In 2021, low-income households in Hawaii were eligible for about $42 million through the state’s refundable food/excise income tax credit. But over one third—or $15.3 million—of this money went unclaimed. These estimates come from a new analysis of state income tax records conducted by UHERO and the Hawaii Department of Taxation (DOTAX). Our findings suggest a puzzle: why are some of the lowest income households in the state not claiming this generous credit? Research suggests this may result from barriers to access created by the complexity of filing a state tax return, and the costs of paid tax preparers.

As state policymakers increasingly look to refundable tax credits as a tool for aiding low-income households, it is critical to find ways to reduce non-claiming behavior. We discuss potential options for doing so, including a new initiative from DOTAX to offer a simplified tax filing option for zero income residents.

The Refundable Food/Excise Tax Credit

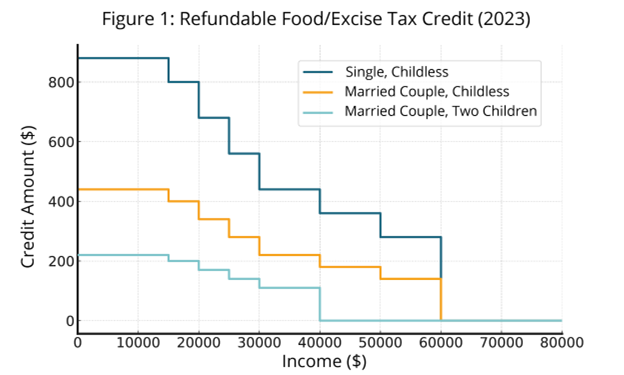

As of 2023, the refundable food/excise tax credit is available to single taxpayers with incomes below $40,000 and non-single taxpayers with incomes below $60,000. The credit is larger for taxpayers with lower levels of income and with larger households. Figure 1 depicts the value of the credit for a range of different incomes and several household types.

This tax credit is the most frequently claimed credit in Hawai’i’s income tax system, which appeared on 226,416 individual income tax returns in 2021 (30.1% of all such returns). The value of these claimed credits in 2021 totaled $26.8 million, down from $29.6 million claimed for tax year 2020 and $28.4 million for tax year 2019.

The credit is refundable, and thus is available to a household even if they have no tax liability, or even no income. For very low-income households with dependents, the credit can become quite valuable. For example, for a family of four with an income below $10,000, the credit is worth $880 (or 8.8% of household income). This is a lot of money for such households to leave on the table. And yet, many do.

Non-Claiming Tax Filers

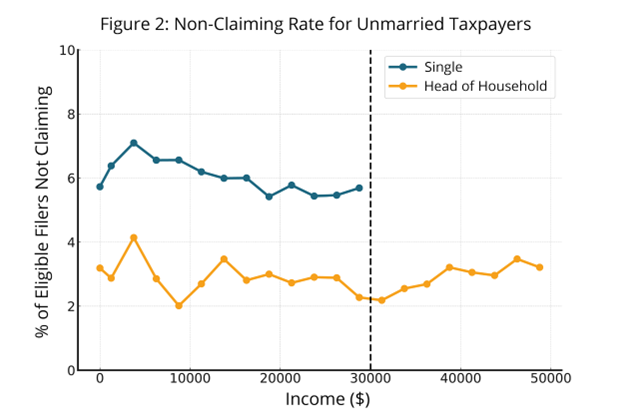

We begin our analysis using state tax return data from 2021: the most recent year for which reliable data is available.1 Figure 2 shows this share of eligible single and head of household (single with dependents) resident state tax filers who did not claim the refundable food/excise income tax credit, at various different levels of income.2 In this year, the credit was only available to single taxpayers with incomes below $30,000 and head-of-household taxpayers with incomes below $50,000. As we can see, at least 5% of eligible singles at any given level of income failed to claim the credit in 2021, whereas the non-claiming rate amongst head of household taxpayers was almost always below 4%.

Amongst single taxpayers, 5.7% of those with zero income fail to claim the credit. This rises to a peak of 7.1% for those with incomes between $2500 and $5000, and thereafter the rate generally declines as incomes rise. This is perhaps somewhat puzzling, given that the lower income individuals are offered a more generous credit and likely have greater need of the credit. By contrast, for head of household taxpayers, there is no clear relationship between the non-claiming rate and income.

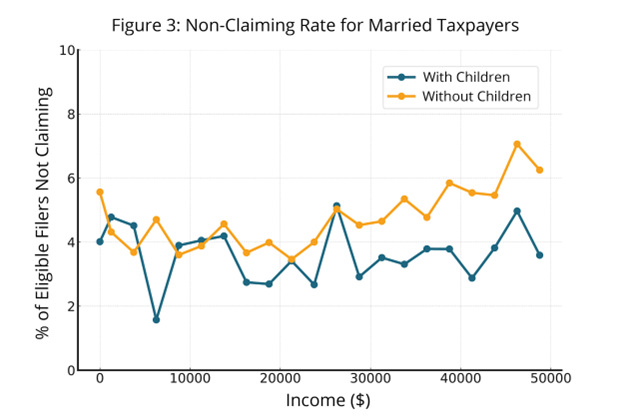

Figure 3 shows non-claiming rates for resident taxpayers who are married, both with and without children in 2021.3 We can see that those with children are somewhat more likely to claim the credit, with a larger difference between the two groups emerging at higher levels of income.

