How Can We Help

Interpreter Services

Important Resources

News and Announcements

2025 Tax Workshops

Flyer – Registration open! Aug 21 (Kona), Aug 22 (Hilo), Aug 26 (Kaua’i), Aug 28 (Maui), and Sept 4 (O’ahu), 2025.

Council on Revenues

Agenda – Thursday, July 31, 2025 2:00 P.M.

Recent Updates

Rental Collection Agreement

Persons authorized under agreements to collect rent (third party rent collectors) on behalf of owners of real property and transient accommodations located within Hawaii are required to file Form RCA-1 electronically. Form RCA-1 will be available for filing at Hawaii Tax Online starting on January 2, 2025.

Visit the Rental Collection Agreement Information page for more information.

Pass-Through Entity Taxation

For taxable years beginning after December 31, 2022, partnerships and S corporations may elect to pay Hawai’i income taxes at the entity level. Eligible members of an electing pass-through entity (PTE) may claim a Hawai’i income tax credit for the pro rata share of PTE taxes paid.

Visit the Pass-Through Entity Taxation page for more information.

Tools & Resources

Tax License Search

Use this page to search for your Hawaii Tax license(s) and status(es).

report tax violations

To ensure that all sectors of Hawaii’s economy, especially those that transact business in cash, pay their fair share of taxes.

online certificate of vendor compliance (hce)

Expedites your ability to furnish proof of compliance with the requirements of 103D-310(c), HRS

Protect Your Information

Helpful tips and reminders to prevent you from getting scammed and to protect your information.

Third Party Registration

This page provides information on how to register as a Verified Practitioner under the State of Hawai‘i.

Collections Services

Tax Collection Services is charged with the recovery of taxes. Got a Collections issue or question?

