Corporations are the main contributors of Hawaii business receipts. In tax year of 2019, corporations contributed 78% of Hawaii business receipts. There are two types of corporations: those operating only in the State of Hawaii and those that operate nationally (i.e. operating in more than one state).

National corporations have business outside of Hawaii and must file schedule O and schedule P to allocate their gross receipts and income to Hawaii, while Hawaii only corporations generate all gross receipts and income within the State.

National corporations received most business receipts in the State. In 2019, national corporations made up 26% of corporate entities while contributing 62% of corporate business receipts.

National corporation also generated more profit (with $238,406 net income per entity in 2019) than local Hawaii corporations (with $66,873 net income per entity in 2019).

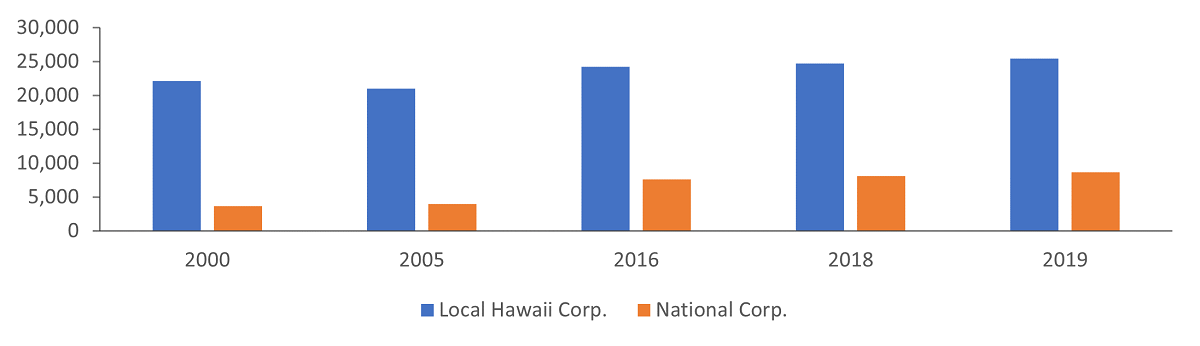

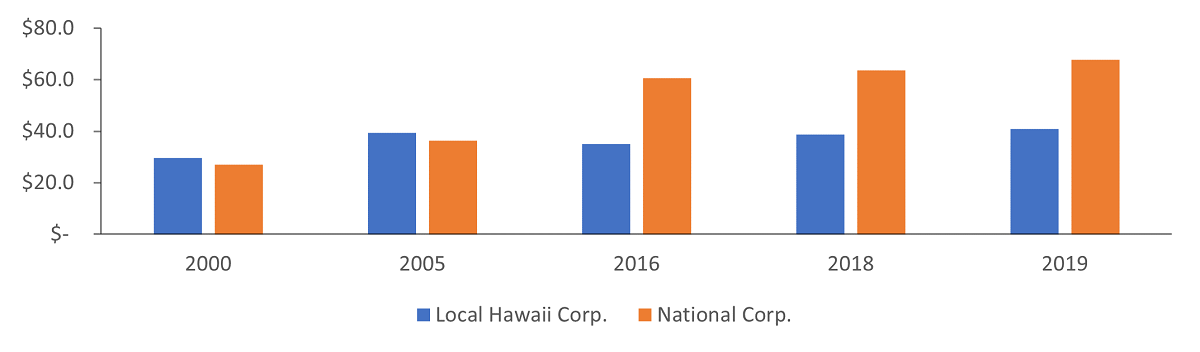

National corporations grew faster than local Hawaii businesses as well. The numbers of local Hawaii corporations remained relatively unchanged from 22,144 in 2000 to 25,416 in 2019, while the numbers of national corporations doubled from 3,661 in 2000 to 8,687 in 2019 (Figure 1). Gross receipts of local Hawaii corporations increased from $29.6 billion in 2000 to $40.8 billion in 2019, while those of national corporations rose from $27.0 billion in 2000 to $67.8 billion in 2019 (Figure 2).

Check out the 2019 Hawaii Business Income Statistics Report for more information.