Social welfare tax credits often have an income-based limitation. What happens when income limits remain unchanged for long periods of time? Let’s look at two examples here

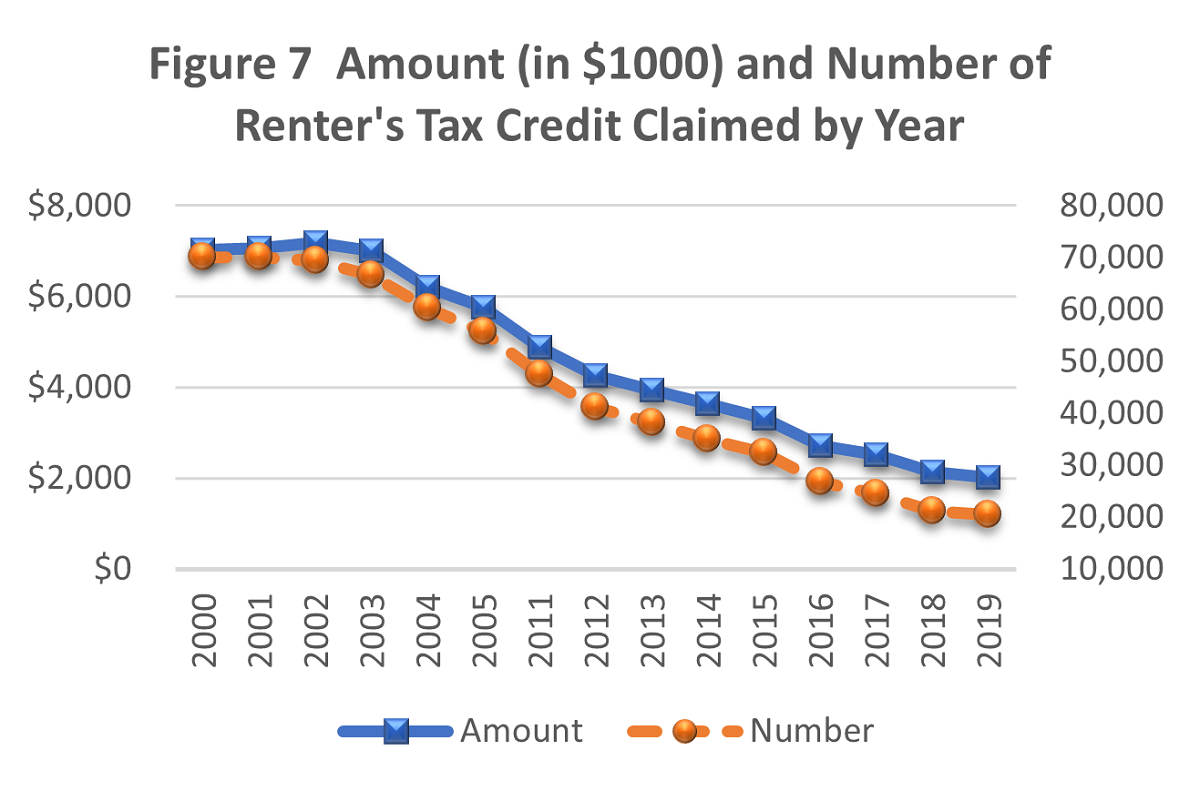

- Tax credit for Low-Income Household Renters. The tax credit is computed by multiplying $50 by the number of personal exemptions permitted under Hawaii law. The $30,000 income limitation has not been changed since 1989, when it was raised from $20,000. The tax credit per exemption was raised from $20 to $50 in 1981 but has remained unchanged since then. The result is that both the number and amount of claims have been steadily declining since 2002 (see Figure 7 Tax Credits Claimed by Hawaii Taxpayers from the report, copied below).

