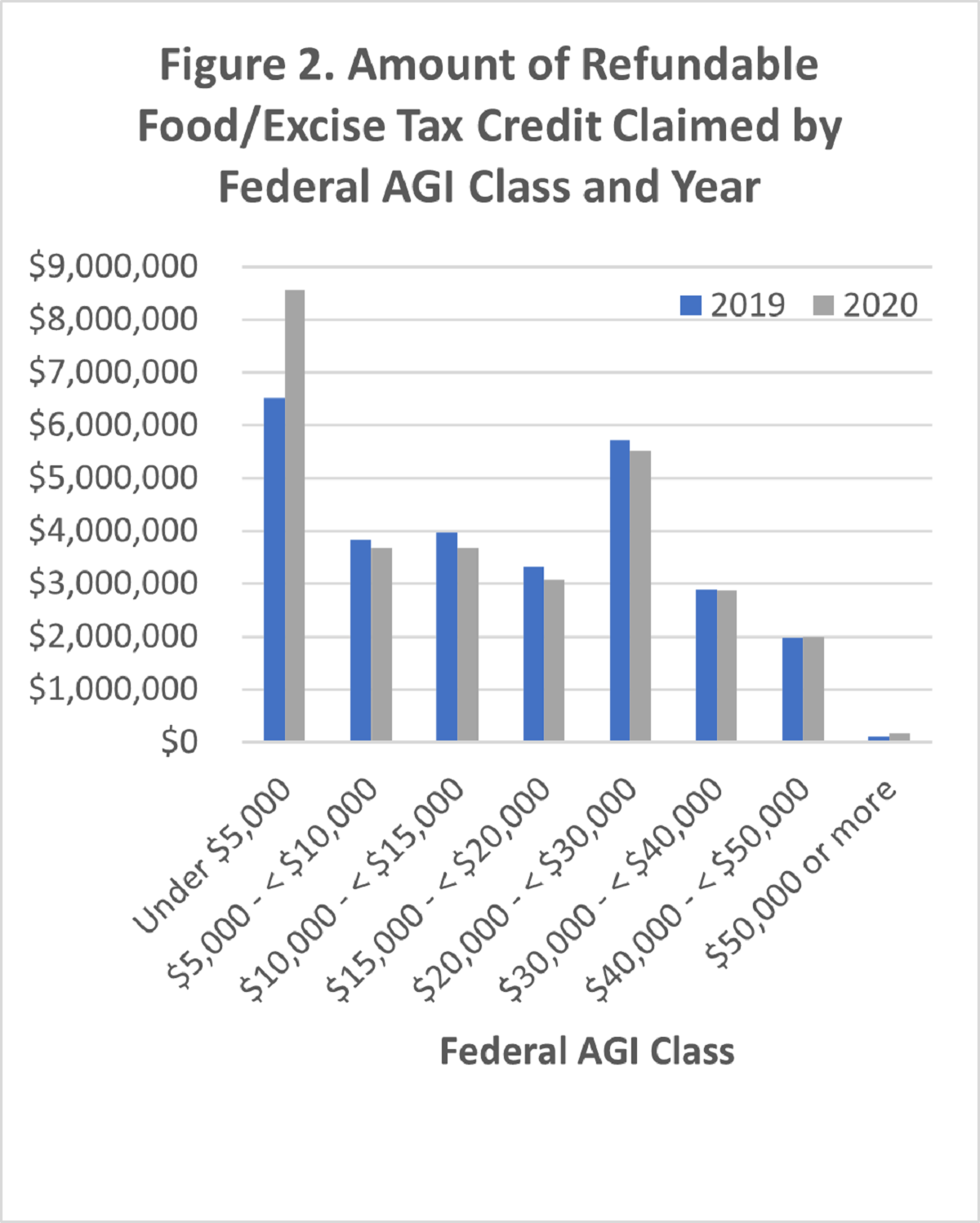

Figure 1 is derived from Figure 6 from the 2020 report Tax Credits Claimed by Hawaii Taxpayers showing only tax years from 2016 to 2020.

