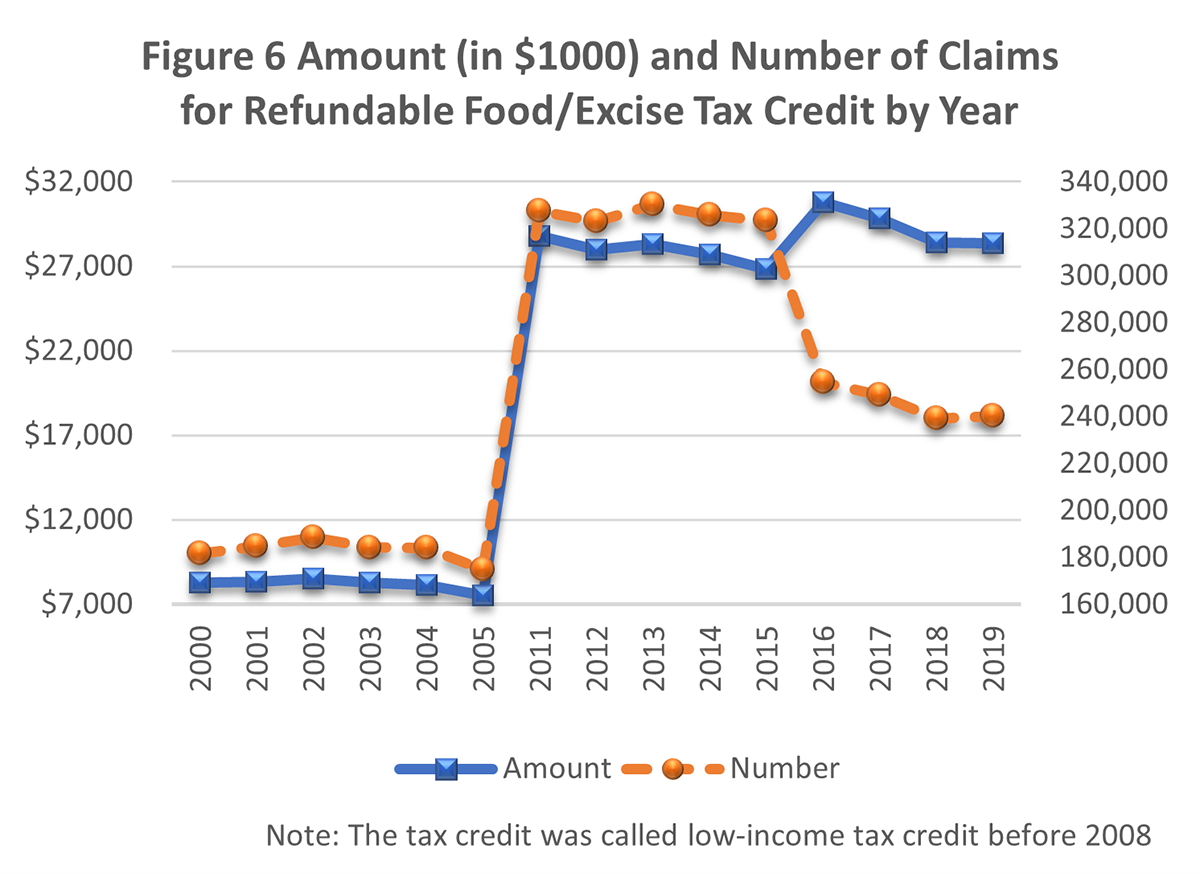

The Food/Excise Tax Credit is the largest tax credit in the State promoting social welfare. In the 2019, there were 240,158 claims worth $28.4 million.

Figure 6, Tax Credits Claimed by Hawaii Taxpayers (copied below), shows how the credit has evolved overtime. The orange line shows that the number of claims increased between 2005 and 2011, remained relatively steady between 2011 and 2015, then suddenly dropped in 2016. What happened?

The amount and number of the tax credit increased in 2008 when Act 211, SLH 2007 increased the amount of credit per exemption (the highest amount was raised from $35 to $85, the lowest was raised from $10 to $25) and expanded eligible maximum federal AGI from $20,000 to $50,000.

Due to Act 223, SLH 2015, claims dropped from 2015 to 2016. This reduced the eligible maximum federal AGI for taxpayers filing a single return from $50,000 to $30,000, while simultaneously increasing the amount of the credit by $10 to $25 depending on income level. This explains why the dollar amount of claims went up from 2015 to 2016 even though the number of claims dropped.

The number of claims has steadily decreased since 2016. This is because the income of many taxpayers has grown beyond the income threshold for the credit. This is common for tax credits with income limitations.

Looking at long term trends for different tax credits, the graph tells an interesting story about the history and nature of each credit. Check out the 2019 tax credit report for more graphs like the one below.