Special Enforcement Section (SES) – Violations

Hawaii law authorizes the Special Enforcement Section to enforce Hawaii tax laws through the issuance of cease and desist citations, which can include substantial monetary fines. The following are offenses citable by the SES –

| Supporting Graphic | Violations may include the Failure to: | A violation of this provision results in a fine not to exceed: |

|---|---|---|

|

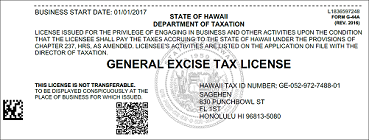

1. Obtain a license for one’s business. | 1. $500 for most persons $2,000 for cash-based businesses |

| 2. Conspicuously display GE license for one’s business or produce license on demand | 2. $500 for most persons $1,000 for cash-based businesses |

|

|

3. Keep adequate books and records Photo credit: “Vintage Ledger” by HA! Designs – Artbyheather is licensed under CC BY 2.0. To view a copy of this license, visit https://creativecommons.org/licenses/by/2.0/?ref=openverse. |

3. $1,000 for most persons $2,000 for cash-based businesses |

|

4. Record transaction

It is unlawful for any person doing business to conduct any transaction in cash and fail to: Each day a person is in violation of this section shall be treated as a separate violation. |

4. $1,000 for most persons $2,000 for cash-based businesses |

|

5. Interference with a tax official | 5. $2000 for most persons |

Poster

- Does your business involve “cash” transactions? (PDF) July 10, 2023, one 8-1/2 x 11 page, 209 KB

- Does your business involve “cash” transactions? (PDF) [ Chinese ] July 30, 2013, one 8-1/2 x 11 page, 288 KB

- Does your business involve “cash” transactions? (PDF) [ Korean ] July 30, 2013, one 8-1/2 x 11 page, 257 KB

The SES is authorized to issue increased fines for persons found to be operating “cash-based businesses.” A cash-based business is defined as a person who operates a business, including for-profit and not-for-profit, where transactions in goods or services are exchanged substantially for cash and where the business is found to have met one or more of the following factors, which include:

- Substantially underreporting or misreporting the proper amount of tax liability on any tax return;

- Failing to have a license or permit as required by law;

- Having no fixed and permanent principal place of business; or

- Not accepting checks or electronic payment devices for business transactions.

The Director of Taxation is authorized to issue additional factors that the SES may consider when characterizing a business as a cash-based business through Tax Information Release.

See also:

Special Enforcement Section (SES) – Mission

Special Enforcement Section (SES) – Overview

Special Enforcement Section (SES) – Violations Enforced by SES

Special Enforcement Section (SES) – Contact SES

Page Last Updated: June 6, 2025