County Surcharge on General Excise and Use Tax

Table of Maximum General Excise Tax Pass-On Rates (PDF) Updated September 2023

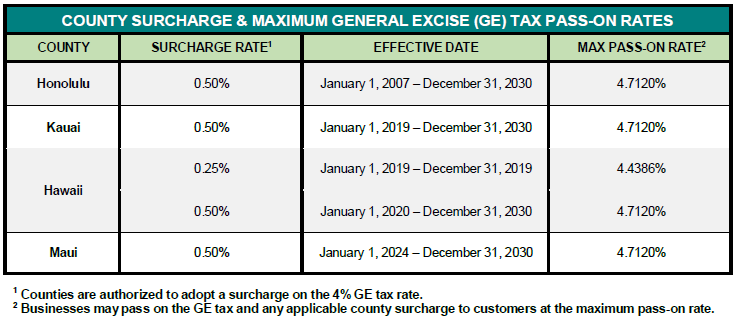

The Legislature authorized the counties to adopt a surcharge on the general excise tax (GET) and use tax by ordinance at a rate of no greater than 0.5%. The following counties have adopted the surcharge:

- City and County of Honolulu: The county surcharge at the rate of 0.5% is effective from January 1, 2007 to December 31, 2030.

- County of Kauai: The county surcharge at the rate of 0.5% is effective from January 1, 2019 to December 31, 2030.

- County of Hawaii: The county surcharge at the rate of 0.25% is effective from January 1, 2019 to December 31, 2019, and at the rate of 0.5% from January 1, 2020 – December 31, 2030.

- County of Maui: The county surcharge at the rate of 0.5% is effective from January 1, 2024 to December 31, 2030.

The county surcharge is only added to activities taxed at the 4.0% rate. The county surcharge does not apply to activities taxed at the 0.5% rate (e.g., wholesaling) or the 0.15% rate (i.e., insurance commissions).

The county surcharge is computed and reported on Forms G-45 and G-49. Taxpayers who do business in more than one county must also complete Form G-75 and attach it to Forms G-45 and G-49.

Maximum Pass-On Rates

Businesses may choose to pass on the GET and any applicable county surcharge to its customers but are not required to do so. If a business passes on its tax, the maximum pass-on rates, which include the county surcharge if applicable, are as follows:

- City and County of Honolulu: 4.7120% (effective January 1, 2007 – December 31, 2030)

- County of Hawaii: 4.4386% (effective January 1, 2019 – December 31, 2019) and 4.7120% (effective January 1, 2020 – December 31, 2030)

- County of Kauai: 4.7120% (effective January 1, 2019 – December 31, 2030)

- County of Maui: 4.7120% (effective January 1, 2024 – December 31, 2030)

Sourcing Rules

Taxpayers are required to allocate their gross proceeds and gross income to the designated taxation districts pursuant to sections 18-237-8.6-01 through 18-237-8.6-10, Hawaii Administrative Rules.

Contracts Entered Prior to June 30, 2023

The county surcharge for Maui county shall not be imposed for gross proceeds or gross income covered under written contracts if the gross proceeds or gross income are received as payments beginning in 2024, the contract was entered into before June 30, 2023 and the written contract does not provide for the passing of increased taxes.

(See section 237-8.6(c), Hawaii Revised Statutes.)

Contracts Entered Prior to June 30, 2018

The county surcharge for Kauai and Hawaii county shall not be imposed for gross proceeds or gross income covered under written contracts if the gross proceeds or gross income are received as payments beginning in 2019, the contract was entered into before June 30, 2018 and the written contract does not provide for the passing of increased taxes.

(See section 237-8.6(c), Hawaii Revised Statutes.)

See also:

- Tax Announcement 2023-05 Maui County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on to Customers, Effective January 1, 2024.

- Tax Announcement 2005-11 Act 247, Session Laws of Hawaii 2005, Relating to County Surcharge on State Tax.

- Tax Announcement 2006-15 General Excise Tax (GET) and County Surcharge Tax (CST) Visibly Passed on to Customers.

- Tax Announcement 2006-17 Relating to the Application of the County Surcharge Sourcing Rules to Cash Basis and Accrual Basis Accounting Method Taxpayers.

- Tax Announcement 2018-14

Kauai County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on to Customers, Effective January 1, 2019 - Tax Announcement 2018-15 Hawaii County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on to Customers, Effective January 1, 2019

- Tax Announcement 2019-04 Hawaii County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on to Customers, Effective January 1, 2020

- Excel Workbook of the General Excise Tax Exemptions/Deductions by Activity Code as of November 6, 2023 (XLSX)

Page Last Updated: January 9, 2024