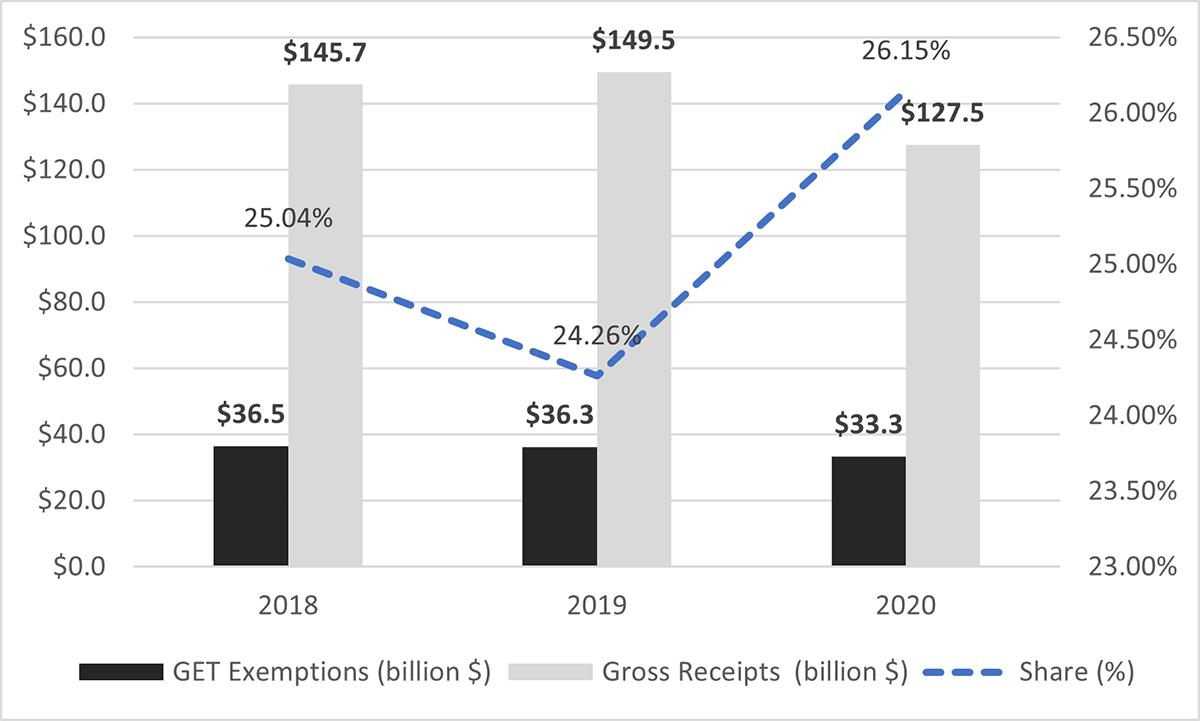

The General Excise & Use Tax (GET), which is a very broad gross receipts tax, is the largest tax type in Hawaii. GET is a tax on income from almost all business activities, including wholesaling, retailing, farming, services, construction contracting, rental of personal or real property, business interest income, and royalties among others. However, Hawaii does have close to 60 different exemptions from the GET that leave about a quarter of gross receipts untaxed (see Figure 1).

Taxpayers claimed $33.3 billion in exemptions—26.1% of the gross receipts were exempted from the GET in 2020.

The top five exemptions in terms of dollar amounts accounted for about 60% of total GET exemptions in 2020:

- Non-profit Organizations ($6.3 billion or 18.8% of total);

- Subcontract Deduction ($3.8 billion or 11.4% of total);

- Foreign Trade Zone Sales ($3.8 billion or 11.3% of total);

- Taxes Passed On ($3.2 billion or 9.6% of total); and

- Out of State Sales ($2.7 billion or 8.1% of total).

Figure 1, from the Hawaii General Excise & Use Tax Exemptions Report for Tax Year 2020, presents the amounts (in billions of dollars) of GET exemptions and gross receipts as well as GET exemptions to gross receipts ratios (%) for tax years 2018 through 2020.

GET exemptions in 2020 were 8.4% below the 2019 level. However, this was in line with the fact that the gross receipts subject to GET also declined (by 14.7%) due to the negative economic impact of the COVID-19 pandemic starting in 2020.

GET Exemptions and Gross Receipts (billion $) for Tax Years 2018 through 2020