Nov 3, 2022 | Tax Research Insights

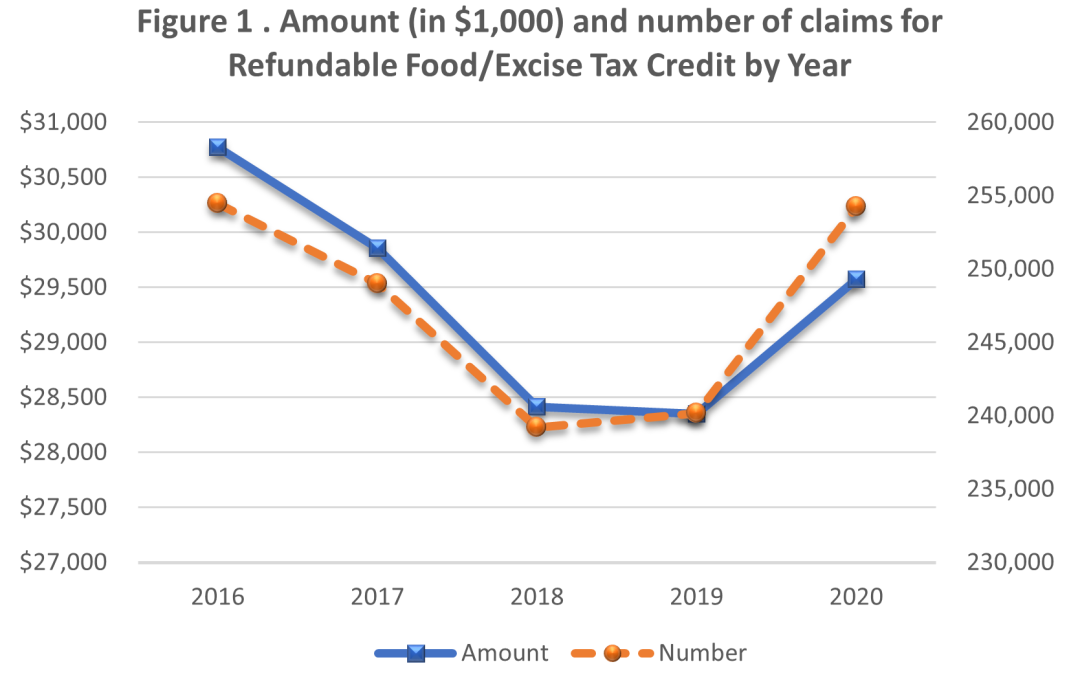

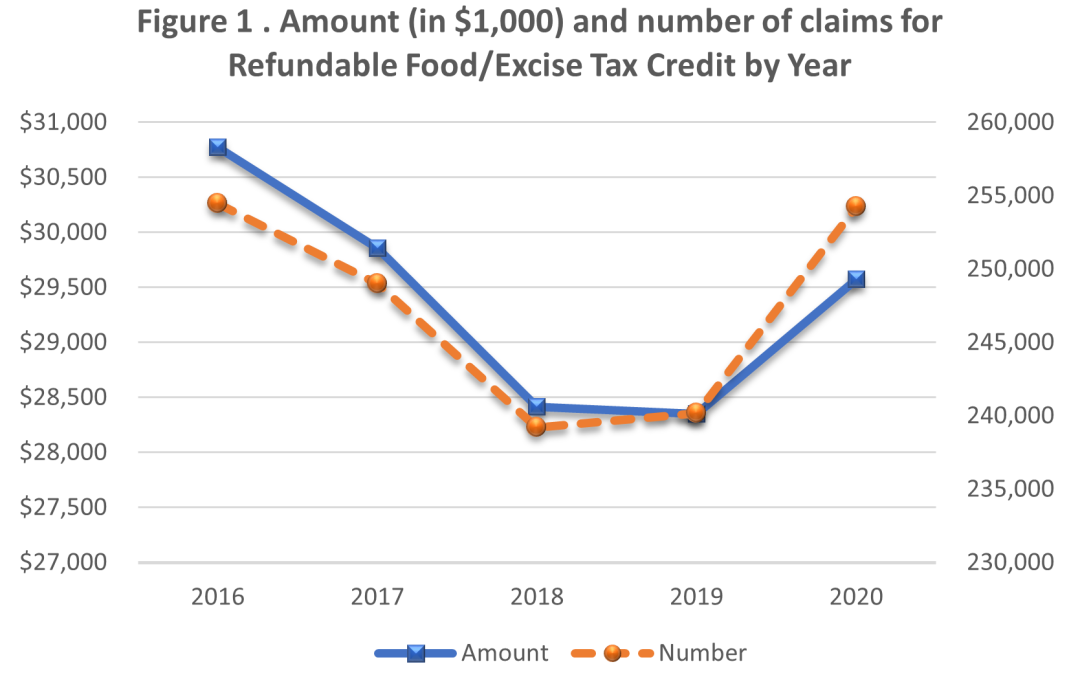

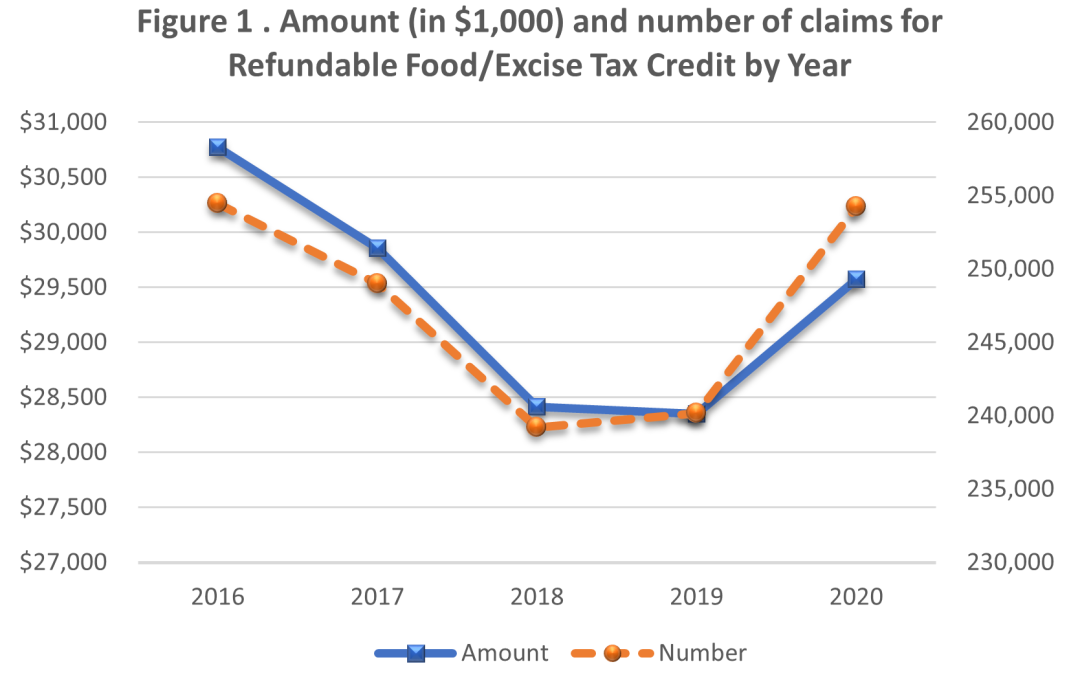

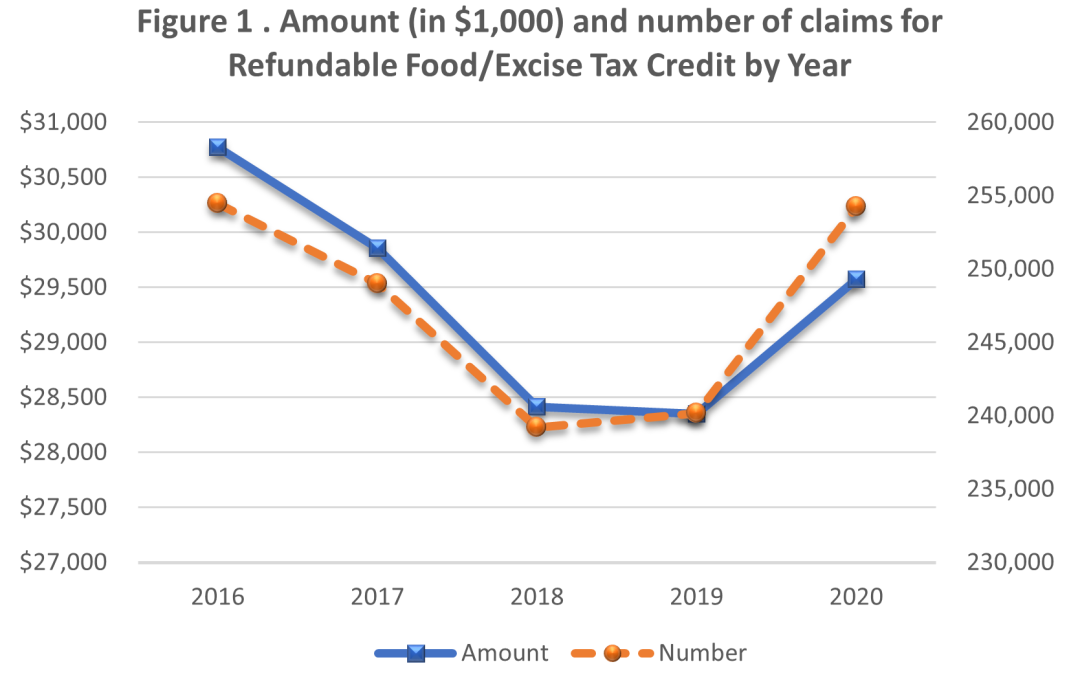

Hawaii has several tax credits that promote social welfare. More people claimed these credits during the Covid-19 pandemic, supporting the idea that these credits provide important economic support when Hawaii’s families are hurting the most. More Hawaii taxpayers...