The number of claims and the amount claimed steadily decreased from 2016 to 2018, stayed flat from 2018 to 2019, and increased from 2019 to 2020.

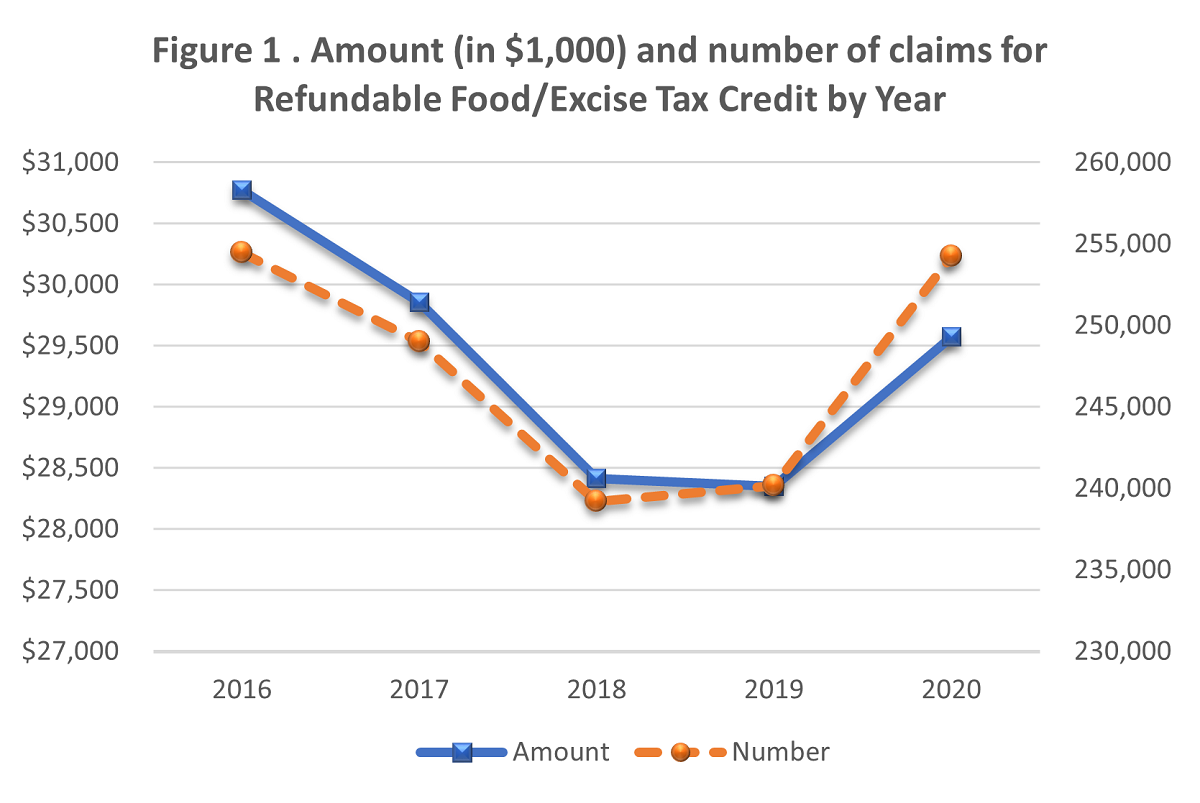

Since eligibility and the credit amount are based on Federal Adjusted Gross Income (AGI), we classified the amount of the credit claimed by Federal AGI classes and compared the data for 2020 to the data for 2019 (Figure 2 below).

The amount of the credit claimed for income groups between $5,000 and $50,000 had little changes from tax year 2019 to 2020, however, the figure increased by roughly 31% for the lowest income class (under $5,000) in 2020 compared to 2019. Furthermore, 14,104 more taxpayers claimed the tax credit in 2020 than in 2019. 98.3% or 13,859 of those net increase belonged to the under $5,000 income group.

The data show that the more of the lowest income taxpayers claimed the credit when times were tough during initial phases of the Covid-19 pandemic.