What’s New to Hawaii Tax Online?

On August 8, 2021, Hawaii Tax Online (HTO) will have a new look which will improve the way you navigate:

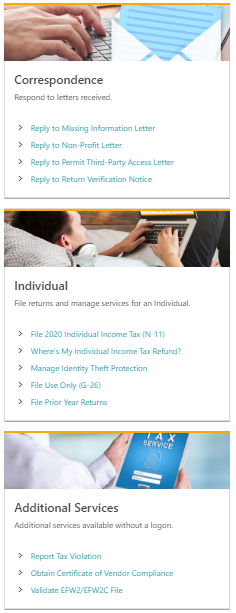

- Home page – The home page has been redesigned into menus and topics are presented in groups. This allows DOTAX to provide more hyperlinks upfront.

- Responsive design – The system intelligently rearranges and resizes elements depending on the size of the window. This feature is particularly useful when you are viewing the system on a mobile device or tablet, as it will be much easier to view and utilize all features.

- Two-Step Verification – To better protect your Hawaii Tax Online profile, each time you sign in a unique code is required to verify your identity. It is also easy to manage and update.

- Viewing of Tax Accounts – The account list is displayed in panels and each panel contains one or more sub-panels with account information. The most recent return due for the tax account is also presented here.

New Tabs

- Favorites – A favorites tab is now available which allows you to flag your most looked at account up front.

- Accounts – The account list is displayed in panels and each panel contains one or more subpanels with account information. The most recent return due for the tax account is also presented here.

- Action Center – Lists actions needing attention by tax account.

- Settings – Allows you to manage settings by tax account (e.g., account security and mail delivery)

- More… – Many actions previously located in the ’I want to’ section have been relocated to the ‘More’ tab.

See also:

Page Last Updated: July 7, 2021