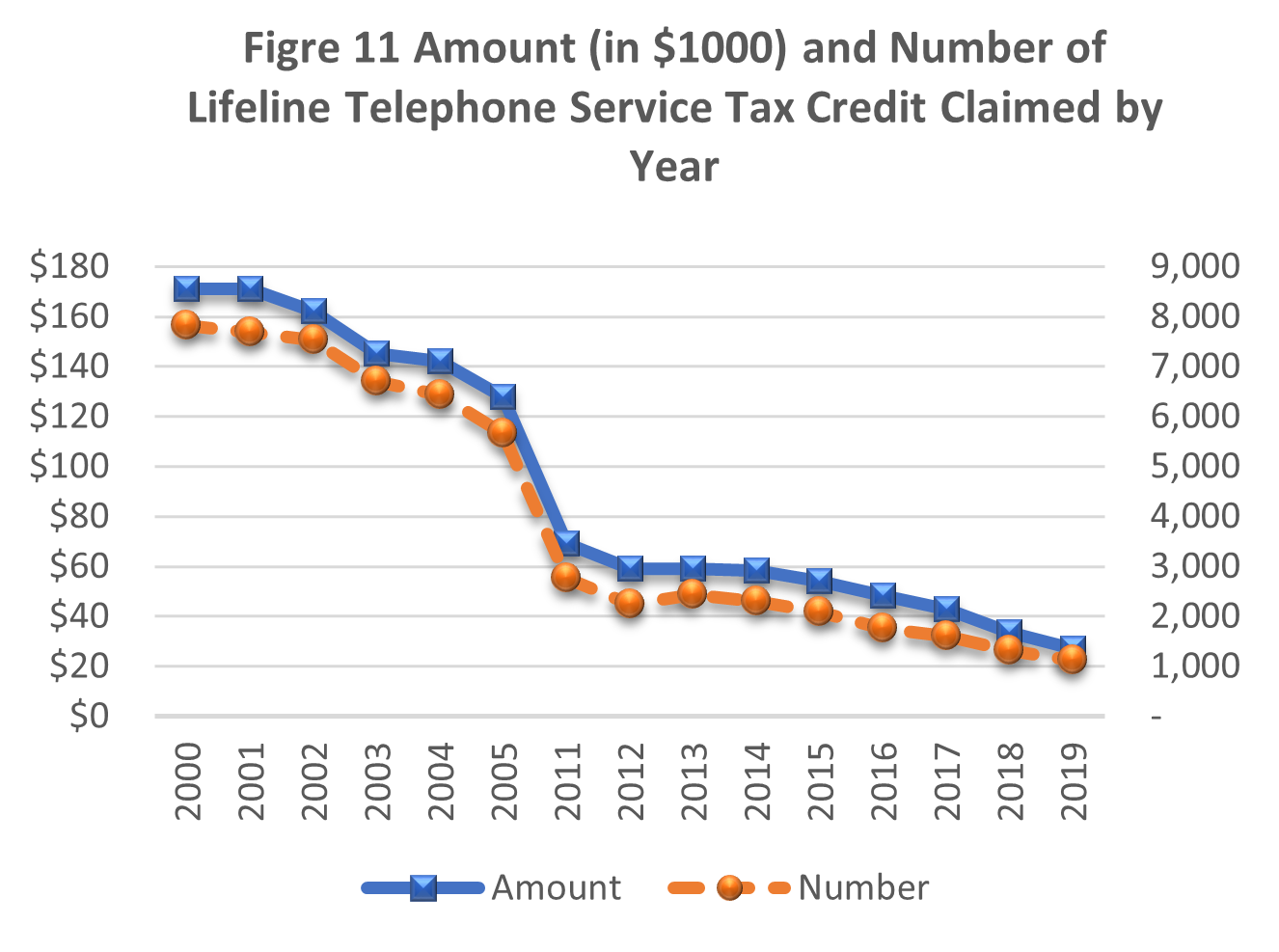

- Lifeline Telephone Service Tax Credit. Lifeline telephone service is available to elderly and disabled residential telephone subscribers who have an annual income less than $10,000. The telephone public utility may claim a nonrefundable tax credit equal to the sum of foregone revenue and the administrative costs of providing such service to the eligible individuals. The $10,000 income limit has never changed since its inception in 1986. As a result, both the number of subscribers and the amount of credit have steadily decreased over years (see Figure 11 Tax Credits Claimed by Hawaii Taxpayers from the report, copied below).

We can see from these two examples that if eligible amount and income limit are not adjusted according to the price index or inflation rate, fewer taxpayers become eligible for the tax credit over the years because their income tends to increase over time.

Thus, the social welfare impacts of tax credit tend to decrease over time if the income limitations are not regularly updated. Building in automatic adjustments like inflation indexation ensures that tax credits continue to benefit the same number of taxpayers over time.