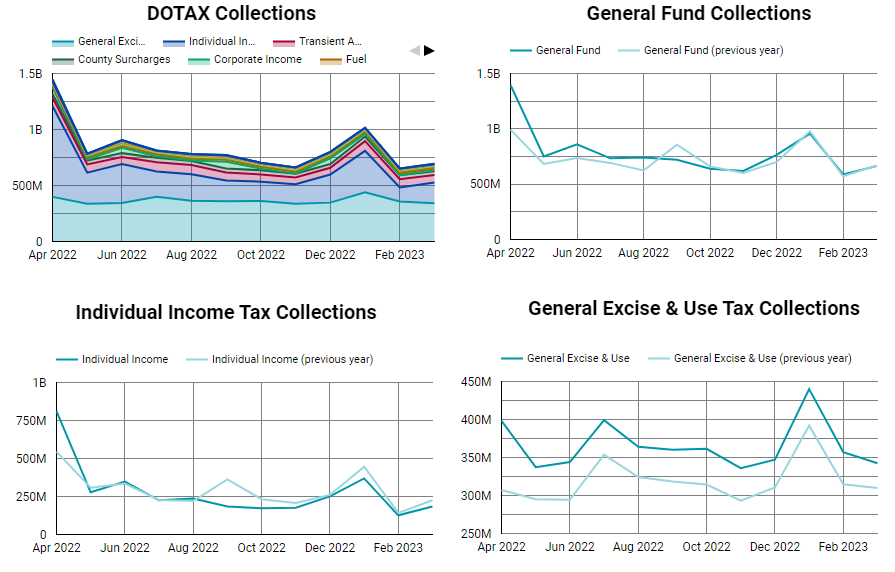

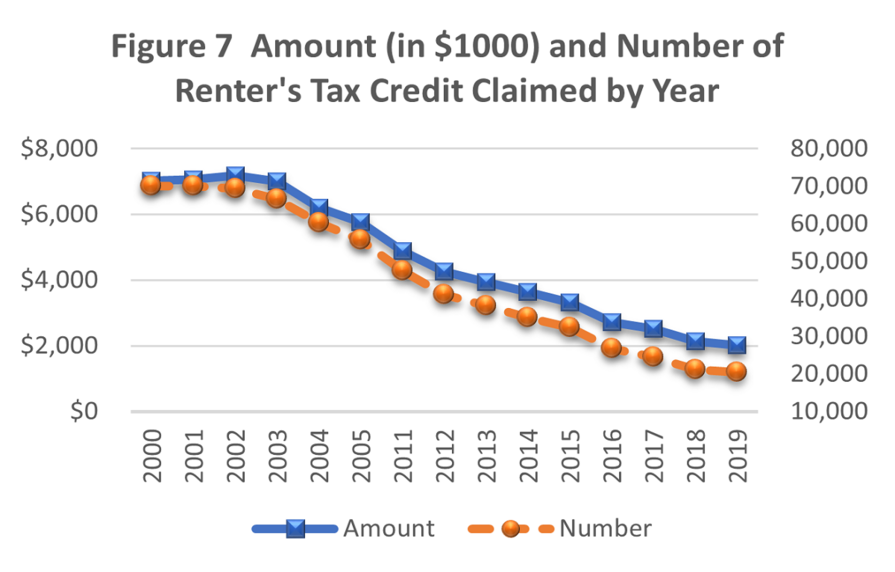

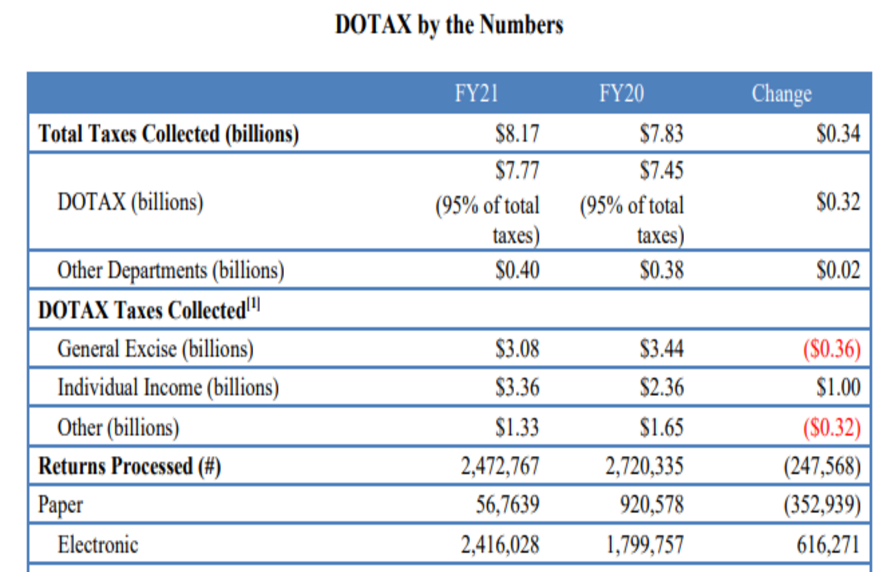

Reports & Data

OAHU

Taxpayer Services

Tel: 808-587-4242

Toll- Free: 1-800-222-3229

Fax: 808-587-1488

Hours:

M-F 8:00 am – 4:00 pm

Office Audit Branch

Tel: 808-587-1644

Fax: 808-587-1633

Hours:

M-F 8:00 am – 4:00 pm

Collection Branch

Tel: 808-587-1600

Fax: 808-587-1720

Hours:

M-F 8:00 am – 4:00 pm

*8 am – 3 pm first Wed of month

For the Hearing Impaired

Tel: 808-587-1418

Toll- Free: 1-800-887-8974

Hours:

M-F 8:00 am – 4:00 pm

NEIGHBOR ISLANDS

Maui

Tel: 808-984-8500

Fax: 808-984-8522

Hours:

M-F 8:00 am – 4:00 pm

Molokai

Tel: 808-553-5541

Fax: 808-553-9878

Hours:

M-F 8:00 am – 4:00 pm

*Closed 1:30 pm – 2:30 pm

Hawaii (Hilo and Kona)

Tel: 808-974-6321

Fax: 808-974-6300

Hours:

M-F 8:00 am – 4:00 pm

*Kona office closed 12 pm – 1 pm

Kauai

Tel: 808-274-3456

Fax: 808-274-3461

Hours:

M-F 8:00 am – 4:00 pm