The end result of all this non-claiming behavior is displayed in the first row of Table 1. In 2021, if we add up all the tax filers who were eligible for the refundable food/excise income tax credit but didn’t claim it, as well as their spouses and dependents (on whose behalf they could claim the credit), we get a total of about 17,800 people (see Table 1). Each of these residents was entitled to either claim the credit themselves or have someone else claim it on their behalf. This non-claiming behavior amongst eligible tax filers resulted in nearly $1.3 million in forgone tax relief.4

| Figure Label | Number of People Unclaimed | Total Value of Unclaimed Credits |

|---|---|---|

| Tax Filers | 17,787 | $1,296,035 |

| Non-filers | 140,166 | $14,016,600 |

| Total | 157,953 | $15,312,635 |

Eligible Non-Filers

The vast majority of unclaimed tax credits come from taxpayers who fail to file a state tax return, as the estimates we present in the second row of Table 1 show. We estimate that over 140,000 people who were eligible to claim the credit, or to be claimed as a spouse or dependent by another person, did not do so due to a failure to file a state income tax return.5 Most of these individuals were likely members of very low-income households, because otherwise they would be obligated to file a state return. A conservative estimate of the value of the tax credits these households are failing to claim is $10.5 million.6 Clearly, non-filing is the primary driver of non-claiming behavior.

Total Non-Claimants

Combining our estimates, we find that about 158,000 eligible residents who did not claim the refundable food/excise tax credit themselves or did not have it claimed for them by anyone else. These residents were eligible for $15.3 million in tax relief, or an average of about $97 per person. In many cases, these taxpayers were eligible for much larger credit amounts but still failed to claim the credit. This leaves us with something of a puzzle.

Why Don’t Taxpayers Claim the Credit?

The non-claiming behavior we document in this blog is not unique. For example, the IRS estimates that, in 2020, 23.2% of Hawaii households who were eligible to claim the federal Earned Income Tax Credit (EITC) failed to do so.7 The rates of claiming for state tax credits are often even lower (Iselin, Mackay, & Unrath, 2023).

Research suggests eligible taxpayers may not claim credits because they are uninformed or because the costs of claiming—in money or time—are too high (Ko & Moffitt, 2024). Informing non-filer households about free tax filing options has been shown to make filing slightly more likely, and consequently, to increase EITC claims (Goldin, Homonoff, Javaid, & Schafer, 2022). Data from California also suggests that paid tax preparers who charge by the tax form may lead some taxpayers to claim the federal EITC but not the state EITC (Iselin, Mackay, & Unrath, 2023).

Attempts to decrease non-claiming rates by informing non-filers about tax credits have had limited success (Linos, Prohofsky, Ramesh, Rothstein, & Unrath, 2022). However, one quite successful intervention provided information about both tax credits and a simplified online filing tool for low-income non-filers, causing a five-fold increase in the rate of tax filing (Lasky-Fink, Linos, Ramesh, & Rothstein, 2022).

Potential Solutions: Simplified Tax Filing & Simplified Credit Claiming

Beginning with the 2023 tax year, DOTAX is offering a new income tax form for use by residents with zero income: the N-11SF. At little more than a page in length, this new form offers a substantially simpler alternative to the standard resident income tax (the N-11). The research discussed above suggests that this new form could help to reduce the non-claiming rate for the refundable food/excise tax credit by making it easier for non-filers to file taxes and claim it. However, outreach campaigns to inform the non-filer population about the N-11SF, and help them file it, are likely necessary to enable this outcome.

DOTAX officials may also be able to enhance the efficacy of the form by making small design tweaks in future years. For example, the requirement that the form can only be used by households with exactly zero income may be overly stringent. A household who receives just $1 of income in a year is, in principle, ineligible to use the form, even though they are eligible for the same credit amount and will not owe any income taxes. Loosening the eligibility criteria for the N-11SF may enhance its efficacy.

Finally, we note that the N-11SF does nothing to resolve the problem of non-claiming by tax filers. While this accounts for a small portion of unclaimed refundable food/excise tax credits, it may be a canary in the coal mine. This credit is perhaps the simplest to claim of any in the state tax system. That some taxpayers do not claim this credit begs the question: what else are they not claiming? We hope to explore these issues further in future work.

1 Because a sizable minority of income taxpayers file their taxes late, and because the details on many tax returns are modified during tax compliance checks, DOTAX generally waits 12-14 months before conducting research using income tax records.

2 Income here is measured using federal adjusted gross income (AGI).

3 Specifically, these are taxpayers who are married, filing jointly.

4 Here, we’ve included in our totals an estimate of the number of eligible non-resident tax filers (and their spouses and dependents) who failed to claim the tax credit, as well as an estimate of the total credits they were entitled to. Non-resident tax filers can claim the credit if they have been present in the state for 9 months. We estimate that this accounts for only about $16,000 in unclaimed credits.

5 We obtain this estimate by starting with a US Census Bureau estimate of the total resident population in the state on July 1, 2021. We then subtract the population accounted for on resident tax returns (resident tax filers and their dependents), an estimate of the number of eligible people accounted for on non-resident tax returns, and an estimate of the total remaining ineligible population. This last total includes some members of the Armed Forces (and their dependents), undocumented immigrants, and some out-of-state college students under the age of 24. We generally adopt a more conservative approach where numbers are uncertain, so our estimates should be a lower bound on the number of unclaimed eligible residents.

6 We obtain this by assuming that anyone who does not file a return, or is not claimed because someone else failed to file a return, is eligible for $100 per exemption (the second highest amount). It is likely that the vast majority of these individuals are actually eligible for the larger $110 per exemption credit value.

7 https://www.eitc.irs.gov/eitc-central/participation-rate-by-state/eitc-participation-rate-by-states